Travelers 2003 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

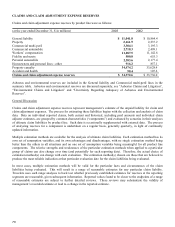

Property

Property is considered a short tail line with a simpler and faster claim adjustment process than liability coverages, and

less uncertainty in the reserve setting process. The claim reporting and settlement process for property coverage claim

reserves is generally restricted to the insured and the insurer.

Property reserves are typically analyzed in two components, one for catastrophic or other large single events, and

another for all other events. Examples of common risk factors that can change and, thus, affect the required property

reserves (beyond those included in the general discussion section) include:

Property risk factors

Physical concentration of policyholders

Availability and cost of local contractors

For the more severe catastrophic events, “demand surge” inflation, whereby the greatly increased demand for building

materials such as plywood far surpasses the immediate supply, leading to short-term material increases in building

material costs

Local building codes

Amount of time to return property to full usage (for business interruption claims)

Court interpretation of policy provisions (such as occurrence definition)

Lags in reporting claims (e.g. winter damage to summer homes, hidden damage after an earthquake)

Court or legislative changes to the statute of limitations

Property book of business risk factors

Policy provisions mix (e.g., deductibles, policy limits, endorsements)

Changes in underwriting standards

Commercial Multi-Peril

Commercial multi-peril provides a combination of property and liability coverage typically for small businesses and,

therefore, includes both short and long tail coverages. For property coverage, it generally takes a relatively short

period of time to close claims, while for the other coverages, generally for the liability coverages, it takes a longer

period of time to close claims.

The reserving risk for this line is dominated by the liability coverage portion of this product, except occasionally in the

event of catastrophic or large single losses. The reserving risk for this line differs from that of the general liability

product line and the property product line due to the nature of the customer. Commercial multi-peril is generally sold

to smaller sized accounts, while the customer profile for general liability and property include larger customers.

See the discussions under the property and general liability product lines with regard to reserving risk for commercial

multi-peril.

Commercial Automobile

The commercial automobile product line is a mix of property and liability coverages and, therefore, includes both short

and long tail coverages. The payments that are made quickly typically pertain to auto physical damage (property)

claims and property damage (liability) claims. The payments that take longer to finalize and are more difficult to

estimate relate to bodily injury claims. This mixture of claim payments creates a moderate estimation risk.

Commercial automobile reserves are typically analyzed in four components; bodily injury liability, property damage

liability, collision claims and comprehensive claims. These last two components have minimum reserve risk and fast

payouts and, accordingly, separate risk factors are not presented.