Travelers 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Introducing one company

with two companies of experience.

2003 Report to Shareholders

Table of contents

-

Page 1

Introducing one company with two companies of experience. 2003 Report to Shareholders -

Page 2

... of two - that's St. Paul Travelers. St. Paul Travelers was formed in April 2004 through the merger of The St. Paul Companies and Travelers Property Casualty, two of the nation's leading property casualty insurance companies. The company offers insurance to a wide variety of businesses and other... -

Page 3

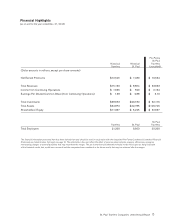

... ended Dec. 31, 2003: • • Travelers Property Casualty produced a very strong performance, with net income of $1.7 billion. This generated a return on shareholders' equity of 15.3 percent for the year. The St. Paul Companies delivered improved results in ongoing businesses but continued to be... -

Page 4

...believe St. Paul Travelers is well-positioned to be the market of choice for our distribution force. As a result of our merger, we are able to bring together the best of two outstanding organizations to offer agents superior expertise in underwriting, risk management and claims management for a wide... -

Page 5

... The key to delivering effective coverage, risk management and claims handling solutions is our people. One of the many reasons we are so excited about the merger is the opportunity it offers to bring together two terrific groups of insurance professionals. St. Paul Travelers is fortunate to have... -

Page 6

.... Our directors have offered invaluable counsel and support at critical junctures. The boards of The St. Paul Companies and Travelers Property Casualty worked exceptionally hard and demonstrated a high degree of professionalism and a sincere concern for all constituents involved in the merger. We... -

Page 7

... from the merger. The pro forma financial information should not be relied upon as being indicative of the historical results that would have occurred had the companies been combined or the future results that may be achieved after the merger. St. Paul Travelers Companies 2003 Annual Report 5 -

Page 8

... National Accounts, which markets insurance and risk management services to large companies and also provides claims administration for state-mandated workers' compensation pools. In addition, specialized units are dedicated to underwriting large property schedules and coverages marketed to national... -

Page 9

... Bruce A. Backberg Senior Vice President, Corporate Secretary John P. Clifford Senior Vice President, Human Resources William A. Bloom Senior Vice President & Chief Information Officer Timothy R. Schwertfeger Chairman & CEO, Nuveen Investments St. Paul Travelers Companies 2003 Annual Report 7 -

Page 10

... Inc. Leslie B. Disharoon Retired Chairman of the Board, President and CEO, Monumental Corporation Janet M. Dolan President and CEO, Tennant Company Kenneth M. Duberstein Chairman and CEO, The Duberstein Group, Inc. Jay S. Fishman President and CEO, St. Paul Travelers Lawrence G. Graev President and... -

Page 11

...01 class A common stock and par value $0.01 class B common stock was exchanged for 0.4334 of a share of St. Paul Travelers common stock without designated par value. For accounting purposes, this transaction will be accounted for as a reverse acquisition with TPC treated as the accounting acquirer... -

Page 12

... of income of SPC and TPC giving effect to the merger as if it had occurred on January 1, 2003. We have adjusted the historical consolidated financial statements to give effect to pro forma events that are (1) directly attributable to the merger, (2) factually supportable and (3) with respect to the... -

Page 13

... obligation - Stock Ownership Plan Common stock: No par value Class A Class B Additional paid-in capital Retained earnings Accumulated other changes in equity from nonowner sources Treasury stock, at cost Unearned compensation Total shareholders' equity Total liabilities and shareholders' equity... -

Page 14

..., 2003 Pro Forma St. Paul Historical Historical Pro Forma Travelers TPC SPC Adjustments (in millions, except per share data) Revenues Premiums Net investment income Fee income Asset management Net realized investment gains Other revenues Total revenues Claims and expenses Claims and claim adjustment... -

Page 15

... of the SPC stock options, the fair value adjustment to SPC's preferred stock and other costs of the transaction, and is calculated as follows: Number of shares of SPC common stock outstanding as of December 31, 2003 (in thousands) SPC's average stock price for the two trading days before through... -

Page 16

...value. Represents adjustments to conform SPC's accounting policy to that of TPC. Represents identified finite and indefinite life intangible assets; primarily customer-related insurance intangibles and management contracts and customer relationships associated with Nuveen's asset management business... -

Page 17

... accounting adjustments may be materially different from the preliminary unaudited pro forma adjustments presented herein. The preliminary unaudited pro forma adjustments included herein are subject to other updates as additional information becomes available and as additional analyses are performed... -

Page 18

...redeemable preferred securities at fair value j) Other liabilities - i. Adjustment to record the fair value of SPC's post-retirement benefit plans, using the December 31, 2003 plan assumptions ii. Adjustment to record the liability for TPC estimated merger related transaction costs $ $ $ $ $ 283 (15... -

Page 19

... under the Preferred Stock Ownership Plan at fair value l) Net adjustment to remove the historical par value of TPC class A common stock, class B common stock, additional paid-in capital and treasury stock m) Adjustment to remove SPC's retained earnings and accumulated other changes in equity from... -

