Travelers 2003 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

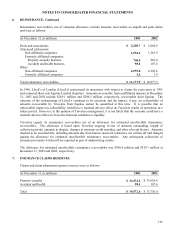

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

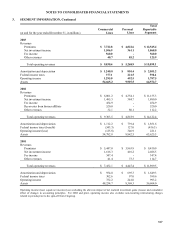

3. SEGMENT INFORMATION, Continued

Business Segment Reconciliations

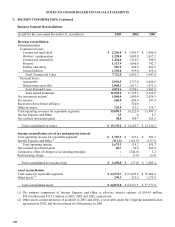

(at and for the year ended December 31, in millions) 2003 2002 2001

Revenue reconciliation

Earned premiums

Commercial Lines:

Commercial multi-peril $ 2,256.8 $ 1,956.7 $ 1,686.4

Workers’ compensation 1,238.0 1,009.8 1,017.1

Commercial automobile 1,424.6 1,310.3 920.9

Property 1,113.9 1,066.6 742.7

Fidelity and surety 587.9 498.8 466.5

General liability 1,101.6 959.0 613.4

Total Commercial Lines 7,722.8 6,801.2 5,447.0

Personal Lines:

Automobile 2,954.5 2,737.0 2,490.6

Homeowners and other 1,868.1 1,617.1 1,473.3

Total Personal Lines 4,822.6 4,354.1 3,963.9

Total earned premiums 12,545.4 11,155.3 9,410.9

Net investment income 1,868.0 1,880.0 2,026.5

Fee income 560.0 454.9 347.4

Recoveries from former affiliates - 520.0 -

Other revenues 125.9 112.2 114.7

Total operating revenues for reportable segments 15,099.3 14,122.4 11,899.5

Interest Expense and Other 1.9 .6 8.5

Net realized investment gains 38.0 146.7 322.5

Total consolidated revenues $ 15,139.2 $ 14,269.7 $ 12,230.5

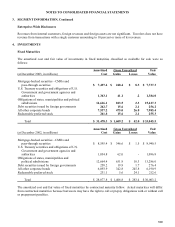

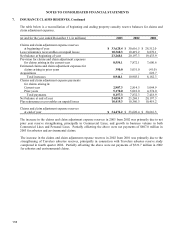

Income reconciliation, net of tax and minority interest

Total operating income for reportable segments $ 1,787.5 $ 221.1 $ 993.2

Interest Expense and Other (1) (112.2) (102.9) (137.5)

Total operating income 1,675.3 118.2 855.7

Net realized investment gains 20.7 99.0 209.9

Cumulative effect of changes in accounting principles - (242.6) 3.2

Restructuring charge - (1.6) (3.4)

Total consolidated net income (loss) $ 1,696.0 $ (27.0) $ 1,065.4

Asset reconciliation

Total assets for reportable segments $ 64,572.7 $ 63,625.3 $ 56,604.0

Other assets (2) 299.3 512.2 1,173.8

Total consolidated assets $ 64,872.0 $ 64,137.5 $ 57,777.8

(1) The primary component of Interest Expense and Other is after-tax interest expense of $104.9 million,

$99.6 million and $133.2 million in 2003, 2002 and 2001, respectively.

(2) Other assets consist primarily of goodwill in 2003 and 2002, a receivable under the Citigroup indemnification

agreement in 2002, and the investment in CitiInsurance in 2001.