Travelers 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

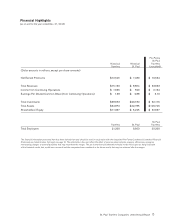

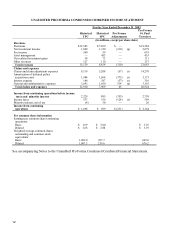

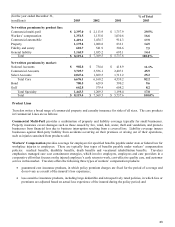

Net tangible assets(1) $ 5,160

Investment real estate(2) 283

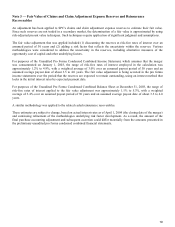

Reinsurance recoverables(2)(3) (417)

Deferred policy acquisition costs(3) (78)

Deferred federal income taxes(5) (296)

Goodwill 2,845

Intangible assets(4) 1,200

Other assets(2) (384)

Claims and claim adjustment expense reserves(2)(3) 761

Long-term debt(2) (160)

Equity unit related debt(2) (24)

Mandatorily redeemable preferred securities(2) (109)

Other liabilities(2) (86)

Estimated purchase price $ 8,695

__________

(1) Reflects SPC's shareholders' equity ($6,225) less SPC's historical goodwill ($926) and intangible assets ($139).

(2) Represents adjustments for fair value.

(3) Represents adjustments to conform SPC's accounting policy to that of TPC.

(4) Represents identified finite and indefinite life intangible assets; primarily customer-related insurance intangibles and

management contracts and customer relationships associated with Nuveen's asset management business.

(5) Represents a deferred tax liability associated with adjustments to fair value of all assets and liabilities included herein,

excluding goodwill, as this transaction is not treated as a purchase for tax purposes.

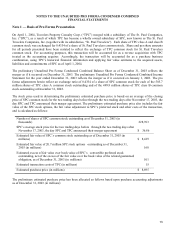

The preliminary unaudited pro forma condensed combined financial statements presented herein are not necessarily

indicative of the results of operations or the combined financial position that would have resulted had the merger been

completed at the dates indicated, nor is it necessarily indicative of the results of operations in future periods or the

future financial position of the combined company.

The preliminary unaudited pro forma condensed combined financial statements have been prepared assuming TPC is

the accounting acquirer. Accordingly, the assets, liabilities and commitments of SPC are adjusted to their fair value.

For purposes of these preliminary unaudited pro forma condensed combined financial statements, consideration has

also been given to the impact of conforming SPC's accounting policies to those of TPC. Additionally, certain amounts

in the historical consolidated financial statements of SPC have been reclassified to conform to the TPC financial

statement presentation. The preliminary unaudited pro forma condensed combined financial statements do not give

consideration to the impact of possible revenue enhancements, expense efficiencies, synergies or asset dispositions.

Also, possible adjustments related to restructuring charges are yet to be determined and are not reflected in the

preliminary unaudited pro forma condensed combined financial statements. Charges or credits, along with the related

tax effects, which result directly from the transaction and are not expected to have a continuing impact will be included

in income within twelve months succeeding the transaction and were not considered in the preliminary unaudited pro

forma condensed combined income statement.

The preliminary unaudited pro forma adjustments represent management's estimates based on information available at

this time. Actual adjustments to the combined balance sheet and income statement will differ, perhaps materially, from

those reflected in these preliminary unaudited pro forma condensed combined financial statements because the then

existing assets and liabilities of SPC will be recorded at their respective fair values on the date the merger was

consummated, and the preliminary assumptions used to estimate their fair values may have changed between the date

of these preliminary unaudited pro forma condensed combined financial statements and date the merger was

consummated. Estimated fair value adjustments to certain balance sheet amounts are preliminary and may change as a

result of additional analysis. Additionally, these preliminary pro forma purchase accounting adjustments do not include

possible fair value adjustments related to certain investments, fixed assets, contracts, leases, other commitments and