Travelers 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

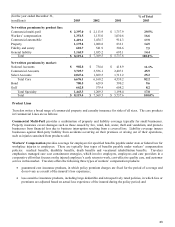

Proposed Merger

On November 16, 2003, Travelers entered into an agreement and plan of merger (the merger) with SPC. The transaction

will be treated as a purchase business combination by Travelers of SPC under accounting principles generally accepted in

the United States of America. In this merger, the acquired entity (SPC) will issue the equity interests and this business

combination meets the criteria of a reverse acquisition. Each share of TPC class A and class B common stock will be

exchanged for 0.4334 of a share of SPC common stock. The transaction is subject to customary closing conditions,

including the approval by the shareholders of both companies as well as certain regulatory approvals. A special

shareholder meeting to consider and to vote upon the merger has been scheduled for March 19, 2004. The transaction is

expected to close in the second quarter of 2004.

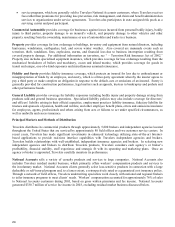

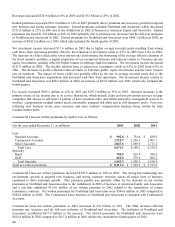

TPC 2003 Debt Offering

On March 11, 2003, TPC issued $1.4 billion of senior notes comprising $400.0 million of 3.75% senior notes due

March 15, 2008, $500.0 million of 5.00% senior notes due March 15, 2013 and $500.0 million of 6.375% senior notes

due March 15, 2033. The notes pay interest semi-annually on March 15 and September 15 of each year, beginning

September 15, 2003, are senior unsecured obligations and rank equally with all of TPC’s other senior unsecured

indebtedness. TPC may redeem some or all of the notes prior to maturity by paying a “make-whole” premium based

on U.S. Treasury rates. The net proceeds from the sale of these notes were contributed to TPC’s primary subsidiary,

Travelers Insurance Group Holdings Inc. (TIGHI), so that TIGHI could prepay and refinance $500.0 million of 3.60%

indebtedness to Citigroup and to redeem $900.0 million aggregate principal amount of TIGHI’s 8.00% to 8.08% junior

subordinated debt securities held by subsidiary trusts. These trusts, in turn, used these funds to redeem $900.0 million

of preferred capital securities on April 9, 2003.

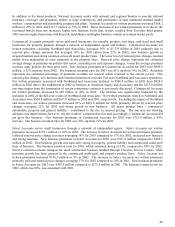

TPC 2002 Corporate Reorganization, Initial Public Offering and Concurrent Convertible Junior Subordinated

Notes Offering

In connection with the 2002 offerings described below, TPC effected a corporate reorganization under which:

• TPC transferred substantially all of its assets to affiliates of Citigroup Inc. (together with its consolidated

subsidiaries, Citigroup), other than the capital stock of TIGHI;

• Citigroup assumed all of TPC’s third-party liabilities, other than liabilities relating to TIGHI and TIGHI’s

active employees;

• TPC effected a recapitalization whereby the previously outstanding shares of its common stock (1,500 shares),

all of which were owned by Citigroup, were changed into 269.0 million shares of class A common stock and 500.0

million shares of class B common stock;

• TPC amended and restated its certificate of incorporation and bylaws.

As a result of these transactions, TIGHI and its property and casualty insurance subsidiaries became TPC’s principal

asset.