Travelers 2003 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

137

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

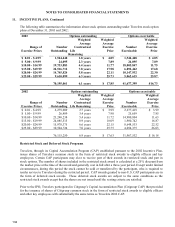

11. INCENTIVE PLANS, Continued

All original and reload stock options granted under the TPC stock option programs had an exercise price equal to

the market value of Travelers class A common stock on the date of the grant. The replacement awards granted

on August 20, 2002 retained the intrinsic value of the awards immediately prior to conversion and therefore the

exercise price either exceeded the market value or was less than the market value on August 20, 2002. The

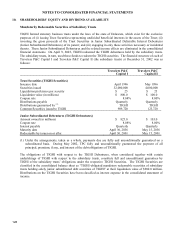

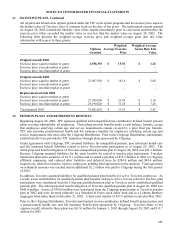

following table presents the weighted average exercise price and weighted average grant date fair value

information with respect to these grants:

Options

Granted

Weighted

Average Exercise

Price

Weighted Average

Grant Date Fair

Value

Original awards 2003

Exercise price equal to market at grant 1,558,353 $ 15.92 $ 1.24

Exercise price exceeds market at grant -- -

Exercise price less than market at grant -- -

Original awards 2002

Exercise price equal to market at grant 21,907,936 $ 18.16 $ 5.84

Exercise price exceeds market at grant - - -

Exercise price less than market at grant - - -

Replacement awards 2002

Exercise price equal to market at grant - - -

Exercise price exceeds market at grant 27,704,096 $ 23.45 $ 3.14

Exercise price less than market at grant 29,190,020 $ 11.43 $ 7.28

Total granted 2002 78,802,052 $ 17.53 $ 5.42

12. PENSION PLANS AND RETIREMENT BENEFITS

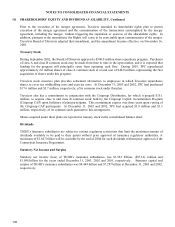

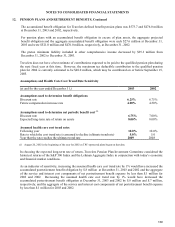

Beginning August 20, 2002, TPC sponsors qualified and nonqualified non-contributory defined benefit pension

plans covering substantially all employees. These plans provide benefits under a cash balance formula, except

that employees satisfying certain age and service requirements remain covered by a prior final pay formula.

TPC also provides postretirement health and life insurance benefits for employees satisfying certain age and

service requirements who retire after the Citigroup Distribution. Prior to the Citigroup Distribution, substantially

similar benefits were provided to TPC employees through plans sponsored by Citigroup.

Under agreements with Citigroup, TPC assumed liabilities for nonqualified pension, post retirement health care

and life insurance benefit liabilities related to active Travelers plan participants as of August 20, 2002. The

initial projected benefit obligation of Travelers nonqualified pension plan at August 20, 2002 was $21.3 million.

Because Citigroup assumed liabilities for the same benefits for retired or inactive plan participants, Travelers

transferred short-term securities of $171.1 million and recorded a payable of $13.5 million in 2002 to Citigroup

affiliated companies, and reduced other liabilities and deferred taxes by $284.0 million and $99.4 million,

respectively, related to retired or inactive employees, pending final agreements on the amounts. Final agreement

on settlement amounts was reached and an additional $2.2 million was paid to Citigroup during the first quarter

of 2003.

In addition, Travelers assumed liabilities for qualified pension plan benefits for active Travelers employees. As

a result, assets and liabilities for qualified pension plan benefits relating to active, but not retired or inactive, plan

participants were transferred from the Citigroup qualified pension plan to Travelers newly established qualified

pension plan. The initial projected benefit obligation of Travelers qualified pension plan at August 20, 2002 was

$445.0 million. Assets of $390.0 million were transferred from the Citigroup pension plan to Travelers pension

plan in 2002 and were invested primarily in a Standard & Poors stock index fund and in a Lehman Brothers

Aggregate bond index fund at December 31, 2002. A final asset transfer of $37.9 million occurred in May 2003.

Prior to the Citigroup Distribution, Travelers participated in non-contributory defined benefit pension plans and

a postretirement health care and life insurance benefit plan sponsored by Citigroup. Travelers share of net

expense (credit) related to these plans was $(3.9) million for January 1, 2002 through August 20, 2002 and $11.7

million for 2001.