Travelers 2003 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.99

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

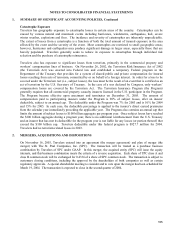

Premiums and Unearned Premium Reserves

Premiums are recognized as revenues pro rata over the policy period. Unearned premium reserves represent the

unexpired portion of policy premiums. Accrued retrospective premiums are included in premium balances

receivable. Premium balances receivable are reported net of an allowance for estimated uncollectible premium

amounts.

Ceded premiums are charged to income over the applicable term of the various reinsurance contracts with third

party reinsurers. Prepaid reinsurance premiums represent the unexpired portion of premiums ceded to reinsurers

and are reported as part of other assets.

Fee Income

Fee income includes servicing fees from carriers and revenues from large deductible policies and service

contracts and is recognized pro rata over the contract or policy periods.

Recoveries From Former Affiliate

Recoveries from former affiliate consist of the recoveries under the Citigroup indemnification agreement.

Other Revenues

Other revenues include revenues from premium installment charges, which are recognized as collected, revenues

of noninsurance subsidiaries other than fee income and gains and losses on dispositions of assets and operations

other than net realized investment gains and losses.

Federal Income Taxes

The provision for federal income taxes comprises two components, current income taxes and deferred income

taxes. Deferred federal income taxes arise from changes during the year in cumulative temporary differences

between the tax basis and book basis of assets and liabilities.

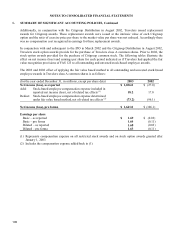

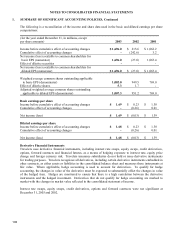

Stock-Based Compensation

Travelers has an employee stock incentive compensation plan that includes stock option programs and restricted

stock programs.

For stock-based employee awards granted, modified, or settled after December 31, 2002, Travelers applies the

FAS 123 fair value method of accounting. Under this method, compensation cost is measured at the grant date

based on the fair value of the award and recognized ratably over the vesting period. For restricted stock the fair

value is measured at the market price of a share on the grant date while for stock options the fair value is derived

by the application of an option pricing model at date of grant.

For stock-based employee awards granted prior to January 1, 2003, Travelers accounts for these awards under

the recognition and measurement principles of Accounting Principles Board Opinion No. 25 (APB 25),

“Accounting for Stock Issued to Employees”, and related interpretations. Travelers continues to apply the APB

25 accounting guidance for these awards as Travelers elected to use the prospective recognition transition

alternative of FAS 148. Under this method, compensation cost is measured at grant date based upon the market

value of the underlying stock at the date of grant less any amount that the employee is required to pay and

recognized ratably over the vesting period. For employee restricted stock awards, the awards are granted at the

market value of the underlying stock on grant date and accordingly the market value of these awards is

recognized as compensation expense ratably over the vesting period. For employee stock option awards, the

awards are granted at an exercise price equal to the market value of the underlying common stock on the date of

the grant and accordingly there has been no employee compensation expense recognized in earnings for the

stock option awards granted prior to adoption of the FAS 123 fair value method of accounting on January 1,

2003.