Page 20

... value of identifiable intangible assets with finite lives - See Note 4 ii. Adjustment to the amortization of deferred policy acquisition costs after conforming the accounting policy described in "c" above v) To adjust income taxes for all pro forma adjustments except goodwill at the statutory rate... -

Page 21

... by expected payment date. For purposes of the Unaudited Pro Forma Condensed Combined Balance Sheet at December 31, 2003, the range of risk-free rates of interest applied to the fair value adjustment was approximately 1.1% to 5.3%, with a weighted average of 3.4% over an assumed payout period of... -

Page 22

...losses) for the resulting new basis that would have been established had the merger been completed on January 1, 2003. Note 7 - Pension and Post Retirement Benefit Cost The fair value adjustment for SPC's pension and postretirement benefit plans treats the previously unrecognized prior service cost... -

Page 23

...home repair costs; developments relating to coverage and liability for mold claims; the effects of corporate bankruptcies on surety bond claims; adverse developments in the cost, availability and/or ability to collect reinsurance; the ability of St. Paul Travelers subsidiaries to pay dividends to St... -

Page 24

... Accounts provides small businesses with property and casualty products, including packaged property and liability policies; Bond provides a wide range of customers with specialty products built around Travelers market leading surety bond business along with an expanding executive liability practice... -

Page 25

... injured employee's early return to work, cost-effective quality care, and customer service in this market. Travelers offers the following three types of workers' compensation products: • • guaranteed cost insurance products, in which policy premium charges are fixed for the period of coverage... -

Page 26

...cost insurance policy. Through a network of field offices, Travelers underwriting specialists work closely with national and regional brokers to tailor insurance programs to meet clients' needs. Workers' compensation accounted for approximately 76% of sales to National Accounts customers during 2003... -

Page 27

... general agents targeting small commercial risks; and Affinity - programs sold to association, franchise, trade or affinity groups. Select Accounts is one of the leading providers of property casualty products to small businesses. It generally serves firms with one to 75 employees. Products offered... -

Page 28

... policies from agency offices. Approximately 2,800 agencies have chosen to take advantage of Select Accounts' service center, which offers agencies a wide range of services, from coverage and billing inquiries to policy changes; the assistance of licensed service professionals; and extended hours... -

Page 29

... insurance risk for Travelers, it does introduce credit risk to Travelers. Receivables on unpaid losses from holders of retrospectively rated policies totaled approximately $254.2 million at December 31, 2003. Significant collateral, primarily letters of credit and, to a lesser extent surety bonds... -

Page 30

... accounted for 3.0% or more of the total direct written premiums written in 2003 by Travelers. PERSONAL LINES Travelers Personal Lines writes virtually all types of property and casualty insurance covering personal risks. The primary coverages in Personal Lines are personal automobile and homeowners... -

Page 31

... Travelers Personal Lines products are distributed primarily through approximately 7,200 independent agencies located throughout the United States, supported by personnel in twelve marketing regions, three single state companies and six business service centers. In selecting new independent agencies... -

Page 32

...filed pricing and rating plans, which enable Travelers to streamline its risk selection and pricing processes. Pricing for personal automobile insurance is driven by changes in the frequency of claims and by inflation in the cost of automobile repairs, medical care and litigation of liability claims... -

Page 33

...problems and opportunities. The Personal Lines products sold through additional marketing channels are underwritten by Travelers employees. Underwriters work with Travelers management on business plan development, marketing, and overall growth and profitability. Channel-specific production and claim... -

Page 34

... an agreement and plan of merger with SPC. Each share of the TPC class A and class B common stock will be exchanged for 0.4334 of a share (the exchange ratio) of SPC common stock. The transaction is expected to close in the second quarter of 2004. A special meeting of Travelers shareholders will be... -

Page 35

... in the United States of America. In this merger, the acquired entity (SPC) will issue the equity interests and this business combination meets the criteria of a reverse acquisition. Each share of TPC class A and class B common stock will be exchanged for 0.4334 of a share of SPC common stock. The... -

Page 36

... by the public and to divest the remaining shares it holds within five years following the Citigroup Distribution. On August 20, 2002, in connection with the Citigroup Distribution, stock-based awards held by Travelers employees on that date under Citigroup's various incentive plans were cancelled... -

Page 37

... to Citigroup. In addition, Travelers purchased from Citigroup affiliated companies the premises located at One Tower Square, Hartford, Connecticut and other properties for $68.2 million. Additionally, certain liabilities relating to employee benefit plans and lease obligations were assigned and... -

Page 38

...by Citigroup. These companies are principally engaged in Commercial Lines specialty and transportation businesses and Personal Lines nonstandard automobile business. CONSOLIDATED OVERVIEW Travelers provides a wide range of commercial and personal property and casualty insurance products and services... -

Page 39

... pretax benefit under the Citigroup indemnification agreement. For additional information see "-Asbestos Claims and Litigation." After tax net investment income increased $12.7 million from 2002 due to higher average invested assets resulting from strong cash flows from operations in 2003, partially... -

