Travelers 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

NOTES TO THE UNAUDITED PRO FORMA CONDENSED COMBINED

FINANCIAL STATEMENTS

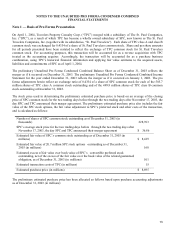

Note 1 — Basis of Pro Forma Presentation

On April 1, 2004, Travelers Property Casualty Corp. (“TPC”) merged with a subsidiary of The St. Paul Companies,

Inc. (“SPC”), as a result of which TPC has become a wholly owned subsidiary of SPC, now known as The St. Paul

Travelers Companies, Inc. (together with its subsidiaries, “St. Paul Travelers”). Each share of TPC class A and class B

common stock was exchanged for 0.4334 of a share of St. Paul Travelers common stock. Share and per share amounts

for all periods presented have been restated to reflect the exchange of TPC common stock for St. Paul Travelers

common stock. For accounting purposes, this transaction will be accounted for as a reverse acquisition with TPC

treated as the accounting acquirer. Accordingly, the transaction will be accounted for as a purchase business

combination, using TPC’s historical financial information and applying fair value estimates to the acquired assets,

liabilities and commitments of SPC as of April 1, 2004.

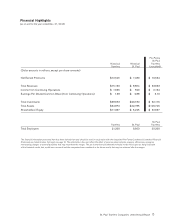

The preliminary Unaudited Pro Forma Condensed Combined Balance Sheet as of December 31, 2003 reflects the

merger as if it occurred on December 31, 2003. The preliminary Unaudited Pro Forma Condensed Combined Income

Statement for the year ended December 31, 2003 reflects the merger as if it occurred on January 1, 2003. The pro

forma adjustments herein reflect an exchange ratio of 0.4334 of a share of SPC common stock for each of the 505.7

million shares of TPC class A common stock outstanding and of the 499.8 million shares of TPC class B common

stock outstanding at December 31, 2003.

The stock price used in determining the preliminary estimated purchase price is based on an average of the closing

price of SPC common stock for the two trading days before through the two trading days after November 17, 2003, the

day SPC and TPC announced their merger agreement. The preliminary estimated purchase price also includes the fair

value of the SPC stock options, the fair value adjustment to SPC’s preferred stock and other costs of the transaction,

and is calculated as follows:

Number of shares of SPC common stock outstanding as of December 31, 2003 (in

thousands) 228,393

SPC’s average stock price for the two trading days before through the two trading days after

November 17, 2003, the day SPC and TPC announced their merger agreement $ 36.86

Estimated fair value of SPC’s common stock outstanding as of December 31, 2003 (in

millions) $ 8,419

Estimated fair value of 20.7 million SPC stock options outstanding as of December 31,

2003 (in millions) 160

Estimated excess of fair value over book value of SPC’s convertible preferred stock

outstanding, net of the excess of the fair value over the book value of the related guaranteed

obligation, as of December 31, 2003 (in millions) 101

Estimated transaction costs of TPC (in millions) 15

Estimated purchase price (in millions) $ 8,695

The preliminary estimated purchase price has been allocated as follows based upon purchase accounting adjustments

as of December 31, 2003 (in millions):