Travelers 2003 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.132

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

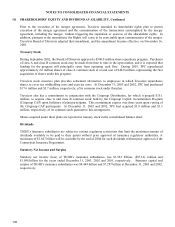

11. INCENTIVE PLANS

Travelers Board of Directors, in connection with the IPO, adopted the Travelers Property Casualty Corp. 2002

Stock Incentive Plan (the 2002 Incentive Plan). The 2002 Incentive Plan permits grants of stock options,

restricted stock, deferred stock and other stock-based awards. The purposes of the 2002 Incentive Plan are to

attract and retain employees by providing compensation opportunities that are competitive with other companies,

provide incentives to those employees who contribute significantly to Travelers long-term performance and

growth, and align employees’ long-term financial interests with those of Travelers shareholders. The maximum

number of shares of class A common stock that may be issued pursuant to awards granted under the 2002

Incentive Plan is 120.0 million shares.

Travelers Board of Directors, in connection with the IPO, also adopted the Travelers Property Casualty Corp.

Compensation Plan for Non-Employee Directors (the Directors Plan). Under the Directors Plan, the directors

receive their annual fees in the form of Travelers common stock. Each director may choose to receive a portion

of their fees in cash to pay taxes. Directors may also defer receipt of shares of class A common stock to a future

distribution date or upon termination of their service. The shares of class A common stock issued under the

Directors Plan come from the 2002 Incentive Plan.

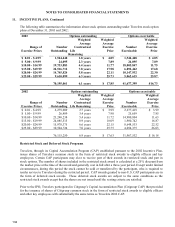

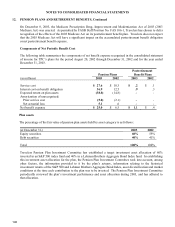

Stock Option Programs

Travelers has established stock option programs pursuant to the 2002 Incentive Plan: the Management stock

option program and the Wealthbuilder stock option program (see also Restricted Stock and Deferred Stock

Programs below). The Management stock option program provides for the granting of stock options to officers

and key employees of Travelers and its participating subsidiaries. The Wealthbuilder stock option program

provides for the granting of stock options to all employees meeting certain requirements. The exercise price of

options is equal to the fair market value of Travelers class A common stock at the time of grant. Generally,

options vest 20% each year over a five-year period and may be exercised for a period of ten years from the date

of the grant only if the optionee is employed by Travelers, and for certain periods after employment termination,

depending on the cause of termination. The Management stock option program also permits an employee

exercising an option to be granted a new option (a reload option) in an amount equal to the number of shares of

class A common stock used to satisfy both the exercise price and withholding taxes due upon exercise of an

option. The reload options are granted at an exercise price equal to the fair market value of the class A common

stock on the date of grant, vest six months after the grant date and are exercisable for the remaining term of the

related original option. The reload feature is not available for initial option grants after January 23, 2003. The

Wealthbuilder stock option program does not contain a reload feature.

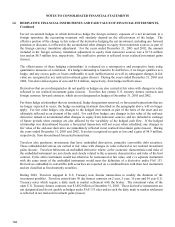

Prior to the IPO, Travelers participated in various stock option plans sponsored by its former affiliate, Citigroup,

that provided for the granting of stock options in Citigroup common stock to officers and key employees, and, in

the case of certain stock option programs, to all employees meeting specific requirements.