Page 40

.... Fees rose as both new business and pricing levels in Travelers National Accounts business increased and more workers' compensation business was written by state residual market pools that are serviced by National Accounts. Net realized investment gains were $38.0 million in 2003 compared to $146... -

Page 41

... or 11% in 2003. The 2003 increase was primarily due to higher but moderating rate increases, new business growth in favorable markets and strong retention across all major lines of business, partially offset by the withdrawal in 2002 of business at American Equity Insurance Company, a subsidiary of... -

Page 42

.... Travelers effective tax rate was 24.1%, (183.4)% and 23.5% in 2003, 2002 and 2001, respectively. The 2003 increase in the effective rate reflected a higher level of pretax income associated with improved underwriting performance primarily related to the impact of the 2002 fourth quarter asbestos... -

Page 43

... the benefit of higher average invested assets resulting from strong cash flows from underwriting, net investment income of $1.123 billion was $69.5 million lower than 2001 due to reduced returns in Travelers public equity investments and the lower interest rate environment. The 2002 operating loss... -

Page 44

...claim and loss prevention services to large companies that choose to self-insure a portion of their insurance risks, and claims and policy management services to workers' compensation residual market pools, automobile assigned risk plans and to self-insurance pools. Fees rose reflecting new business... -

Page 45

... market workers' compensation and automobile assigned risk plans. National Accounts net written premiums increased $168.2 million or 23% in 2003 and $315.7 million or 75% in 2002. These increases in net written premiums were due to the continued benefit from rate increases, higher new business... -

Page 46

... and strong new business, principally in executive liability product lines, which target middle and small market private accounts, partially offset by higher reinsurance costs. In addition, the surety product lines benefited from higher premium rates in 2003. Bond net written premiums increased $39... -

Page 47

... its reserves for other general liability exposures $94.8 million. These actions were taken as a result of recent payment and settlement experience. In addition, in 2003 Travelers strengthened prior year reserves for certain run-off lines of business, including assumed reinsurance, and experienced... -

Page 48

... million or 42%. Operating income benefited from the favorable but moderating premium rate environment in both automobile and property, increased business volumes and a continued moderation in the increase in loss costs. Operating income in 2003 included catastrophe losses of $161.6 million compared... -

Page 49

... price change increases for standard voluntary business averaged 6% in 2003, two percentage points below 2002. Renewal price change for Personal Lines products represents the estimated average change in premium on policies that renew, including rate and exposure changes, versus the average premium... -

Page 50

... 420.0 $ 4,555.2 $ 4,328.9 $ 4,109.7 Total claims and expenses increased $226.3 million or 5% in 2003 and $219.2 million or 5% in 2002. Claims and claim adjustment expenses increased $128.0 million or 4% in 2003 primarily due to increased loss costs, growth in business volume and higher catastrophe... -

Page 51

... loss cost trends, continued reduced levels of non-catastrophe property claim frequency and higher favorable prior year reserve development, partially offset by higher catastrophes. The improvement in the underwriting expense ratio was primarily due to the benefits of the favorable rate environment... -

Page 52

... volatility of asbestos-related losses by initially delaying the reporting of claims and later by significantly accelerating and increasing loss payments by insurers, including Travelers. Travelers is currently involved in coverage litigation concerning a number of policyholders who have filed for... -

Page 53

... the coverage can be accessed. During the course of 2003, Travelers made final payments to three policyholders with settlement agreements. No new policyholders were added to this category during 2003. Other policyholders with active claims are identified as home office review or field office review... -

Page 54

... be, litigation and direct actions against Travelers. During 2003, $117.0 million and $31.2 million of reserves were recategorized from unallocated IBNR to policyholders with settlement agreements and other policyholders subject to home office review, respectively, due to additional settlements and... -

Page 55

...any pending coverage litigation dispute with the policyholder. This form of settlement is commonly referred to as a "buy-back" of policies for future environmental liability. In addition, many of the agreements have also extinguished any insurance obligation which Travelers may have for other claims... -

Page 56

..., have fewer sites and are lower tier defendants. Further, regulatory agencies are utilizing risk-based analysis and more efficient clean-up technologies. As of December 31, 2003, the number of policyholders with pending coverage litigation disputes pertaining to environmental claims was 189... -

Page 57

...to fund future claims payments, Travelers employs a conservative investment philosophy. Travelers fixed maturity portfolio at December 31, 2003 totaled $33.046 billion, comprising $32.563 billion of publicly traded fixed maturities and $482.8 million of private fixed maturities. The weighted average... -

Page 58

...impact, if any, of the proposed merger including the integration of Travelers business with that of SPC. The 2003 year continued to see a significant increase in the number of downgrades by rating agencies for property casualty insurance companies. Many competitors are experiencing pressure on their... -

Page 59

... case of a war declared by Congress, only workers' compensation losses are covered by the Terrorism Act. The Terrorism Insurance Program (the Program) generally requires that all commercial property/casualty insurers licensed in the U.S. participate in the Program. The Program became effective upon... -

