Travelers 2003 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

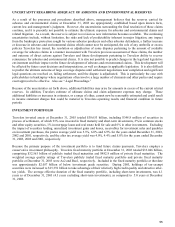

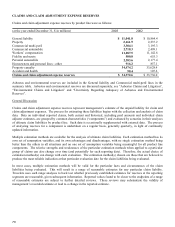

65

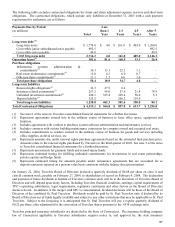

Notes payable to former affiliates, long-term debt, convertible notes and TIGHI junior subordinated debt securities

outstanding at December 31, were as follows:

(in millions) 2003 2002

Notes payable to former affiliates $ -

$ 700.0

Floating rate note due 2004, prepaid February 2003 - 550.0

6.75% Notes due 2006 150.0 150.0

3.75% Notes due 2008 400.0 -

7.81% Note various due dates through 2011 24.0 27.0

5.00% Notes due 2013 500.0 -

7.75% Notes due 2026 200.0 200.0

6.375% Notes due 2033 500.0 -

Convertible junior subordinated notes payable due 2032 892.5 892.5

Convertible notes payable due 2032 49.8 49.7

TIGHI junior subordinated debt securities - 900.0

2,716.3 3,469.2

Debt issuance costs 41.8 25.5

Total $ 2,674.5

$ 3,443.7

In February 2002, TPC paid a dividend of $1.000 billion to Citigroup in the form of a non-interest bearing note

payable on December 31, 2002. On December 31, 2002, this note was repaid in its entirety. Also in February 2002,

TPC paid an additional dividend of $3.700 billion to Citigroup in the form of a note payable in two installments. This

note was substantially prepaid following the offerings. The balance of $150.0 million was due on May 9, 2004. This

note was prepaid on May 8, 2002. In March 2002, TPC paid a dividend of $395.0 million to Citigroup in the form of a

note. This note was prepaid following the offerings.

In March 2002, TPC issued $892.5 million aggregate principal amount of 4.5% convertible junior subordinated notes

which will mature on April 15, 2032, unless earlier redeemed, repurchased or converted. Interest is payable quarterly

in arrears. See note 8 of notes to Travelers consolidated financial statements for a further discussion.