Travelers 2003 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.125

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

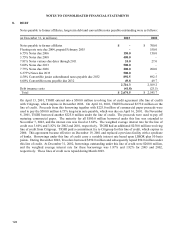

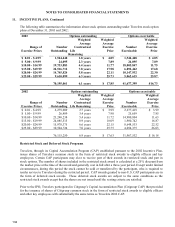

8. DEBT, Continued

On March 11, 2003, TPC issued $1.400 billion of senior notes comprised of $400.0 million of 3.75% senior

notes due March 15, 2008, $500.0 million of 5.00% senior notes due March 15, 2013 and $500.0 million of

6.375% senior notes due March 15, 2033. The notes pay interest semi-annually on March 15 and September 15

of each year, beginning September 15, 2003, are senior unsecured obligations and rank equally with all of TPC’s

other senior unsecured indebtedness. TPC may redeem some or all of the notes prior to maturity by paying a

“make-whole” premium based on U.S. Treasury rates. The net proceeds from the sale of these notes were

contributed to TIGHI, so that TIGHI could prepay and refinance $500.0 million of 3.60% indebtedness to

Citigroup and to redeem $900.0 million aggregate principal amount of TIGHI’s 8.00% to 8.08% junior

subordinated debt securities held by subsidiary trusts. These trusts, in turn, used these funds to redeem $900.0

million of preferred capital securities on April 9, 2003.

These senior notes were sold to qualified institutional buyers as defined under Rule 144A under the Securities

Act of 1933 (the Securities Act) and outside the United States in reliance on Regulation S under the Securities

Act. Accordingly, the notes (the restricted notes) were not registered under the Securities Act or any state

securities laws and could not be transferred or resold except pursuant to certain exemptions. As part of this

offering, TPC agreed to file a registration statement under the Securities Act to permit the exchange of the notes

for registered notes (the Exchange Notes) having terms identical to those of the senior notes described above

(Exchange Offer). On April 14, 2003, TPC initiated the Exchange Offer pursuant to a Form S-4 that was filed

with the Securities and Exchange Commission. Accordingly, each series of Exchange Notes has been registered

under the Securities Act, and the transfer restrictions and registration rights relating to the restricted notes do not

apply to the Exchange Notes. As of May 13, 2003 (the Expiration Date of the Exchange Offer), 99.8%, 99.4%

and 100% of TPC’s 5, 10, and 30-year restricted notes, respectively, were exchanged for Exchange Notes.

TPC’s primary source of funds for debt service is dividends from subsidiaries, which are subject to various

restrictions. See note 10.