Page 60

... claims settlement, loss control and risk management information services, generally offered in connection with a large deductible or self-insured program, and risk transfer, typically provided through a retrospectively rated or guaranteed cost insurance policy, new business levels increased in 2003... -

Page 61

... 2003 levels. Personal Lines reported strong property underwriting results in 2003 as market conditions for property insurance improved in 2003. Significant rate increases were earned and the effects of increased underwriting discipline and product modification were recognized. Catastrophe losses... -

Page 62

... affiliated companies, including facilities management, banking and financial functions, benefit coverages, data processing services, and short-term investment pool management services. Charges for these shared services were allocated at cost. In connection with the Citigroup Distribution, Travelers... -

Page 63

...asset portfolios. Travelers invested assets at December 31, 2003 totaled $38.653 billion, including $348.8 million of securities in process of settlement, of which 91% was invested in fixed maturity and short-term investments, 2% in common stocks and other equity securities, 1% in mortgage loans and... -

Page 64

... determined by writing down the investments to quoted market prices. For non-publicly traded securities, impairments are determined by writing down the investment to its estimated fair value, as determined during Travelers quarterly internal review process. The specific circumstances that led to the... -

Page 65

...31, 2003: (in millions) Fixed maturities Equity securities Other Total Loss $ 147.2 9.2 14.8 171.2 Fair Value $ 3,776.1 72.0 3.6 $ 3,851.7 $ Resulting purchases and sales of investments are based on cash requirements, the characteristics of the insurance liabilities and current market conditions... -

Page 66

... funds available to TPC, primarily additional dividends from Travelers operating subsidiaries, are considered sufficient to meet the liquidity requirements of TPC and TIGHI. These liquidity requirements include primarily, shareholder dividends and debt service. In addition, effective April 17, 2003... -

Page 67

... payable due 2032 TIGHI junior subordinated debt securities Debt issuance costs Total 2003 $ 150.0 400.0 24.0 500.0 ...paid an additional dividend of $3.700 billion to Citigroup in the form of a note payable in two installments. This note was substantially prepaid following the offerings. The balance... -

Page 68

... notes were used to repay the $550.0 million due on the Promissory Note. The Floating Rate Notes also carried a variable interest rate of LIBOR plus 25 basis points per annum. On March 14, 2003 and June 17, 2003, Travelers repurchased $75.0 million and $24.0 million, respectively, of the Floating... -

Page 69

... and hedge funds. Represents estimated timing for amounts payable under reinsurance agreements that are accounted for as deposits (amounts reported on a present value basis consistent with the balance sheet presentation). On January 22, 2004, Travelers Board of Directors declared a quarterly... -

Page 70

... of the Connecticut Insurance Department. On September 25, 2002, the Board of Directors approved a $500.0 million share repurchase program. Purchases of class A and class B stock may be made from time to time in the open market, and it is expected that funding for the program will principally... -

Page 71

... carrier arrangements with various involuntary assigned risk pools and $2.411 billion of structured settlement annuities. Amounts recoverable from reinsurers are estimated in a manner consistent with the claim liability associated with the reinsured business. Travelers evaluates and monitors the... -

Page 72

... 31, $ in millions) General liability Property Commercial multi-peril Commercial automobile Workers' compensation Fidelity and surety Personal automobile Homeowners and personal lines - other Property-casualty Accident and health Claims and claim adjustment expense reserves 2003 $ 11,041.8 2,161... -

Page 73

... claim liability that is different from that being estimated currently. Some risk factors will affect more than one product line. Examples include changes in claim department practices, changes in settlement patterns, regulatory and legislative actions, court actions, timeliness of claim reporting... -

Page 74

... estimated claim liabilities. The final estimate selected by management in a reporting period is a function of these detailed analyses of past data, adjusted to reflect any new actionable information. Discussion of Product Lines The following section details reserving considerations and common risk... -

Page 75

... courts Changes in claim adjuster office structure (causing distortions in the data) General liability book of business risk factors Changes in policy provisions (e.g., deductibles, policy limits, endorsements) Changes in underwriting standards Product mix (e.g., size of account, industries insured... -

Page 76

... of limitations Property book of business risk factors Policy provisions mix (e.g., deductibles, policy limits, endorsements) Changes in underwriting standards Commercial Multi-Peril Commercial multi-peril provides a combination of property and liability coverage typically for small businesses and... -

Page 77

...In addition, some payments can run as long as the injured worker's life, such as permanent disability benefits and on-going medical care. Workers' compensation reserves are typically analyzed in three components: indemnity losses, medical losses and claim adjustment expenses. Examples of common risk... -

Page 78

...of cost shifting between workers' compensation and health insurance Fidelity and Surety Fidelity is considered a short tail coverage. It takes a relatively short period of time to finalize and settle fidelity claims. The volatility of fidelity reserves is generally related to the type of business of... -

