Travelers 2003 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

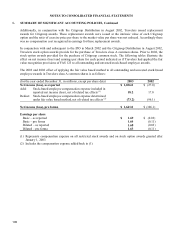

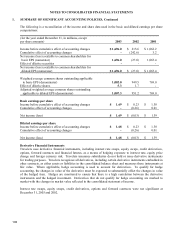

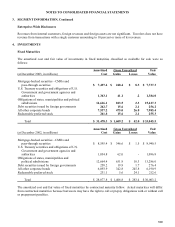

The following is a reconciliation of the income and share data used in the basic and diluted earnings per share

computations:

(for the year ended December 31, in millions, except

per share amounts) 2003

2002

2001

Income before cumulative effect of accounting changes $ 1,696.0 $ 215.6 $ 1,062.2

Cumulative effect of accounting changes - (242.6) 3.2

Net income (loss) available to common shareholders for

basic EPS (numerator)

1,696.0

(27.0)

1,065.4

Effect of dilutive securities - - -

Net income (loss) available to common shareholders for

diluted EPS (numerator)

$ 1,696.0

$ (27.0)

$ 1,065.4

Weighted average common shares outstanding applicable

to basic EPS (denominator)

1,002.0

949.5

769.0

Effect of dilutive shares 5.3 1.7 -

Adjusted weighted average common shares outstanding

applicable to diluted EPS (denominator) 1,007.3 951.2 769.0

Basic earnings per share

Income before cumulative effect of accounting changes $ 1.69 $ 0.23 $ 1.38

Cumulative effect of accounting changes - (0.26) 0.01

Net income (loss) $ 1.69 $ (0.03) $ 1.39

Diluted earnings per share

Income before cumulative effect of accounting changes $ 1.68 $ 0.23 $ 1.38

Cumulative effect of accounting changes - (0.26) 0.01

Net income (loss) $ 1.68 $ (0.03) $ 1.39

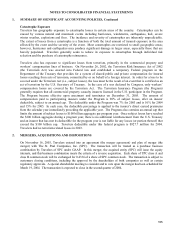

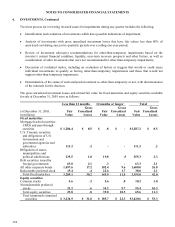

Derivative Financial Instruments

Travelers uses derivative financial instruments, including interest rate swaps, equity swaps, credit derivatives,

options, forward contracts and financial futures, as a means of hedging exposure to interest rate, equity price

change and foreign currency risk. Travelers insurance subsidiaries do not hold or issue derivative instruments

for trading purposes. Travelers recognizes all derivatives, including certain derivative instruments embedded in

other contracts, as either assets or liabilities in the consolidated balance sheet and measures those instruments at

fair value. Where applicable, hedge accounting is used to account for derivatives. To qualify for hedge

accounting, the changes in value of the derivative must be expected to substantially offset the changes in value

of the hedged item. Hedges are monitored to ensure that there is a high correlation between the derivative

instruments and the hedged investment. Derivatives that do not qualify for hedge accounting are marked to

market with the changes in market value reflected in the consolidated statement of income.

Interest rate swaps, equity swaps, credit derivatives, options and forward contracts were not significant at

December 31, 2003 and 2002.