Travelers 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19

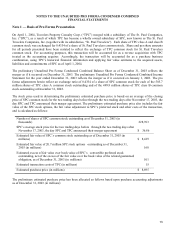

Note 3 — Fair Value of Claims and Claim Adjustment Expense Reserves and Reinsurance

Recoverables

An adjustment has been applied to SPC's claims and claim adjustment expense reserves to estimate their fair value.

Since such reserves are not traded in a secondary market, the determination of a fair value is approximated by using

risk-adjusted present value techniques. Such techniques require application of significant judgment and assumptions.

The fair value adjustment that was applied included (1) discounting the reserves at risk-free rates of interest over an

assumed period of 30 years and (2) adding a risk factor that reflects the uncertainty within the reserves. Various

methodologies were considered to address the uncertainty in the reserves, including alternative measures of the

opportunity cost of capital and other underlying factors.

For purposes of the Unaudited Pro Forma Condensed Combined Income Statement, which assumes that the merger

was consummated on January 1, 2003, the range of risk-free rates of interest employed in the calculation was

approximately 1.2% to 4.9%, with a weighted average of 3.0% over an assumed payout period of 30 years and an

assumed average payout date of about 3.5 to 4.0 years. The fair value adjustment is being accreted in the pro forma

income statements over the period that the reserves are expected to remain outstanding, using an interest method that

locks in the initial interest rates by expected payment date.

For purposes of the Unaudited Pro Forma Condensed Combined Balance Sheet at December 31, 2003, the range of

risk-free rates of interest applied to the fair value adjustment was approximately 1.1% to 5.3%, with a weighted

average of 3.4% over an assumed payout period of 30 years and an assumed average payout date of about 3.5 to 4.0

years.

A similar methodology was applied to the related ceded reinsurance recoverables.

These estimates are subject to change, based on actual interest rates as of April 1, 2004 (the closing date of the merger)

and continuing refinement of the methodologies underlying risk factor development. As a result, the amount of the

final purchase accounting adjustment and subsequent accretion could differ materially from the amounts presented in

the preliminary unaudited pro forma condensed combined financial statements.