Page 79

...) include: Bodily injury and property damage liability risk factors Trends in jury awards Changes in the underlying court system and its philosophy Changes in case law Litigation trends Frequency of claims with payment capped by policy limits Change in average severity of accidents, or proportion... -

Page 80

... insurer). The resulting settlement process is typically fairly short term, although exceptions do exist. The liability portion of the homeowners policy generates claims which take longer to pay due to the involvement of litigation and negotiation. In addition, reserves related to umbrella coverages... -

Page 81

... shares along with class A and class B common stock received in the Citigroup Distribution on the Citigroup restricted shares, were equal to the value of the cancelled Citigroup restricted share awards. In addition the Board of Directors plan allows deferred receipt of shares of class A common stock... -

Page 82

... effect of changes in accounting principles Cumulative effect of changes in accounting principles, net of tax Reported net income (loss) Goodwill amortization Adjusted earnings (loss) per share Year-end common shares outstanding (4) Per common share data: Cash dividends(5) Book value $ $ 2003... -

Page 83

... cash tender offer and acquired all of Travelers Insurance Group Holdings Inc.'s (TIGHI) outstanding shares of common stock that were not already owned by TPC for approximately $2.413 billion financed by a loan from Citigroup. On May 31, 2000, Travelers acquired the surety business of Reliance Group... -

Page 84

.... Travelers has no direct commodity risk. For fixed maturity securities, short-term liquidity needs and the potential liquidity needs of the business are key factors in managing the portfolio. The portfolio duration relative to the liabilities' duration is primarily managed through cash market... -

Page 85

... stocks, mortgage loans, short-term securities, cash, investment income accrued, fixed rate trust securities and derivative financial instruments. The primary market risk to Travelers market sensitive instruments is interest rate risk. The sensitivity analysis model uses a 100 basis point change... -

Page 86

...' REPORT The Board of Directors and Shareholders Travelers Property Casualty Corp.: We have audited the accompanying consolidated balance sheet of Travelers Property Casualty Corp. and subsidiaries as of December 31, 2003 and 2002, and the related consolidated statements of income (loss), changes... -

Page 87

...and claim adjustment expenses Amortization of deferred acquisition costs Interest expense General and administrative expenses Total claims and expenses Income (loss) before federal income taxes, minority interest and cumulative effect of changes in accounting principles Federal income taxes (benefit... -

Page 88

TRAVELERS PROPERTY CASUALTY CORP. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEET (in millions, except shares and per share data) At December 31, Assets Fixed maturities, available for sale at fair value (including $696.4 and $580.5 at December 31, 2003 and 2002, respectively, subject to securities ... -

Page 89

... pension liability adjustment Net unrealized gains on investment securities obtained as part of affiliate acquisition Other (1) Balance, end of year Treasury stock (at cost) Balance, beginning of year Treasury stock acquired Net shares issued under employee stock-based compensation plans Balance... -

Page 90

... redeemable preferred stock Treasury stock acquired: Purchased Net shares issued under employee stock-based compensation plans Initial public offering Issuance of common stock-employee stock options Receipts from former affiliates Dividends to shareholders Dividends to former affiliate Payment of... -

Page 91

... life insurance operations), certain other wholly-owned noninsurance subsidiaries of TPC and substantially all of TPC's assets and certain liabilities not related to the property casualty business. On March 21, 2002, TPC issued 231 million shares of its class A common stock in an IPO, representing... -

Page 92

... to Citigroup. In addition, Travelers has purchased from Citigroup affiliated companies the premises located at One Tower Square, Hartford, Connecticut and other properties for $68.2 million. Additionally, certain liabilities relating to employee benefit plans and lease obligations were assigned and... -

Page 93

... markets, using a variety of strategies and instruments (including securities, non-securities and derivatives). The three hedge funds that were determined to be significant VIEs have a total value for all investors combined of approximately $326.2 million at December 31, 2003. Travelers share... -

Page 94

... beginning with year-end 2002 reporting. The transition provisions of this statement apply upon adoption of the FAS 123 fair value based method. Effective January 1, 2003, Travelers adopted the fair value method of accounting for its employee stock-based compensation plans as defined in FAS 123... -

Page 95

...1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity Effective January 1, 2003, Travelers adopted FASB Statement of Financial Accounting Standards No. 150 (FAS 150), "Accounting for Certain Financial... -

Page 96

... on the present value of estimated net cash flows. The Northland reporting unit is a component of the Commercial Lines operating segment. Accounting for Derivative Instruments and Hedging Activities Effective January 1, 2001, Travelers adopted FASB Statement of Financial Accounting Standards No. 133... -

Page 97

...are classified as available for sale and carried at fair value based on quoted market prices. Changes in fair values of equity securities, net of income tax, are charged or credited directly to shareholders' equity. Mortgage loans are carried at amortized cost. A mortgage loan is considered impaired... -

Page 98

... 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued Real estate held for sale is carried at the lower of cost or fair value less estimated costs to sell. Fair value is established at the time of acquisition by internal analysis or external appraisers, using discounted cash flow analyses and... -

