Travelers 2003 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

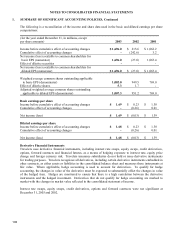

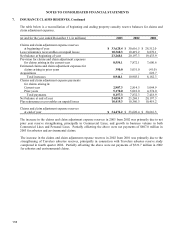

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

4. INVESTMENTS, Continued

Travelers process for reviewing invested assets for impairments during any quarter includes the following:

• Identification and evaluation of investments which have possible indications of impairment;

• Analysis of investments with gross unrealized investment losses that have fair values less than 80% of

amortized cost during successive quarterly periods over a rolling one-year period;

• Review of investment advisor(s) recommendations for other-than-temporary impairments based on the

investee’s current financial condition, liquidity, near-term recovery prospects and other factors, as well as

consideration of other investments that were not recommended for other-than-temporary impairments;

• Discussion of evidential matter, including an evaluation of factors or triggers that would or could cause

individual investments to qualify as having other-than-temporary impairments and those that would not

support other-than-temporary impairment;

• Determination of the status of each analyzed investment as other-than-temporary or not, with documentation

of the rationale for the decision.

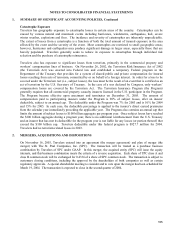

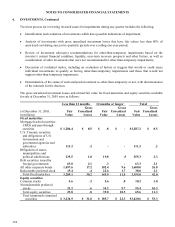

The gross unrealized investment losses and related fair value for fixed maturities and equity securities available

for sale at December 31, 2003 were as follows:

Less than 12 months 12 months or longer Total

Gross Gross Gross

(

at December 31, 2003, Fair Unrealized Fair Unrealized Fair Unrealized

in millions

)

Value Losses Value Losses Value Losses

Fixed maturities

Mort

g

a

g

e-

b

acked securities-

CMOs and

p

ass-throu

g

h

securities $ 1,286.4 $ 8.5 $ .8 $ - $ 1,287.2 $ 8.5

U.S. Treasur

y

securities

and obli

g

ations of U.S.

Government and

g

overnment a

g

encies and

authorities 111.2 .2 - - 111.2 .2

Obli

g

ations of states,

munici

p

alities and

p

olitical subdivisions 235.5 1.8 19.8 .5 255.3 2.3

Debt securities issued b

y

forei

g

n

g

overnments 63.0 2.1 .3 - 63.3 2.1

All other cor

p

orate bonds 1,497.6 17.2 102.4 9.6 1,600.0 26.8

Redeemable

p

referred stock 15.4 .4 22.6 1.7 38.0 2.1

Total fixed maturities 3

,

209.1 30.2 145.9 11.8 3

,

355.0 42.0

E

q

uit

y

securities

Common stocks 4.6 .2 5.6 .8 10.2 1.0

Nonredeemable

p

referred

stocks 21.2 .6 34.2 9.7 55.4 10.3

Total e

q

uit

y

securities 25.8 .8 39.8 10.5 65.6 11.3

Total tem

p

oraril

y

im

p

aired

securities $ 3,234.9 $ 31.0 $ 185.7 $ 22.3 $ 3,420.6 $ 53.3