Travelers 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

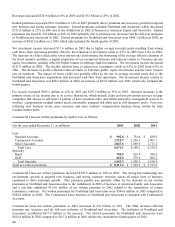

Bond provides a variety of fidelity and surety bonds and executive liability coverages to clients of all sizes through

independent agents and brokers. Bond net written premiums increased $150.6 million or 24% in 2003. This increase

reflected a favorable premium rate environment and strong new business, principally in executive liability product

lines, which target middle and small market private accounts, partially offset by higher reinsurance costs. In addition,

the surety product lines benefited from higher premium rates in 2003. Bond net written premiums increased $39.7

million or 7% in 2002. The 2002 amount was reduced by $17.5 million due to a change in the Bond Executive

Liability excess of loss reinsurance treaty that was effective January 1, 2002. Excluding this reinsurance adjustment,

Bond net written premiums increased $133.1 million or 21% during 2003. In addition, the 2001 amount was increased

by $34.1 million due to the termination of the Master Bond Liability reinsurance treaty effective January 1, 2001.

Excluding both reinsurance adjustments, Bond net written premiums increased $91.3 million during 2002. This

increase reflected a favorable premium rate environment and strong production growth in executive liability product

lines. In addition, the surety product lines benefited from higher premium rates in 2002.

Gulf markets products to national, mid-sized and small customers and distributes them through both wholesale brokers

and retail agents and brokers throughout the United States with particular emphasis on management and professional

liability coverages and excess and surplus lines of insurance. Gulf net written premiums increased $83.4 million or

14% in 2003 as a result of significant rate increases across all classes of management liability products. Gulf net

written premiums decreased $28.8 million in 2002 due to Gulf’s decision to exit non-core businesses, including

assumed reinsurance, transportation, residual value and property, partially offset by increases in Gulf’s core specialty

lines.

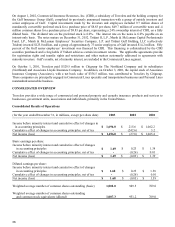

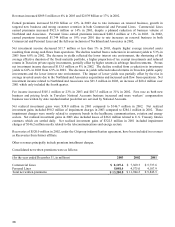

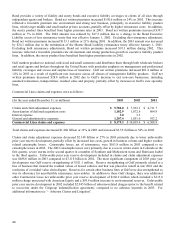

Commercial Lines claims and expenses were as follows:

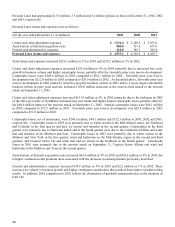

(for the year ended December 31, in millions) 2003 2002 2001

Claims and claim ad

j

ustment ex

p

enses $ 5,784.0 $ 7,932.1 $ 4,711.7

Amortization of deferred ac

q

uisition costs 1,182.9 1,072.8 864.9

Interest ex

p

ense 5.0 3.5 -

General and administrative ex

p

enses 1,207.4 1,031.0 932.2

Commercial Lines claims and expenses $ 8,179.3 $ 10,039.4 $ 6,508.8

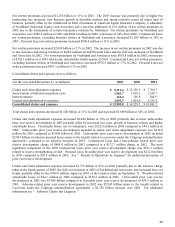

Total claims and expenses decreased $1.860 billion or 19% in 2003 and increased $3.531 billion or 54% in 2002.

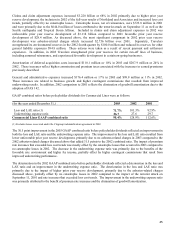

Claims and claim adjustment expenses decreased $2.148 billion or 27% in 2003 primarily due to lower unfavorable

prior year reserve development, partially offset by increased loss costs, growth in business volume and higher weather

related catastrophe losses. Catastrophe losses, net of reinsurance, were $103.8 million in 2003 compared to no

catastrophe losses in 2002. The 2003 catastrophe losses were primarily due to a severe winter storm in Colorado in the

first quarter, severe storms in the second quarter in a number of Southern and Midwestern states and Hurricane Isabel

in the third quarter. Unfavorable prior year reserve development included in claims and claim adjustment expenses

was $688.0 million in 2003 compared to $3.118 billion in 2002. The most significant component of 2003 prior year

development was Gulf reserve strengthening of $521.1 million. Reserve strengthening at Gulf primarily related to a

line of business that insured the residual values of leased vehicles and that was placed in runoff in late 2001 and the

resolution of a residual value claim dispute. Reserves for certain other business lines at Gulf were also strengthened as

was its allowance for uncollectible reinsurance recoverables. In addition to these Gulf charges, there was additional

other Commercial Lines net unfavorable prior year reserve development of $166.9 million which included a $115.0

million charge associated with American Equity and a $59.8 million increase in environmental reserves. Unfavorable

prior year reserve development in 2002 included $2.945 billion of asbestos-related charges (prior to the benefit related

to recoveries under the Citigroup indemnification agreement), compared to no asbestos incurrals in 2003. For

additional information see “– Asbestos Claims and Litigation”.