Travelers 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

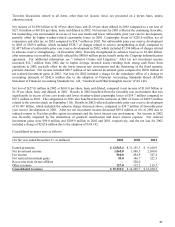

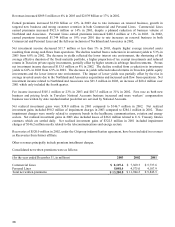

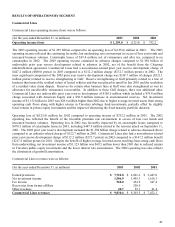

Revenues increased $526.9 million or 6% in 2003 and $1.851 billion or 25% in 2002.

Earned premiums increased $921.6 million or 14% in 2003 primarily due to premium rate increases, growth in targeted

new business and strong customer retention. Earned premiums included Northland and Associates which decreased

$213.8 million or 25% in 2003 due to the withdrawal in 2002 of business at American Equity and Associates. Earned

premiums increased $1.354 billion or 25% in 2002 primarily due to premium rate increases and the full-year inclusion

of Northland and Associates in 2002. Earned premiums for Northland and Associates were $846.1 million in 2002, an

increase of $642.9 million over 2001 which only included the fourth quarter of 2001.

Net investment income increased $11.6 million in 2003 due to higher average invested assets resulting from strong

cash flows from operations partially offset by the reduction in investment yields to 5.3% in 2003 from 6.0% in 2002.

The decrease in yields reflected the lower interest rate environment, the shortening of the average effective duration of

the fixed maturity portfolio, a higher proportion of tax-exempt investments and reduced returns in Travelers private

equity investments; partially offset by higher returns in arbitrage fund investments. Net investment income decreased

$121.0 million in 2002. The decline resulted from a reduction in investment yields to 6.0% in 2002 from 6.9% in

2001. The decrease in yields reflected reduced returns in Travelers public equity investments and the lower interest

rate environment. The impact of lower yields was partially offset by the rise in average invested assets due to the

Northland and Associates acquisitions and increased cash flow from operations. Net investment income related to

Northland and Associates was $88.2 million in 2002, an increase of $65.8 million over 2001 which only included the

fourth quarter.

Fee income increased $105.1 million or 23% in 2003 and $107.5 million or 31% in 2002. National Accounts is the

primary source of fee income due to its service businesses, which include claim and loss prevention services to large

companies that choose to self-insure a portion of their insurance risks, and claims and policy management services to

workers’ compensation residual market pools, automobile assigned risk plans and to self-insurance pools. Fees rose

reflecting new business levels, price increases and more workers’ compensation business being written by state

residual market pools.

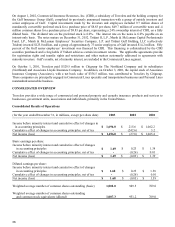

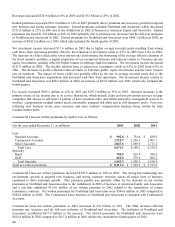

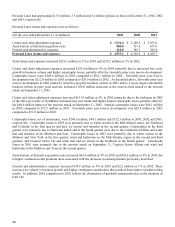

Commercial Lines net written premiums by market were as follows:

(for the year ended December 31, in millions) 2003 2002 2001

Core

National Accounts $ 902.8 $ 734.6 $ 418.9

Commercial Accounts 3,725.7 3,556.1 2,407.1

Select Accounts 2,047.6 1,869.5 1,713.2

Total Core 6

,

676.1 6

,

160.2 4

,

539.2

S

p

ecialt

y

Bond 780.5 629.9 590.2

Gulf 662.8 579.4 608.2

Total S

p

ecialt

y

1

,

443.3 1

,

209.3 1

,

198.4

Total net written premiums $ 8,119.4 $ 7,369.5 $ 5,737.6

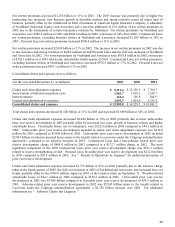

Commercial Lines net written premiums increased $749.9 million or 10% in 2003. The strong but moderating rate

environment, growth in targeted new business, and strong customer retention across all major lines of business

combined to drive premium growth. This premium growth was partially offset by the decrease in net written

premiums at Northland and Associates due to the withdrawal in 2002 of business at American Equity and Associates

and a one-time additional $115.0 million of net written premium in 2002 related to the termination of certain

reinsurance contracts. Net written premiums for Northland and Associates were $546.8 million in 2003 compared to

$824.8 million in 2002. The Commercial Lines business of Northland and Associates is included with Commercial

Accounts.

Commercial Lines net written premiums in 2002 increased $1.632 billion or 28%. The 2002 increase reflected

premium rate increases and the full-year inclusion of Northland and Associates. The inclusion of Northland and

Associates contributed $657.4 million to the increase. Net written premiums for Northland and Associates were

$824.8 million in 2002 compared to $167.4 million in 2001 which only included the fourth quarter of 2001.