Page 99

... by a qualified actuary employed by Travelers. These reserves represent the estimated ultimate cost of all incurred claims and claim adjustment expenses. Since the reserves are based on estimates, the ultimate liability may be more or less than such reserves. The effects of changes in such estimated... -

Page 100

... the market value of the loaned securities plus accrued interest. Collateral is marked to market daily. In those cases where cash collateral is received, Travelers reinvests the collateral in a short-term investment pool, the loaned securities remain a recorded asset of Travelers and a liability is... -

Page 101

... and liabilities. Stock-Based Compensation Travelers has an employee stock incentive compensation plan that includes stock option programs and restricted stock programs. For stock-based employee awards granted, modified, or settled after December 31, 2002, Travelers applies the FAS 123 fair value... -

Page 102

...The 2003 and 2002 effect of applying the fair value based method to all outstanding and unvested stock-based employee awards in Travelers class A common shares is as follows: (for the year ended December 31, in millions, except per share data) Net income (loss), as reported Add: Stock-based employee... -

Page 103

... The 2001 effect of applying the fair value based method to all outstanding and unvested stock-based employee awards in Citigroup's common stock is as follows: (for the year ended December 31, in millions, except per share data) Net income, as reported Add: Stock-based employee compensation expense... -

Page 104

... Derivatives that do not qualify for hedge accounting are marked to market with the changes in market value reflected in the consolidated statement of income. Interest rate swaps, equity swaps, credit derivatives, options and forward contracts were not significant at December 31, 2003 and 2002. 102 -

Page 105

... fidelity and surety bonds, directors' and officers' liability insurance, errors and omissions insurance, professional liability insurance, employment practices liability insurance, fiduciary liability insurance, and other related coverages. Gulf markets products to national, mid-sized and small... -

Page 106

... Lines writes virtually all types of property and casualty insurance covering personal risks. The primary coverages in Personal Lines are automobile and homeowners insurance sold to individuals. These products are distributed through independent agents, sponsoring organizations such as employee... -

Page 107

... commercial property and workers' compensation lines of business. On November 26, 2002, the Terrorism Risk Insurance Act of 2002 (the Terrorism Act) was enacted into Federal law and established a temporary Federal program in the Department of the Treasury that provides for a system of shared public... -

Page 108

... acquisitions were accounted for as transfers of net assets between entities under common control. The prior period financial statements were not restated due to immateriality. 3. SEGMENT INFORMATION Travelers comprises two reportable business segments: Commercial Lines and Personal Lines. See note... -

Page 109

... SEGMENT INFORMATION, Continued Commercial Lines Personal Lines Total Reportable Segments (at and for the year ended December 31, in millions) 2003 Revenues Premiums Net investment income Fee income Other revenues Total operating revenues Amortization and depreciation Federal income taxes Operating... -

Page 110

... Revenue reconciliation Earned premiums Commercial Lines: Commercial multi-peril Workers' compensation Commercial automobile Property Fidelity and surety General liability Total Commercial Lines Personal Lines: Automobile Homeowners and other Total Personal Lines Total earned premiums Net investment... -

Page 111

... in fixed maturities classified as available for sale were as follows: Amortized Cost Gross Unrealized Gains Losses Fair Value (at December 2003, in millions) Mortgage-backed securities - CMOs and pass-through securities U.S. Treasury securities and obligations of U.S. Government and government... -

Page 112

... drives the investment process to generally favor prepayment protected CMO tranches including planned amortization classes and last cash flow tranches. Travelers does invest in other types of CMO tranches if a careful assessment indicates a favorable risk/return tradeoff. Travelers does not purchase... -

Page 113

... recovery. Additionally, for certain securitized financial assets with contractual cash flows (including asset-back securities), EITF 99-20 requires Travelers to periodically update its best estimate of cash flows over the life of the security. If management determines that the fair value of its... -

Page 114

... agencies and authorities Obligations of states, municipalities and political subdivisions Debt securities issued by foreign governments All other corporate bonds Redeemable preferred stock Total fixed maturities Equity securities Common stocks Nonredeemable preferred stocks Total equity securities... -

Page 115

..., loans in the process of foreclosure and loans modified at interest rates below market, were $30.7 million at December 31, 2003. There were no underperforming mortgage loans at December 31, 2002. Concentrations At December 31, 2003 and 2002, Travelers had concentrations of credit risk in tax-exempt... -

Page 116

... gains (losses) on investment securities Balance, beginning of year Balance, end of year 5. INTANGIBLE ASSETS During the third quarter of 2003, Travelers purchased the renewal rights to Royal & SunAlliance USA Inc.'s commercial lines national accounts, middle market and marine businesses, and... -

Page 117

... losses, minimize exposure to large risks, provide additional capacity for future growth and to effect business-sharing arrangements. In addition, Travelers assumes 100% of the workers' compensation premiums written by the Accident Department of its former affiliate, The Travelers Insurance Company... -

Page 118

... companies Total net written premiums Earned premiums Direct Assumed from: Formerly affiliated companies Non-affiliated companies Ceded to: Formerly affiliated companies Non-affiliated companies Total net earned premiums Percentage of amount assumed to net earned Ceded claims incurred $ 2003... -

