Travelers 2003 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

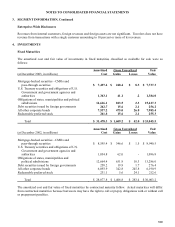

4. INVESTMENTS, Continued

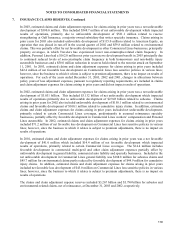

Net Realized and Unrealized Investment Gains (Losses)

Net realized investment gains (losses) for the periods were as follows:

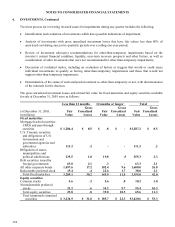

(for the year ended December 31, in millions) 2003 2002 2001

Net realized investment gains (losses)

Fixed maturities $ 69.1 $ 167.5 $ 331.0

Equity securities 6.6 (4.1) (8.1)

Other (37.7) (16.7) (.4)

Net realized investment gains $ 38.0 $ 146.7 $ 322.5

Changes in net unrealized gains (losses) on investment securities that are included as a separate component of

accumulated other changes in equity from nonowner sources were as follows:

(at and for the year ended December 31, in millions) 2003 2002 2001

Change in net unrealized investments gains (losses)

Fixed maturities $ 441.8 $ 735.6 $ (279.0)

Equity securities 70.7 (14.0) 47.0

512.5 721.6 (232.0)

Related taxes 183.0 249.4 (81.1)

Minority interest (.8) 3.2 -

Change in net unrealized gains (losses) on investment securities 328.7 475.4 (150.9)

Balance, beginning of year 731.6 256.2 407.1

Balance, end of year $ 1,060.3 $ 731.6 $ 256.2

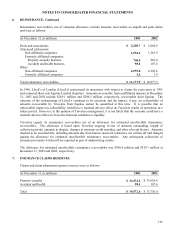

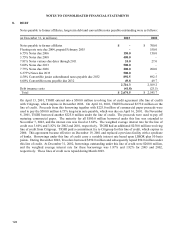

5. INTANGIBLE ASSETS

During the third quarter of 2003, Travelers purchased the renewal rights to Royal & SunAlliance USA Inc.’s

commercial lines national accounts, middle market and marine businesses, and standard and preferred personal

lines businesses. Also in the third quarter of 2003, Travelers purchased renewal rights to the majority of Atlantic

Mutual’s commercial lines inland marine and ocean cargo businesses written by Atlantic Mutual’s Marine

Division. The minimum purchase price for both transactions, which has been paid, was $48.0 million. The final

purchase price, currently estimated to be $84.5 million, is dependent on the level of business renewed by

Travelers. Travelers recorded customer-related intangible assets of $79.5 million and a marketing-related

intangible asset of $5.0 million related to these transactions. These intangible assets are estimated to have useful

lives of 5 years.