Travelers 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61

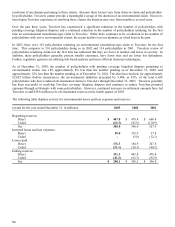

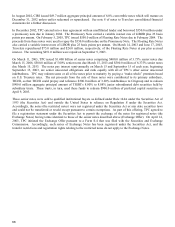

Net cash flows used in investing activities totaled $2.475 billion, $2.270 billion and $95.5 million in 2003, 2002 and

2001, respectively. The 2003 net cash flows used in investing activities primarily reflected the investing of net cash

from operating activities of $3.833 billion. This was offset, in part, by sales of securities to fund net payment activity

of $771.6 million related to debt and TIGHI’s junior subordinated debt securities held by subsidiary trusts. In addition,

cash was used to pay quarterly dividends to shareholders of $281.8 million. The 2002 net cash flows used in investing

activities principally reflected investing of net cash from operating activities of $2.926 billion and the receipt of $4.090

billion from the first quarter 2002 initial public offering and the concurrent issuance of $867.0 million of convertible

notes payable, partially offset by the repayment of $6.349 billion of notes payable to a former affiliate. The 2001 net

cash flows used in investing activities principally reflected investing of net cash from operating activities of $1.219

billion, partially offset by sales of securities to fund the repayment of $1.040 billion of notes payable to a former

affiliate and the payment of $526.0 million of dividends.

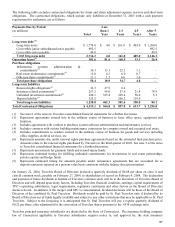

Net cash flows are generally invested in marketable securities. Travelers closely monitors the duration of these

investments, and investment purchases and sales are executed with the objective of having adequate funds available to

satisfy Travelers liabilities. As Travelers investment strategy focuses on asset and liability durations, and not specific

cash flows, asset sales may be required to satisfy obligations and/or rebalance asset portfolios. Travelers invested

assets at December 31, 2003 totaled $38.653 billion, including $348.8 million of securities in process of settlement, of

which 91% was invested in fixed maturity and short-term investments, 2% in common stocks and other equity

securities, 1% in mortgage loans and real estate held for sale and 6% in other investments. The effective average

duration of fixed maturities and short-term securities, net of securities lending activities and net receivables and

payables on investment sales and purchases, was 4.1 years as of December 31, 2003, a 0.9 decrease from 5.0 years as

of December 31, 2002. The reduction in effective average duration resulted from the investment of underwriting cash

flows and investment maturities and sales proceeds in shorter-term investments along with the sale of certain treasury

futures contracts.

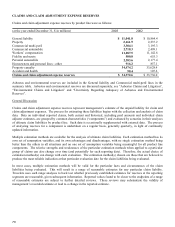

An investment in a fixed maturity or equity security which is available for sale is impaired if its fair value falls below

its book value and the decline is considered to be other-than-temporary.

Debt securities for which fair value is less than 80% of amortized cost for more than one quarter are evaluated for

other-than-temporary impairment. A debt security is impaired if it is probable that Travelers will not be able to collect

all amounts due under the security’s contractual terms.

Factors Travelers considers in determining whether a decline is other-than-temporary for debt securities include the

following:

• The length of time and the extent to which fair value has been below cost. It is likely that the decline will become

“other than temporary” if the market value has been below cost for six to nine months or more;

• The financial condition and near-term prospects of the issuer. The issuer may be experiencing depressed and

declining earnings relative to competitors, erosion of market share, deteriorating financial position, lowered

dividend payments, declines in securities ratings, bankruptcy, and financial statement reports that indicate an

uncertain future. Also, the issuer may experience specific events that may influence its operations or earnings

potential, such as changes in technology, discontinuation of a business segment, catastrophic losses or exhaustion

of natural resources.

• Travelers ability and intent to hold the investment for a period of time sufficient to allow for any anticipated

recovery.

Equity investments are impaired when it becomes probable that Travelers will not recover its cost over the expected

holding period. Public equity investments (i.e., common stocks) trading at a price that is less than 80% of cost for more

than one quarter are reviewed for impairment. Investments accounted for using the equity method of accounting are

evaluated for impairment any time the investment has sustained losses and/or negative operating cash flow for a period

of 9 months or more. Events triggering the other-than-temporary impairment analysis of public and non-public equities

may include the following, in addition to the considerations noted above for debt securities:

Factors affecting performance:

• The investee loses a principal customer or supplier for which there is no short-term prospect for replacement

or experiences other substantial changes in market conditions;