Travelers 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68

commissioner for the declaration or payment of any dividend that together with other distributions made within the

preceding twelve months exceeds the greater of 10% of the insurer's surplus as of the preceding December 31, or the

insurer's net income for the twelve-month period ended the preceding December 31, in each case determined in

accordance with statutory accounting practices. This declaration or payment is further limited by adjusted unassigned

surplus, as determined in accordance with statutory accounting practices. The insurance holding company laws of

other states in which Travelers subsidiaries are domiciled generally contain similar, although in some instances

somewhat more restrictive, limitations on the payment of dividends. A maximum of $1.647 billion is available by the

end of 2004 for such dividends without prior approval of the Connecticut Insurance Department.

On September 25, 2002, the Board of Directors approved a $500.0 million share repurchase program. Purchases of class A

and class B stock may be made from time to time in the open market, and it is expected that funding for the program will

principally come from dividends from TPC’s operating subsidiaries. Shares repurchased are reported as treasury stock in

the consolidated balance sheet. During 2003, TPC repurchased approximately 2.6 million shares of class A common stock

at a total cost of $40.0 million, representing the first acquisition of shares under this program. Also during 2003, 1.8

million shares of common stock were acquired from employees as treasury stock primarily to cover payroll withholding

taxes in connection with the vesting of restricted stock awards and exercises of stock options. In anticipation of the

potential merger with SPC, Travelers does not anticipate the repurchase of additional shares in 2004.

TPC has the option to defer interest payments on its convertible junior subordinated notes for a period not exceeding

20 consecutive quarterly interest periods. If TPC elects to defer interest payments on the notes, it will not be

permitted, with limited exceptions, to pay dividends on its common stock during a deferral period.

The NAIC adopted RBC requirements for property casualty companies to be used as minimum capital requirements by

the NAIC and states to identify companies that merit further regulatory action. The formulas have not been designed

to differentiate among adequately capitalized companies that operate with levels of capital higher than RBC

requirements. Therefore, it is inappropriate and ineffective to use the formulas to rate or to rank these companies. At

December 31, 2003, all of Travelers insurance subsidiaries had adjusted capital in excess of amounts requiring any

company or regulatory action.

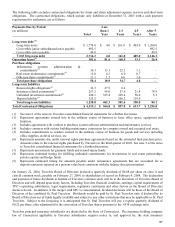

CRITICAL ACCOUNTING ESTIMATES

Travelers considers its most significant accounting estimates to be those applied to claim and claim adjustment

expense reserves and related reinsurance recoverables.

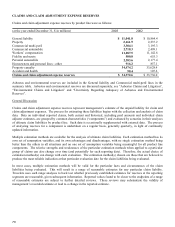

Total claims and claim adjustment expense reserves were $34.573 billion at December 31, 2003. Travelers maintains

property and casualty loss reserves to cover estimated ultimate unpaid liability for losses and loss adjustment expenses

with respect to reported and unreported claims incurred as of the end of each accounting period. Reserves do not

represent an exact calculation of liability, but instead represent estimates, generally utilizing actuarial projection

techniques at a given accounting date. These reserve estimates are expectations of what the ultimate settlement and

administration of claims will cost based on Travelers assessment of facts and circumstances then known, review of

historical settlement patterns, estimates of trends in claims severity, frequency, legal theories of liability and other

factors. Variables in the reserve estimation process can be affected by both internal and external events, such as

changes in claims handling procedures, economic inflation, legal trends and legislative changes. Many of these items

are not directly quantifiable, particularly on a prospective basis. Additionally, there may be significant reporting lags

between the occurrence of the policyholder event and the time it is actually reported to the insurer. Reserve estimates

are continually refined in a regular ongoing process as historical loss experience develops and additional claims are

reported and settled. Adjustments to reserves are reflected in the results of the periods in which the estimates are

changed. Because establishment of reserves is an inherently uncertain process involving estimates, currently

established reserves may not be sufficient. If estimated reserves are insufficient, Travelers will incur additional

income statement charges.

Some of Travelers loss reserves are for asbestos and environmental claims and related litigation which aggregated

$3.267 billion at December 31, 2003. While the ongoing study of asbestos claims and associated liabilities and of

environmental claims considers the inconsistencies of court decisions as to coverage, plaintiffs’ expanded theories of

liability, and the risks inherent in major litigation and other uncertainties, in the opinion of Travelers management, it is

possible that the outcome of the continued uncertainties regarding asbestos-related claims could result in liability in

future periods that differ from current reserves by an amount that could be material to Travelers future operating

results and financial condition. See the preceding discussion of Asbestos Claims and Litigation and Environmental