Travelers 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

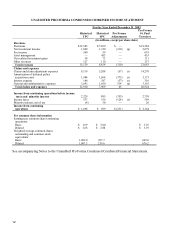

20

Note 4 — Identified Intangible Assets

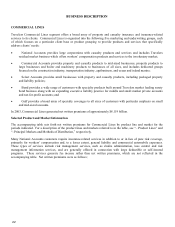

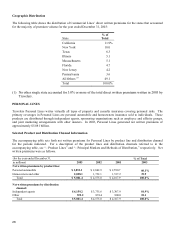

A summary of the significant identifiable intangible assets and their respective estimated useful lives is as follows:

December 31, 2003

Intangible

Asset

Balance

Estimated

Useful Life

Amortization

Method

($ in millions)

Insurance Operations:

Customer relationships $ 540 8 years Accelerated(a)

Contractual agency relationships 20 2 years Straight line

SPC trademark and trade name 20 2 years Straight line

State licenses 30 Indefinite N/A

Total Insurance Operations $ 610

Asset Management Business(b):

Management contracts and customer relationships:

Closed-end funds $ 435 Indefinite N/A

Open-end funds 65 12 years Straight line

Managed wrap/hedge accounts 50 4 years Straight line

Managed institutional accounts 25 7 years Straight line

Nuveen trade name 15 Indefinite N/A

Total Asset Management $ 590

(a) Based on rates derived from expected business retention and profitability levels

(b) Amounts related to this business are included at SPC's 79% approximate ownership interest of Nuveen Investments

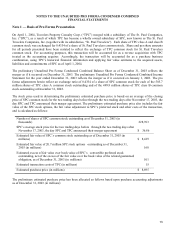

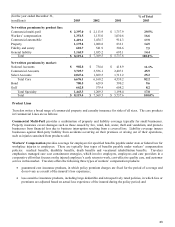

Note 5 — Earnings Per Share

The pro forma earnings per common share data has been computed based on the combined historical income of SPC

and TPC and the impact of purchase accounting adjustments. Weighted average shares were calculated using SPC's

historical weighted average common shares outstanding and TPC’s weighted average common shares outstanding

multiplied by the exchange ratio.

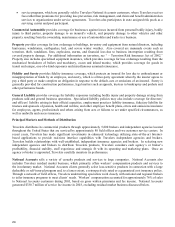

Note 6 — Net Realized Investment Gains (Losses)

The investment portfolio fair value adjustment treats net unrealized investment gains (losses) as though they were

realized, thereby creating a new basis for such investments. No separate adjustment has been made in the preliminary

Unaudited Pro Forma Condensed Combined Income Statement to adjust historical net realized investment gains

(losses) for the resulting new basis that would have been established had the merger been completed on January 1,

2003.

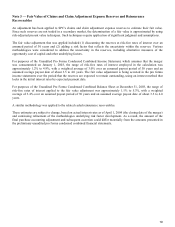

Note 7 — Pension and Post Retirement Benefit Cost

The fair value adjustment for SPC's pension and postretirement benefit plans treats the previously unrecognized prior

service cost and net actuarial loss as though they were recognized. No separate adjustment has been made in the

preliminary Unaudited Pro Forma Condensed Combined Income Statement to adjust net periodic pension and

postretirement benefit cost.