Travelers 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

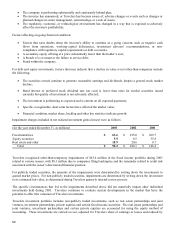

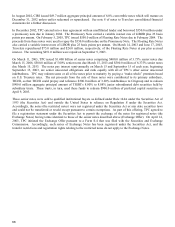

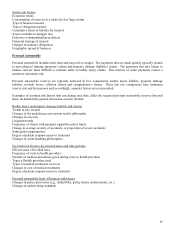

The following table excludes contractual obligations for claim and claim adjustment expense reserves and short-term

obligations. The contractual obligations, which include only liabilities at December 31, 2003 with a cash payment

requirement for settlement, are as follows:

Payments Due by Period

(in millions)

Total

Less

than 1

Year

1-3

Years

4-5

Years

After 5

Years

Lon

g

-term debt (1)

Lon

g

-term notes $ 1,774.0 $ 4.0 $ 161.0 $ 405.0 $ 1,204.0

Convertible

j

unior subordinated notes

p

a

y

able 892.5 - - - 892.5

Convertible notes

p

a

y

able 49.8 - - - 49.8

Total lon

g

-term debt 2

,

716.3 4.0 161.0 405.0 2

,

146.3

O

p

eratin

g

leases(2) 301.6 81.6 160.5 33.1 26.4

Purchase obligations

Information s

y

stems administration &

commitments(3) 36.3 13.1 22.1 1.1 -

Real estate maintenance commitments(4) 11.0 4.3 6.0 0.7 -

Other

p

urchase commitments(5) 11.1 1.5 6.6 3.0 -

Total

p

urchase obli

g

ations 58.4 18.9 34.7 4.8 -

Long-term liabilities

Renewal ri

g

hts obli

g

ations(6) 36.3 27.9 8.4 - -

Insurance related assessments(7) 257.2 99.0 57.6 21.8 78.8

Unfunded investment commitments(8) 620.1 335.4 229.4 50.0 5.3

De

p

osit liabilit

y

(9) 325.2 - 206.2 119.0 -

Total long-term liabilities 1,238.8 462.3 501.6 190.8 84.1

Total Contractual Obligations $ 4,315.1 $ 566.8 $ 857.8 $ 633.7 $ 2,256.8

(1) See note 8 of the notes to Travelers consolidated financial statements for a further discussion.

(2) Represents agreements entered into in the ordinary course of business to lease office space, equipment and

furniture.

(3) Includes agreements with vendors to purchase system software administration and maintenance services.

(4) Includes contracts with various building maintenance contractors for company owned and occupied real estate.

(5) Includes commitments to vendors entered in the ordinary course of business for goods and services including

office supplies, archival services, etc.

(6) Represents amounts due under renewal rights purchase agreements based on the estimated final purchase price.

Amounts relate to the renewal rights purchased by Travelers in the third quarter of 2003. See note 5 of the notes

to Travelers consolidated financial statements for a further discussion.

(7) Represents assessments for guaranty funds and second-injury funds.

(8) Represents estimated timing for fulfilling unfunded commitments for investments in real estate partnerships,

private equities and hedge funds.

(9) Represents estimated timing for amounts payable under reinsurance agreements that are accounted for as

deposits (amounts reported on a present value basis consistent with the balance sheet presentation).

On January 22, 2004, Travelers Board of Directors declared a quarterly dividend of $0.08 per share on class A and

class B common stock, payable on February 27, 2004, to shareholders of record on February 4, 2004. The declaration

and payment of future dividends to holders of Travelers common stock will be at the discretion of Travelers Board of

Directors and will depend upon many factors, including Travelers financial condition, earnings, capital requirements of

TPC’s operating subsidiaries, legal requirements, regulatory constraints and other factors as the Board of Directors

deems relevant. In addition, if the merger with SPC is consummated, dividend decisions will be those of the Board of

Directors of the combined St. Paul Travelers. Dividends would be paid by St. Paul Travelers only if declared by its

Board of Directors out of funds legally available and subject to any other restrictions that may be applicable to St. Paul

Travelers. Subject to the foregoing, it is anticipated that St. Paul Travelers will pay a regular quarterly dividend of

$0.22 per share, after adjustment for the conversion of Travelers shares pursuant to the .4334 exchange ratio.

Travelers principal insurance subsidiaries are domiciled in the State of Connecticut. The insurance holding company

law of Connecticut applicable to Travelers subsidiaries requires notice to, and approval by, the state insurance