Travelers 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2

The St. Paul – Travelers Merger

When we began our discussions with respect to the merger in the summer of 2003, we

quickly became enthusiastic at the prospect of bringing our companies together. Looking

broadly at the property casualty insurance landscape, we saw a window of opportunity to

combine two strong carriers with exceptional talent and complementary product offerings,

geographic reach and corporate cultures. We anticipated that, with careful planning and

disciplined execution, we would have the potential to realize $350 million in annualized

expense savings, as well as significant economies of scale, following the merger’s close.

Also, in the near term, we knew that we could expand existing distribution relationships to

realize revenue gains. Early evidence confirms our initial optimism on both points.

Longer term, we have the opportunity to demonstrate the value of our franchise to our agents

and brokers. We believe that our distributors’ businesses will become more productive and

profitable as they expand their relationship with St. Paul Travelers. This should ultimately help

us gain market share in a disciplined and profitable manner.

St. Paul Travelers Competitive Advantages

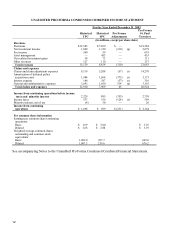

• On a pro forma basis, St. Paul Travelers had total revenues of $23.7 billion for 2003, which

place us among the 100 largest U.S. companies. Based on 2002 direct written premium

data published by A.M. Best, we are the second-largest writer of commercial insurance in

the United States, with a No. 1 or No. 2 position in 35 of 50 states. Based on the same

data, we are also the second-largest writer of personal insurance through independent

agents countrywide. That said, we still have ample opportunity to grow. In an industry where

size matters, we believe that our capitalization and geographic reach place us at a distinct

advantage relative to smaller competitors due to our increased ability to diversify risk across

industries, products and geographic regions.

Our increased size and our level of combined earnings potential will also better position us

to absorb the shocks to which our industry is prone, both natural and man-made. They will

also allow us to make increased investments in the technology, training and people that

provide us the opportunity to maintain the leading-edge competitive advantages that we

deliver to agents and brokers. Finally, our size and strength should allow us to rely less

on reinsurance, which we believe to be a meaningful competitive advantage.

• We believe that insurance carriers’ success will increasingly be driven by their ability to

build effective partnerships with key agents and brokers, and we believe St. Paul Travelers

is well-positioned to be the market of choice for our distribution force. As a result of our

merger, we are able to bring together the best of two outstanding organizations to offer

agents superior expertise in underwriting, risk management and claims management for a

wide variety of both standard and specialty commercial risks. Coupled with a strong field

management staff, strong brand names and award-winning systems, we have a great deal

to offer our key distributors.

Most importantly, we believe long-term success in our industry comes from listening to

our distributors, working closely with them, and investing in processes that help them grow

their businesses. Our intention is not to use our size to leverage our agency partners, but

to create new opportunities for them to leverage our resources and grow their share of

business with us.