Travelers 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

Insurers writing personal lines property casualty policies may be unable to increase prices until some time after the

costs associated with coverage have increased, primarily because of state insurance rate regulation. The pace at which

an insurer can change rates in response to increased costs depends, in part, on whether the applicable state law requires

prior approval of rate increases or notification to the regulator either before or after a rate change is imposed. In states

with prior approval laws, rates must be approved by the regulator before being used by the insurer. In states having

“file-and-use” laws, the insurer must file rate changes with the regulator, but does not need to wait for approval before

using the new rates. A “use-and-file” law requires an insurer to file rates within a period of time after the insurer

begins using the new rate. Approximately one-half of the states require prior approval of most rate changes.

Independent agents either submit applications to Travelers service centers for underwriting review, quote, and issuance

or they utilize one of its automated quote and issue systems. Automated transactions are edited by Travelers systems

and issued if they conform to established guidelines. Exceptions are reviewed by underwriters in Travelers business

centers or by agency managers. Audits are conducted by business center underwriters and agency managers, on a

systematic sampling basis, across all of Travelers independent agency generated business. Each agent is assigned to a

specific employee or team of employees responsible for working with the agent on business plan development,

marketing, and overall growth and profitability. Travelers uses agency level management information to analyze and

understand results and to identify problems and opportunities.

The Personal Lines products sold through additional marketing channels are underwritten by Travelers employees.

Underwriters work with Travelers management on business plan development, marketing, and overall growth and

profitability. Channel-specific production and claim information is used to analyze results and identify problems and

opportunities.

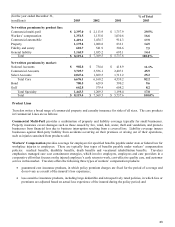

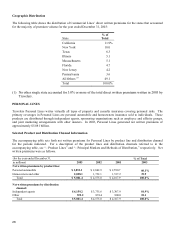

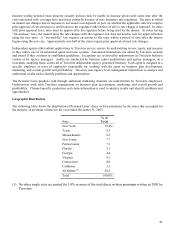

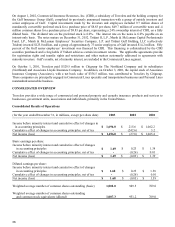

Geographic Distribution

The following table shows the distribution of Personal Lines’ direct written premiums for the states that accounted for

the majority of premium volume for the year ended December 31, 2003:

State

% of

Total

New York 18.4%

Texas 9.5

Massachusetts 8.2

New Jersey 7.7

Pennsylvania 7.1

Florida 5.1

Georgia 4.4

Virginia 4.1

Connecticut 4.0

California 3.3

All Others (1) 28.2

Total 100.0%

(1) No other single state accounted for 3.0% or more of the total direct written premiums written in 2003 by

Travelers.