Travelers 2003 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

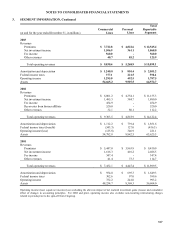

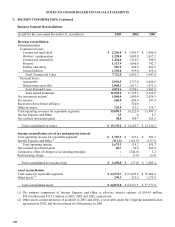

3. SEGMENT INFORMATION, Continued

Enterprise-Wide Disclosures

Revenues from internal customers, foreign revenues and foreign assets are not significant. Travelers does not have

revenue from transactions with a single customer amounting to 10 percent or more of its revenues.

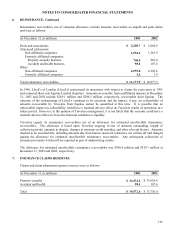

4. INVESTMENTS

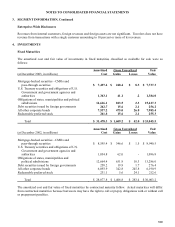

Fixed Maturities

The amortized cost and fair value of investments in fixed maturities classified as available for sale were as

follows:

Gross Unrealized

(at December 2003, in millions)

Amortized

Cost Gains Losses

Fair

Value

Mortgage-backed securities - CMOs and

pass-through securities $ 7,497.4 $ 248.4 $ 8.5 $ 7,737.3

U.S. Treasury securities and obligations of U.S.

Government and government agencies and

authorities 1,343.1

41.1

.2

1,384.0

Obligations of states, municipalities and political

subdivisions 14,616.1

813.5

2.3

15,427.3

Debt securities issued by foreign governments 242.7 15.6 2.1 256.2

All other corporate bonds 7,537.2 475.0 26.8 7,985.4

Redeemable preferred stock 241.8 15.6 2.1 255.3

Total $ 31,478.3 $ 1,609.2 $ 42.0 $ 33,045.5

Gross Unrealized

(at December 2002, in millions)

Amortized

Cost Gains Losses

Fair

Value

Mortgage-backed securities - CMOs and

pass-through securities $ 8,595.4 $ 346.6 $ 1.5 $ 8,940.5

U.S. Treasury securities and obligations of U.S.

Government and government agencies and

authorities

1,034.8

62.0

-

1,096.8

Obligations of states, municipalities and

political subdivisions

12,664.4

631.9

10.3

13,286.0

Debt securities issued by foreign governments 258.2 19.9 1.7 276.4

All other corporate bonds 6,093.9 342.8 245.8 6,190.9

Redeemable preferred stock 231.1 5.6 24.1 212.6

Total $ 28,877.8 $ 1,408.8 $ 283.4 $ 30,003.2

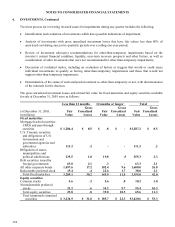

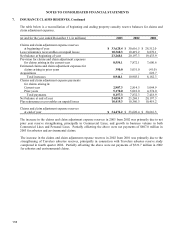

The amortized cost and fair value of fixed maturities by contractual maturity follow. Actual maturities will differ

from contractual maturities because borrowers may have the right to call or prepay obligations with or without call

or prepayment penalties.