Reebok 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

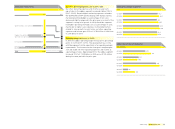

092 Group Management Report – Our Financial Year Group Business Performance — Balance Sheet and Cash Flow Statement — Treasury

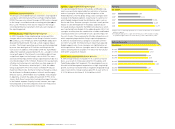

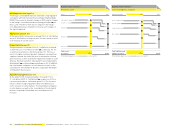

Shareholders’ equity

€ in millions

2004 1) 1,544

2005 2,684

2006 2) 2,828

2007 3,023

2008 3,386

1) Restated due to application of amendment to IAS 19.

2) Including Reebok business segment from February 1, 2006 onwards.

Accounts payable

€ in millions

2004 592

2005 684

2006 1) 752

2007 849

2008 1,218

1) Including Reebok business segment from February 1, 2006 onwards.

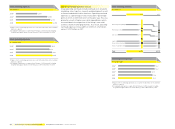

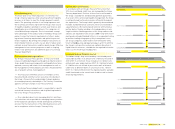

Change in cash and cash equivalents

€ in millions

Cash and cash

equivalents

at the end

of 2007

Net cash

provided by

operating

activities

Net cash

used in

investing

activities

Net cash

used in

fi nancing

activities

Cash and cash

equivalents

at the end

of 2008 1)

1) Includes a positive exchange rate effect of € 2 million.

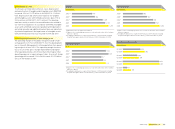

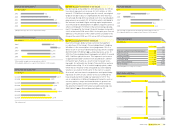

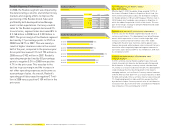

2008 capital expenditure by segment

2008 capital expenditure by type

adidas 50%

Own retail 37%

Other 37%

TaylorMade-

adidas Golf 4%

Retailer

support 7%

Reebok 14%

IT 19%

HQ /

Consolidation 32%

Cash fl ow development refl ects increased

working capital needs

In 2008, cash infl ow from operating activities was € 497 mil-

lion (2007: € 780 million). The decrease in cash provided by

operating activities compared to the prior year was primarily

due to higher working capital needs. Cash outfl ow for invest-

ing activities was € 444 million (2007: € 285 million) and was

mainly related to spending for property, plant and equipment

such as investments in the furnishing and fi tting of adidas and

Reebok own-retail stores and in IT systems. Cash outfl ows

for fi nancing activities were related to the buyback of adidas

AG shares in an amount of € 409 million and the payment of

dividends to shareholders in an amount of € 99 million. Cash

outfl ow in the amount of € 186 million led to a corresponding

change in short-term borrowings. An increase of long-term

borrowings

by € 588 million only partly offset these outfl ows.

Conse

quently, net cash used in fi nancing activities totalled

€ 106 million (2007: € 510 million). As a result of this develop-

ment and despite a positive exchange rate effect of € 2 mil-

lion (2007: negative € 1 million), cash and cash equivalents

decreased by € 51 million to € 244 million at the end of 2008

(2007: € 295 million).

Capital expenditure focus on Group expansion

Capital expenditure is the total cash expenditure for the

purchase of tangible and intangible assets. Group capital

expenditures increased 32% to € 380 million in 2008 (2007:

€ 289 million). The adidas segment accounted for 50% of Group

capital expenditures (2007: 52%). Expenditures in the Reebok

segment accounted for 14% of total expenditures (2007: 20%).

The majority of adidas and Reebok expenditures focused on

the expansion of own-retail activities. TaylorMade-adidas Golf

capital expenditures accounted for 4% of total expenditures

(2007: 4%). The remaining 32% of total capital expenditures

was recorded in the HQ /Consolidation segment (2007: 24%)

and was mainly related to IT infrastructure measures see

Global Operations, p. 064.

244

(106)

(444)497

295