Travelers 2003 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

8. DEBT

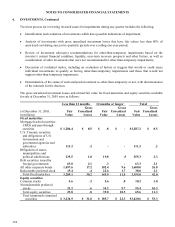

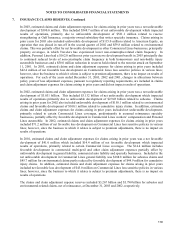

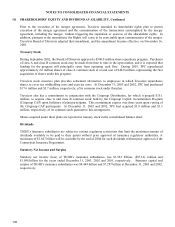

Notes payable to former affiliates, long-term debt and convertible notes payable outstanding were as follows:

(

at December 31, in millions

)

2003 2002

Notes payable to former affiliates $ - $ 700.0

Floating rate note due 2004, prepaid February 2003 - 550.0

6.75% Notes due 2006 150.0 150.0

3.75% Notes due 2008 400.0 -

7.81% Notes various due dates through 2011 24.0 27.0

5.00% Notes due 2013 500.0 -

7.75% Notes due 2026 200.0 200.0

6.375% Notes due 2033 500.0 -

4.50% Convertible junior subordinated notes payable due 2032 892.5 892.5

6.00% Convertible notes payable due 2032 49.8 49.7

2,716.3

2,569.2

Debt issuance costs (41.8) (25.5)

Total $ 2,674.5 $ 2,543.7

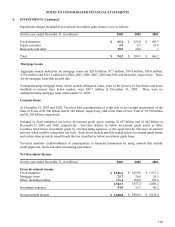

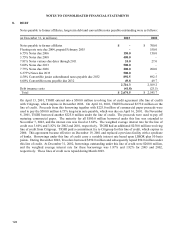

On April 13, 2001, TIGHI entered into a $500.0 million revolving line of credit agreement (the line of credit)

with Citigroup, which expires in December 2006. On April 16, 2001, TIGHI borrowed $275.0 million on the

line of credit. Proceeds from this borrowing together with $225.0 million of commercial paper proceeds were

used to pay the $500.0 million 6.75% long-term note payable, which was due on April 16, 2001. On November

8, 2001, TIGHI borrowed another $225.0 million under the line of credit. The proceeds were used to pay off

maturing commercial paper. The maturity for all $500.0 million borrowed under this line was extended to

November 7, 2003, and the interest rate was fixed at 3.60%. The weighted average interest rate for the line of

credit was 3.60% and 3.82% for 2002 and 2001, respectively. TIGHI had an additional $250.0 million revolving

line of credit from Citigroup. TIGHI paid a commitment fee to Citigroup for this line of credit, which expires in

2006. This agreement became effective on December 19, 2001 and replaced a previous facility with a syndicate

of banks. Borrowings under this line of credit carry a variable interest rate based upon LIBOR plus 50 basis

points. During December 2002, Travelers borrowed $250.0 million and subsequently repaid $50.0 million under

this line of credit. At December 31, 2002, borrowings outstanding under this line of credit were $200.0 million,

and the weighted average interest rate for these borrowings was 1.87% and 1.92% for 2003 and 2002,

respectively. These lines of credit were repaid during March 2003.