Travelers 2003 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

Homeowners and Personal Lines Other

Homeowners is considered a short tail coverage. Most payments are related to the property portion of the policy,

where the claim reporting and settlement process is generally restricted to the insured and the insurer. Claims on

property coverage are typically reported soon after the actual damage occurs, although delays of several months are not

unusual. The claim is settled when the two parties agree on the amount due in accordance with the policy contract

language and the appropriate payment is made (or alternatively, the property replacement/repair is performed by the

insurer). The resulting settlement process is typically fairly short term, although exceptions do exist.

The liability portion of the homeowners policy generates claims which take longer to pay due to the involvement of

litigation and negotiation. In addition, reserves related to umbrella coverages have greater uncertainty since umbrella

liability payments are often made far into the future.

Homeowners reserves are typically analyzed in two components: non-catastrophe related losses and catastrophe loss

payments.

Examples of common risk factors that can change and, thus, affect the required homeowners reserves (beyond those

included in the general reserve discussion section) include:

Non-catastrophe risk factors

Salvage opportunities

Amount of time to return property to residential use

Changes in weather patterns

Local building codes

Litigation trends

Trends in jury awards

Catastrophe risk factors

Physical concentration of policyholders

Availability and cost of local contractors

Local building codes

Quality of construction of damaged homes

Amount of time to return property to residential use

For the more severe catastrophic events, “demand surge” inflation, whereby the greatly increased demand for building

materials such as plywood far surpasses the immediate supply, leading to short-term material increases in building

material costs

Homeowners book of business risk factors

Policy provisions mix (e.g., deductibles, policy limits, endorsements, etc.)

Degree of concentration of policyholders

Changes in underwriting standards

OTHER MATTERS

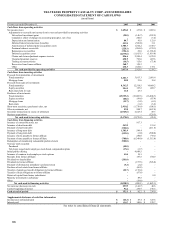

Reserves for losses and loss adjustment expenses on a statutory basis were $24.029 billion, $23.280 billion and

$20.215 billion at December 31, 2003, 2002 and 2001, respectively. The $749.0 million increase from December 31,

2002 to December 31, 2003 was primarily due to business growth, and reserve strengthening at Gulf which increased

reserves by $521.1 million and American Equity which increased reserves by $115.0 million, partially offset by

asbestos and environmental net loss payments of $607.0 million. The $3.065 billion increase from December 31, 2001

to December 31, 2002 was primarily due to the increase in asbestos reserves of $2.584 billion during the year, partially

offset by net loss payments of $521.7 million for asbestos and environmental claims.