Travelers 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

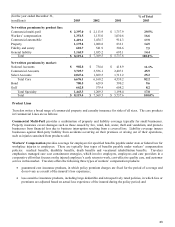

Travelers residual market business sells claims and policy management services to workers’ compensation and

automobile assigned risk plans and to self-insurance pools throughout the United States. Travelers services

approximately 35% of the total workers’ compensation assigned risk market. Travelers is one of only two servicing

carriers that operate nationally. Assigned risk plan contracts generated approximately $197.3 million in service fee

income in 2003.

Commercial Accounts sells a broad range of property and casualty insurance products through a large network of

independent agents and brokers. Commercial Accounts’ casualty products primarily target mid-sized businesses with

75 to 1,000 employees, while its property products target large, mid-sized and small businesses. Travelers offers a full

line of products to its Commercial Accounts customers with an emphasis on guaranteed cost programs.

A key objective of Commercial Accounts is continued focus on first party product lines of business, which cover risks

of loss to property of the insured. Beyond the traditional middle market network, dedicated units exist to complement

the middle market or specifically respond to the unique or unusual business client insurance needs. These units are:

• Construction - dedicated claim, engineering and underwriting expertise solely targeting construction risks;

• National property - underwrites large property schedules insuring buildings, property and business interruption

exposures;

• Transportation - auto products tailored to the trucking industry distributed via general agents;

• Boiler and machinery - comprehensive breakdown coverages for equipment;

• Marine - inland and ocean coverages for mid-sized to large accounts;

• Agribusiness - insurance programs for small to mid-sized farmowners, ranchowners and commercial growers;

• Specialty excess and surplus - products sold through general agents targeting small commercial risks; and

• Affinity - programs sold to association, franchise, trade or affinity groups.

Select Accounts is one of the leading providers of property casualty products to small businesses. It generally serves

firms with one to 75 employees. Products offered by Select Accounts are guaranteed cost policies, often a packaged

product covering property and liability exposures. Products are sold through independent agents, who are often the

same agents that sell Travelers Commercial Accounts and Personal Lines products.