Travelers 2003 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.124

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

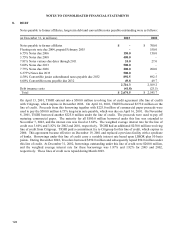

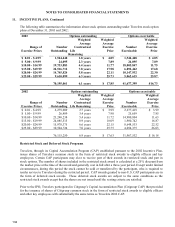

8. DEBT, Continued

Unless previously redeemed or repurchased, the notes are convertible into shares of class A common stock at the

option of the holders at any time after March 27, 2003 and prior to April 15, 2032 if at any time (1) the average

of the daily closing prices of class A common stock for the 20 consecutive trading days immediately prior to the

conversion date is at least 20% above the then applicable conversion price on the conversion date, (2) the notes

have been called for redemption, (3) specified corporate transactions have occurred, or (4) specified credit rating

events with respect to the notes have occurred. The notes will be convertible into shares of class A common

stock at a conversion rate of 1.0808 shares of class A common stock for each $25 principal amount of notes

(equivalent to an initial conversion price of $23.13 per share of class A common stock), subject to adjustment in

certain events. On or after April 18, 2007, the notes may be redeemed at TPC’s option. TPC is not required to

make mandatory redemption or sinking fund payments with respect to the notes. The notes are general

unsecured obligations and are subordinated in right of payment to all existing and future Senior Indebtedness.

The notes are also effectively subordinated to all existing and future indebtedness and other liabilities of any of

TPC’s current or future subsidiaries.

During May 2002, TPC fully and unconditionally guaranteed the payment of all principal, premiums, if any, and

interest on certain debt obligations of its wholly-owned subsidiary TIGHI. TPC is deemed to have no

independent assets or operations except for its wholly-owned subsidiary TIGHI. Consolidated financial

statements of TIGHI have not been presented herein or in any separate reports filed with the Securities and

Exchange Commission because management has determined that such financial statements would not be

material to holders of TIGHI debt. The guarantees pertain to the $150.0 million 6.75% Notes due 2006 and the

$200.0 million 7.75% Notes due 2026 included in long-term debt, and the $900.0 million of TIGHI-obligated

mandatorily redeemable securities of subsidiary trusts holding solely junior subordinated debt securities of

TIGHI (TIGHI Securities).

In August 2002, CIRI, a subsidiary of Travelers, issued $49.7 million aggregate principal amount of 6.0%

convertible notes (the CIRI Notes) which will mature on December 31, 2032 unless earlier redeemed or

repurchased. Interest on the CIRI Notes is payable quarterly in arrears. The CIRI Notes are convertible as a

whole and not in part into shares of CIRI common stock at the option of the holders of 66-2/3% of the aggregate

principal amount of the notes, in the event of an IPO or change of control of CIRI. At any time after the earlier

of (a) December 31, 2010 or (b) an IPO by CIRI, the notes may be redeemed by CIRI.

CIRI also issued $85.9 million of mandatorily convertible preferred stock during August 2002. The declaration

and payment of dividends to holders of CIRI’s convertible preferred stock will be at the discretion of the CIRI

Board of Directors and if declared, paid on a cumulative basis for each share of convertible preferred stock at an

annual rate of 6% of the stated value per share of the convertible preferred stock. Dividends of $5.1 million and

$2.2 million were declared and paid during 2003 and 2002, respectively.

In December 2002, Travelers entered into a loan agreement with an unaffiliated lender and borrowed $550.0

million under a Promissory Note due in January 2004. The Promissory Note carried a variable interest rate of

LIBOR plus 25 basis points per annum. On February 5, 2003, Travelers issued $550.0 million of Floating Rate

Notes due in February 2004, which was included in short-term debt in the condensed consolidated balance sheet.

The proceeds from these notes were used to prepay the $550.0 million due on the Promissory Note. The

Floating Rate Notes also carry a variable interest rate of LIBOR plus 25 basis points per annum. On March 14,

2003 and June 17, 2003, Travelers repurchased $75.0 million and $24.0 million, respectively, of the Floating

Rate Notes at par plus accrued interest. The remaining $451.0 million were repaid on September 5, 2003.