Travelers 2003 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.92

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

Retirement-Plan Disclosures

In December 2003, the FASB issued a revised Statement of Financial Accounting Standards No. 132,

“Employers’ Disclosures about Pensions and Other Postretirement Benefits” (Revised FAS 132). The Revised

FAS 132 does not change the measurement or recognition provisions required by FASB Statements No. 87,

“Employers’ Accounting for Pensions,” No. 88, “Employers’ Accounting for Settlements and Curtailments of

Defined Benefits Pension Plans and Termination of Benefits,” and No. 106, “Employers’ Accounting for

Postretirement Benefits Other Than Pensions.” This statement retains the disclosure requirements of the

original FAS 132 issued in February 1998 and requires additional disclosures about the assets, obligations, cash

flows and net periodic benefit cost of defined benefit pension plans and other defined benefit postretirement

plans. The Revised FAS 132 is effective for fiscal years ending after December 15, 2003, except for disclosures

of estimated future benefit payments, which are effective for fiscal years ending after June 15, 2004. Interim

period disclosures are effective for interim periods beginning after December 15, 2003. Effective December 31,

2003, Travelers adopted the Revised FAS 132.

The Meaning of Other-Than-Temporary Impairment and Its Application to Certain Investments

Effective December 31, 2003, Travelers adopted FASB Emerging Issues Task Force (EITF) Issue 03-01, “The

Meaning of Other-Than-Temporary Impairment and Its Application to Certain Investments” (EITF 03-01).

EITF 03-01 requires that certain quantitative and qualitative disclosures be made for debt and marketable equity

securities classified as available for sale or held to maturity that are impaired at the balance sheet date but for

which an other-than-temporary impairment has not been recognized.

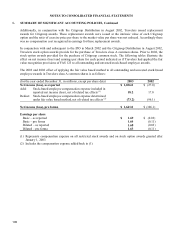

Stock-Based Compensation

In December 2002, the FASB issued Statement of Financial Standards No. 148, “Accounting for Stock-Based

Compensation-Transition and Disclosure” (FAS 148), an amendment to FASB Statement of Financial

Accounting Standards No. 123, “Accounting for Stock-Based Compensation” (FAS 123). Provisions of this

statement provide two additional alternative transition methods: modified prospective method and retroactive

restatement method, for an entity that voluntarily changes to the fair value based method of accounting for stock-

based employee compensation. The statement eliminates the use of the original FAS 123 prospective method of

transition alternative for those entities that change to the fair value based method in fiscal years beginning after

December 15, 2003. It also amends the disclosure provisions of FAS 123 to require prominent annual disclosure

about the effects on reported net income in the Summary of Significant Accounting Policies and also requires

disclosure about these effects in interim financial statements. These provisions are effective for financial

statements for fiscal years ending after December 15, 2002. Accordingly, Travelers adopted the applicable

disclosure requirements of this statement beginning with year-end 2002 reporting. The transition provisions of

this statement apply upon adoption of the FAS 123 fair value based method.

Effective January 1, 2003, Travelers adopted the fair value method of accounting for its employee stock-based

compensation plans as defined in FAS 123. FAS 123 indicates that the fair value based method is the preferred

method of accounting. Travelers has elected to use the prospective recognition transition alternative of FAS 148.

Under this alternative only the awards granted, modified, or settled after January 1, 2003 will be accounted for in

accordance with the fair value method. The adoption of FAS 123 did not have a significant impact on Travelers

results of operations, financial condition or liquidity.