Travelers 2003 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.93

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

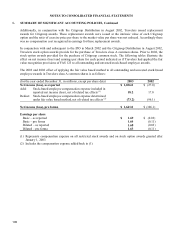

Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity

Effective January 1, 2003, Travelers adopted FASB Statement of Financial Accounting Standards No. 150 (FAS

150), “Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity”, which

establishes standards for how an issuer classifies and measures certain financial instruments with characteristics

of both liabilities and equity. FAS 150 requires an issuer to classify the following instruments as liabilities (or

assets in some circumstances):

• A financial instrument issued in the form of shares that is mandatorily redeemable - that embodies an

unconditional obligation requiring the issuer to redeem it by transferring its assets at a specified or

determinable date (or dates) or upon an event that is certain to occur;

• A financial instrument, other than an outstanding share, that, at inception, embodies an obligation to

repurchase the issuer’s equity shares, or is indexed to such an obligation, and that requires or may require

the issuer to settle the obligation by transferring assets (for example, a forward purchase contract or

written put option on the issuer’s equity shares that is to be physically settled or net cash settled);

• A financial instrument that embodies an unconditional obligation, or a financial instrument other than an

outstanding share that embodies a conditional obligation, that the issuer must or may settle by issuing a

variable number of its equity shares,

if, at inception, the monetary value of the obligation is based solely or predominantly on any of the following:

(a) a fixed monetary amount known at inception, (b) variations in something other than the fair value of the

issuer’s equity shares, or (c) variations inversely related to changes in the fair value of the issuer’s equity shares.

The adoption of FAS 150 did not impact Travelers consolidated financial statements.

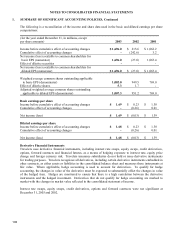

Business Combinations, Goodwill and Other Intangible Assets

Effective January 1, 2002, Travelers adopted FASB Statements of Financial Accounting Standards No. 141,

“Business Combinations” (FAS 141) and No. 142, “Goodwill and Other Intangible Assets” (FAS 142). These

standards change the accounting for business combinations by, among other things, prohibiting the prospective

use of pooling-of-interests accounting and requiring companies to stop amortizing goodwill and certain

intangible assets with an indefinite useful life created by business combinations accounted for using the purchase

method of accounting. Instead, goodwill and intangible assets deemed to have an indefinite useful life will be

subject to an annual review for impairment. Other intangible assets that are not deemed to have an indefinite

useful life will continue to be amortized over their useful lives.