Travelers 2003 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

126

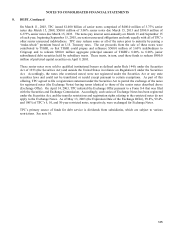

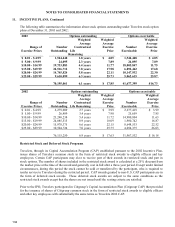

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

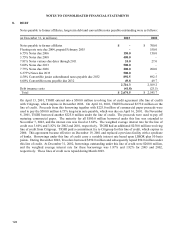

9. FEDERAL INCOME TAXES

(for the year ended December 31, in millions) 2003 2002 2001

Effective tax rate

Income (loss) before federal income taxes, minority interest and

cumulative effect of changes in accounting principles

$ 2,229.4

$ (259.8)

$ 1,389.0

Statutory tax rate 35.0% 35.0% 35.0%

Expected federal income taxes (benefit) 780.3 (90.9) 486.2

Tax effect of:

Nontaxable investment income (200.5) (180.1) (169.2)

Recoveries under Citigroup Indemnification Agreement - (182.0) -

Tax reserve adjustment (40.0) (23.0) (15.0)

Other, net (2.4) (.5) 24.8

Federal income taxes (benefit) $ 537.4 $ (476.5) $ 326.8

Effective tax rate 24.1% (183.4)% 23.5%

Composition of federal income taxes

Current expense:

United States $ (6.7) $ 109.0 $ 310.6

Foreign 5.0 3.3 5.1

Total (1.7) 112.3 315.7

Deferred expense:

United States 538.7 (588.5) 11.0

Foreign .4 (.3) .1

Total 539.1 (588.8) 11.1

Federal income taxes (benefit) $ 537.4 $ (476.5) $ 326.8

Additional tax benefits attributable to employee stock plans allocated directly to shareholders’ equity were $6.3

million, $2.6 million and $.3 million for the years ended December 31, 2003, 2002 and 2001, respectively.

The current federal income tax payable was $226.4 million and $179.5 million at December 31, 2003 and 2002,

respectively and is included in other liabilities in the consolidated balance sheet.