Page 119

...unpaid and paid claims and were as follows: (at December 31, in millions) Pools and associations Structured settlements: Non-affiliated companies Formerly affiliated companies: Property-casualty business Accident and health business Other: Non-affiliated companies Formerly affiliated companies Total... -

Page 120

...Lines. Partially offsetting the above were net payments of $607.0 million in 2003 for asbestos and environmental claims. The increase in the claims and claim adjustment expense reserves in 2002 from 2001 was primarily due to the strengthening of Travelers asbestos reserves, principally in connection... -

Page 121

... Lines workers' compensation and Personal Lines automobile. In 2002, estimated claims and claim adjustment expenses for claims arising in prior years included $71.2 million of net favorable loss development on Commercial Lines loss sensitive policies in various lines; however, since the business... -

Page 122

... activity and loss development on pending claims; past settlement values of similar claims; allocated claim adjustment expense; potential role of other insurance; the role, if any, of non-asbestos claims or potential non-asbestos claims in any resolution process; and applicable coverage defenses or... -

Page 123

... number of claimants and other parties and require court approval to be effective. In March 2002, Citigroup entered into an agreement under which it provided Travelers with financial support for asbestos claims and related litigation, in any year that Travelers insurance subsidiaries record asbestos... -

Page 124

.... TIGHI paid a commitment fee to Citigroup for this line of credit, which expires in 2006. This agreement became effective on December 19, 2001 and replaced a previous facility with a syndicate of banks. Borrowings under this line of credit carry a variable interest rate based upon LIBOR plus 50... -

Page 125

... interest from December 31, 2002 on any outstanding balance at the floating base rate of Citibank, N.A., New York City plus 2.0%. On December 31, 2002, this note was repaid in its entirety. In February 2002, TPC also paid a dividend of $3.700 billion to Citigroup in the form of a note payable in two... -

Page 126

..., the notes are convertible into shares of class A common stock at the option of the holders at any time after March 27, 2003 and prior to April 15, 2032 if at any time (1) the average of the daily closing prices of class A common stock for the 20 consecutive trading days immediately prior to the... -

Page 127

...in turn, used these funds to redeem $900.0 million of preferred capital securities on April 9, 2003. These senior notes were sold to qualified institutional buyers as defined under Rule 144A under the Securities Act of 1933 (the Securities Act) and outside the United States in reliance on Regulation... -

Page 128

... effect of changes in accounting principles Statutory tax rate Expected federal income taxes (benefit) Tax effect of: Nontaxable investment income Recoveries under Citigroup Indemnification Agreement Tax reserve adjustment Other, net Federal income taxes (benefit) Effective tax rate Composition... -

Page 129

..., Travelers is included in the consolidated federal income tax return filed by Citigroup. Citigroup allocates federal income taxes to its subsidiaries on a separate return basis adjusted for credits and other amounts required by the consolidation process. Any resulting liability is paid currently... -

Page 130

... 10. SHAREHOLDERS' EQUITY AND DIVIDEND AVAILABILITY Mandatorily Redeemable Securities of Subsidiary Trusts TIGHI formed statutory business trusts under the laws of the state of Delaware, which exist for the exclusive purposes of (i) issuing Trust Securities representing undivided beneficial... -

Page 131

... Travelers IPO, Travelers Board of Directors adopted a shareholder rights plan as a result of which each outstanding share of Travelers class A common stock and class B common stock carries with it the right to acquire one-thousandth of a share in a new series of Travelers preferred stock designated... -

Page 132

... from operating cash flow. During 2003, TPC repurchased approximately 2.6 million shares of class A common stock at a total cost of $40.0 million, representing the first acquisition of shares under this program. Travelers stock incentive plan provides settlement alternatives to employees in which... -

Page 133

... included in net income, net of tax and minority interest of ($17.3) Minimum pension liability adjustment, net of tax of $33.3 Other, net of tax of $17.8 Current period change Balance, December 31, 2003 $ Minimum Pension Liability Adjustment $ - Other (1) $ (6.4) 21.1 37.9 - - 21.1 37.9 (209... -

Page 134

... number of shares of class A common stock that may be issued pursuant to awards granted under the 2002 Incentive Plan is 120.0 million shares. Travelers Board of Directors, in connection with the IPO, also adopted the Travelers Property Casualty Corp. Compensation Plan for Non-Employee Directors... -

Page 135

... Travelers class A common stock under Travelers own incentive plan. These replacement awards were granted on substantially the same terms, including vesting, as the former Citigroup awards. The total number of Travelers class A common stock subject to the replacement awards was 56.9 million shares... -

Page 136

...Continued The following table summarizes the information about stock options outstanding under Travelers stock option plans at December 31, 2003 and 2002: 2003 Options outstanding Weighted Average Number Contractual Outstanding Life Remaining 1,544,448 1.8 years 24,095 2.3 years 19,753,883 4.4 years... -

