Travelers 2003 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

143

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

14. DERIVATIVE FINANCIAL INSTRUMENTS AND FAIR VALUE OF FINANCIAL INSTRUMENTS,

Continued

Fair Value of Financial Instruments

Travelers uses various financial instruments in the normal course of its business. Certain insurance contracts are

excluded by Statement of Financial Accounting Standards No. 107, “Disclosures about Fair Value of Financial

Instruments,” and, therefore, are not included in the amounts discussed.

At December 31, 2003 and 2002, investments in fixed maturities had a fair value, which equaled carrying value,

of $33.046 billion and $30.003 billion, respectively. The fair value of investments in fixed maturities for which

a quoted market price or dealer quote are not available was $685.4 million and $892.5 million at December 31,

2003 and 2002, respectively. See note 1.

The carrying values of cash, trading securities, short-term securities, mortgage loans, investment income

accrued, receivables for investment sales, payables for investment purchases and securities lending payable

approximated their fair values. See notes 1 and 4.

The carrying values of $284.3 million and $607.5 million of financial instruments classified as other assets

approximated their fair values at December 31, 2003 and 2002, respectively. The carrying values of

$2.690 billion and $2.272 billion of financial instruments classified as other liabilities at December 31, 2003 and

2002, respectively, also approximated their fair values. Fair value is determined using various methods

including discounted cash flows, as appropriate for the various financial instruments.

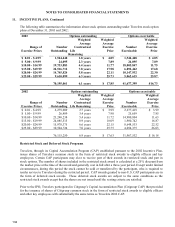

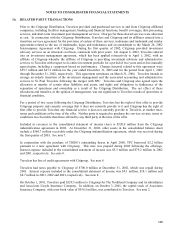

The carrying value and fair value of Travelers debt and the TIGHI debentures was as follows:

2003 2002

(at December 31, in millions)

Carrying

Value

Fair

Value

Carrying

Value

Fair

Value

Notes payable to former affiliates $ - $ - $ 700.0 $ 707.5

Convertible notes 918.5 924.5 917.5 849.2

Long-term debt 1,756.0 1,840.5

926.2 971.7

TIGHI Securities - -

900.0 905.0

Total $ 2,674.5 $ 2,765.0 $ 3,443.7 $ 3,433.4

The fair value of the notes payable to former affiliates is based upon discounted cash flows. The fair value of the

convertible notes and the long-term debt is based upon bid price at December 31, 2003 and 2002. The fair value

of the TIGHI Securities is based upon the closing price at December 31, 2002.