Travelers 2003 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

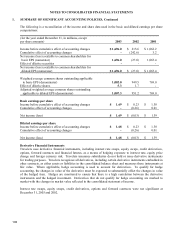

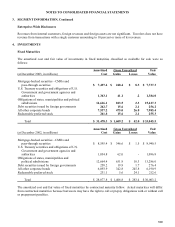

The 2001 effect of applying the fair value based method to all outstanding and unvested stock-based employee

awards in Citigroup’s common stock is as follows:

(for the year ended December 31, in millions, except per share data) 2001

Net income, as reported $ 1,065.4

Add: Stock-based employee compensation expense included in

reported net income, net of related tax effects (1)

19.4

Deduct: Stock-based employee compensation expense determined

under fair value based method, net of related tax effects (2)

(68.1)

Net income, pro forma $ 1,016.7

Earnin

g

s

p

er share

Basic and diluted – as reported $ 1.39

Basic and diluted – pro forma 1.32

(1) Restricted stock compensation expense.

(2) Includes the restricted stock compensation expense added back in (1).

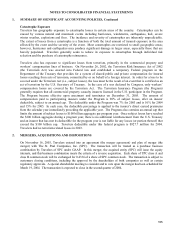

Earnings per Share (EPS)

EPS has been computed in accordance with Financial Accounting Standards No. 128, “Earnings per Share”.

Basic EPS is computed by dividing income available to common shareholders by the weighted average number

of common shares outstanding during the period. The computation of diluted EPS reflects the effect of

potentially dilutive outstanding employee stock-based awards, principally the incremental shares which are

assumed to be issued under Travelers 2002 Incentive Plan. Excluded from the computation of diluted EPS were

38.6 million of potentially dilutive shares related to convertible junior subordinated notes because the

contingency conditions for their issuance have not been satisfied. Shares for the years ended December 31, 2002

and 2001 have been adjusted to give effect to the recapitalization in March 2002, prior to the IPO, whereby the

outstanding shares of common stock (1,500 shares) were changed into 269.0 million shares of class A common

stock and 500.0 million shares of class B common stock.