Travelers 2003 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

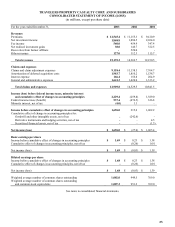

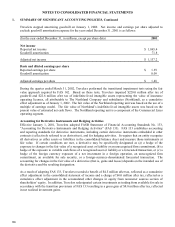

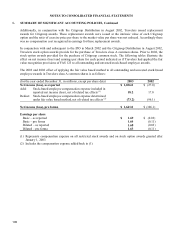

Travelers stopped amortizing goodwill on January 1, 2002. Net income and earnings per share adjusted to

exclude goodwill amortization expense for the year ended December 31, 2001 is as follows:

(for the year ended December 31, in millions, except per share data) 2001

Net income

Reported net income $ 1,065.4

Goodwill amortization 71.8

Adjusted net income $ 1,137.2

Basic and diluted earnings per share

Reported earnings per share $ 1.39

Goodwill amortization 0.09

Adjusted earnings per share $ 1.48

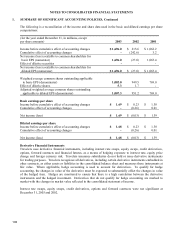

During the quarter ended March 31, 2002, Travelers performed the transitional impairment tests using the fair

value approach required by FAS 142. Based on these tests, Travelers impaired $220.0 million after tax of

goodwill and $22.6 million after tax of indefinite-lived intangible assets representing the value of insurance

operating licenses, all attributable to The Northland Company and subsidiaries (Northland), as a cumulative

effect adjustment as of January 1, 2002. The fair value of the Northland reporting unit was based on the use of a

multiple of earnings model. The fair value of Northland’s indefinite-lived intangible assets was based on the

present value of estimated net cash flows. The Northland reporting unit is a component of the Commercial Lines

operating segment.

Accounting for Derivative Instruments and Hedging Activities

Effective January 1, 2001, Travelers adopted FASB Statement of Financial Accounting Standards No. 133,

“Accounting for Derivative Instruments and Hedging Activities” (FAS 133). FAS 133 establishes accounting

and reporting standards for derivative instruments, including certain derivative instruments embedded in other

contracts (collectively referred to as derivatives), and for hedging activities. It requires that an entity recognize

all derivatives as either assets or liabilities in the consolidated balance sheet and measure those instruments at

fair value. If certain conditions are met, a derivative may be specifically designated as (a) a hedge of the

exposure to changes in the fair value of a recognized asset or liability or an unrecognized firm commitment, (b) a

hedge of the exposure to variable cash flows of a recognized asset or liability or a forecasted transaction, or (c) a

hedge of the foreign currency exposure of a net investment in a foreign operation, an unrecognized firm

commitment, an available for sale security, or a foreign-currency-denominated forecasted transaction. The

accounting for changes in the fair value of a derivative (that is, gains and losses) depends on the intended use of

the derivative and the resulting designation.

As a result of adopting FAS 133, Travelers recorded a benefit of $4.5 million after tax, reflected as a cumulative

effect adjustment in the consolidated statement of income and a charge of $4.0 million after tax, reflected as a

cumulative effect adjustment in the accumulated other changes in equity from nonowner sources section of

shareholders’ equity. In addition, Travelers redesignated certain investments as trading from available for sale in

accordance with the transition provisions of FAS 133 resulting in a gross gain of $8.0 million after tax, reflected

in net realized investment gains.