Page 137

... were eligible to participate in a 401(k) savings plan sponsored by Citigroup, for which there was no Travelers matching contribution for substantially all employees. Stock Option Fair Value Information The fair value effect of stock options is derived by application of a variation of the Black... -

Page 138

... of stock options Expected volatility of TPC stock (1) Risk-free interest rate Expected annual dividend per TPC share Expected annual forfeiture rate (1) The expected volatility is based on the average volatility of an industry peer group of entities because Travelers only became publicly traded in... -

Page 139

... to retired or inactive employees, pending final agreements on the amounts. Final agreement on settlement amounts was reached and an additional $2.2 million was paid to Citigroup during the first quarter of 2003. In addition, Travelers assumed liabilities for qualified pension plan benefits for... -

Page 140

...of year (1) Actual return on plan assets Travelers contributions Benefits paid Fair value of plan assets at end of year Reconciliation of prepaid (accrued) benefit cost and total amount recognized Funded status of plan Unrecognized: Prior service cost Net actuarial loss Net amount recognized Amounts... -

Page 141

... paid to the qualified pension plan during the next fiscal year at this time. However, the maximum tax deductible contribution to the qualified pension plan for 2004 is currently estimated to be $40.0 million, which may be contributed on or before September 15, 2005. Assumptions and Health Care Cost... -

Page 142

... returns of the S&P 500 and Lehman Brothers Aggregate Bond Index, asset diversification and market conditions at the time each contribution to the plan was to be invested. The Pension Plan Investment Committee periodically reviewed the plan's investment performance and asset allocation during 2003... -

Page 143

...to interest rate, equity price change and foreign currency risk. Travelers insurance subsidiaries do not hold or issue derivatives for trading purposes. To qualify as a hedge, the hedge relationship is designated and formally documented at inception detailing the particular risk management objective... -

Page 144

...notational value of the open U.S. Treasury futures contracts was $1.482 billion at December 31, 2003. These derivative instruments are not designated and do not qualify as hedges under FAS 133 rules and as such the daily mark to market settlement is reflected in net realized investment gains (losses... -

Page 145

... market price or dealer quote are not available was $685.4 million and $892.5 million at December 31, 2003 and 2002, respectively. See note 1. The carrying values of cash, trading securities, short-term securities, mortgage loans, investment income accrued, receivables for investment sales, payables... -

Page 146

... on key terms to settle asbestos-related coverage litigation under insurance policies issued to PPG. While there remain a number of contingencies, including the final execution of documents, court approval and possible appeals, Travelers believes that the completion of the settlement pursuant to the... -

Page 147

... numbers of settled asbestos claims and to impose liability for damages, including punitive damages, directly on insurers. Lawsuits similar to Wise have been filed in Massachusetts (2002) and Hawaii (filed in 2002, and served in May 2003) (these suits are collectively referred to as the "Statutory... -

Page 148

... to additional litigation based on similar theories of liability. Travelers has numerous defenses in all of the direct action cases. Many of these defenses have been raised in initial motions to dismiss filed by Travelers and other insurers. There have been favorable rulings during 2003 in Texas... -

Page 149

... v. Travelers Property Casualty Corp., et al. (Jud. Dist. of Hartford, CT December 15, 2003). The Henzel and Vozzolo actions were consolidated and transferred to the complex litigation docket in Waterbury, Connecticut; the Farina action is pending in Hartford, Connecticut. All the complaints allege... -

Page 150

...above, Travelers is involved in numerous lawsuits, not involving asbestos and environmental claims, arising mostly in the ordinary course of business operations either as a liability insurer defending third-party claims brought against policyholders or as an insurer defending coverage claims brought... -

Page 151

... affiliated companies, including facilities management, banking and financial functions, benefit coverages, data processing services, and short-term investment pool management services. Charges for these shared services were allocated at cost. In connection with the Citigroup Distribution, Travelers... -

Page 152

... surety customers. In the ordinary course of business, Travelers purchases and sells securities through formerly affiliated brokerdealers. These transactions are conducted on an arm's-length basis. Commissions are not paid for the purchase and sale of debt securities. Citigroup was the underwriter... -

Page 153

... per share data) Total revenues Total expenses Income (loss) before federal income taxes, cumulative effect of change in accounting principle and minority interest Federal income taxes (benefit) Minority interest, net of tax Income (loss) before cumulative effect of change in accounting principle... -

Page 154

...01 class A common stock and par value $0.01 class B common stock was exchanged for 0.4334 of a share of St. Paul Travelers common stock without designated par value. For accounting purposes, this transaction will be accounted for as a reverse acquisition with TPC treated as the accounting acquirer... -

Page 155

... Travelers Property Casualty Corp. as filed with the SEC. Requests may be directed to: Bruce Backberg, Corporate Secretary The St. Paul Travelers Companies, Inc. 385 Washington Street Saint Paul, MN 55102 Stock Price and Dividend Rate Our common stock is traded on the New York Stock Exchange under... -

Page 156

www.stpaultravelers.com NYSE: STA