Travelers 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

BUSINESS DESCRIPTION

COMMERCIAL LINES

Travelers Commercial Lines segment offers a broad array of property and casualty insurance and insurance-related

services to its clients. Commercial Lines is organized into the following five marketing and underwriting groups, each

of which focuses on a particular client base or product grouping to provide products and services that specifically

address clients’ needs:

• National Accounts provides large corporations with casualty products and services and includes Travelers

residual market business which offers workers’ compensation products and services to the involuntary market;

• Commercial Accounts provides property and casualty products to mid-sized businesses, property products to

large businesses and boiler and machinery products to businesses of all sizes, and includes dedicated groups

focused on the construction industry, transportation industry, agribusiness, and ocean and inland marine;

• Select Accounts provides small businesses with property and casualty products, including packaged property

and liability policies;

• Bond provides a wide range of customers with specialty products built around Travelers market leading surety

bond business along with an expanding executive liability practice for middle and small market private accounts

and not-for-profit accounts; and

• Gulf provides a broad array of specialty coverages to all sizes of customers with particular emphasis on small

and mid-sized accounts.

In 2003, Commercial Lines generated net written premiums of approximately $8.119 billion.

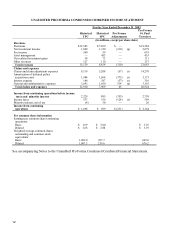

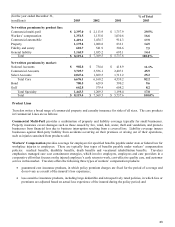

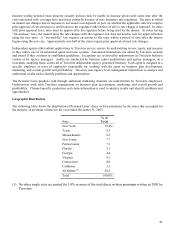

Selected Product and Market Information

The accompanying table sets forth net written premiums for Commercial Lines by product line and market for the

periods indicated. For a description of the product lines and markets referred to in the table, see “– Product Lines” and

“–Principal Markets and Methods of Distribution,” respectively.

Many National Accounts customers require insurance-related services in addition to or in lieu of pure risk coverage,

primarily for workers’ compensation and, to a lesser extent, general liability and commercial automobile exposures.

These types of services include risk management services, such as claims administration, loss control and risk

management information services, and are generally offered in connection with large deductible or self-insured

programs. These services generate fee income rather than net written premiums, which are not reflected in the

accompanying table. Net written premiums were as follows: