Reebok 2008 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

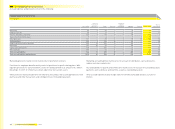

adidas Group Annual Report 2008 163

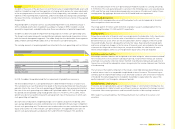

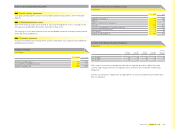

3 Assets / liabilities classifi ed as held-for-sale

Part of the assets of GEV Grundstücksgesellschaft Herzogenaurach mbH & Co. KG and adidas AG

as well as assets of Immobilieninvest und Betriebsgesellschaft Herzo-Base GmbH & Co. KG

within the HQ /Consolidation segment are presented as disposal groups held-for-sale as of

December 31, 2007 following a Memorandum of Understanding signed by the Group’s Manage-

ment on December 21, 2006. At December 31, 2007, the respective disposal groups contained

assets of € 60 million less liabilities of € 4 million. In the meantime, assets of adidas AG and

assets of Immobilieninvest und Betriebsgesellschaft Herzo-Base GmbH & Co. KG as well as

part of the assets of GEV Grundstücksgesellschaft Herzogenaurach mbH & Co. KG have been

transferred to property, plant and equipment due to a change in conditions. For the years end-

ing December 31, 2008 and 2007, depreciation in the amount of € 1 million and € 2 million,

respectively, has been refl ected for the assets transferred to property, plant and equipment.

The remaining part of GEV Grundstücksgesellschaft Herzogenaurach mbH & Co. KG continues

to be presented as held-for-sale due to a Memorandum of Understanding of a new investor. At

December 31, 2008, these assets classifi ed as held-for-sale amounted to € 12 million. Contract

fi nalisation is expected in 2009.

Furthermore, the previous adidas and Reebok warehouses in the UK have been classifi ed as

assets held-for-sale due to the proposed move of storage and distribution facilities to a new

shared warehouse (December 31, 2008: € 5 million; December 31, 2007: € 10 million). In 2008,

impairment losses in the amount of € 2 million were recognised in other operating expenses.

Furthermore, the assets lost in value due to the devaluation of the British pound. The selling

process commenced in April 2007 and contract fi nalisation is expected in 2009.

In addition, a Rockport warehouse in the USA is classifi ed as held-for-sale as a result of the

intention to sell and the existence of a purchase offer (€ 4 million). Contract fi nalisation is

expected in 2009.

Due to the intention to sell and several existing letters of intent, Gekko Brands, LLC, which was

acquired within the scope of the acquisition of Ashworth, Inc., is classifi ed as a disposal group

held-for-sale. The selling process commenced in December 2008, and contract fi nalisation is

expected in 2009. At December 31, 2008, this disposal group contains assets of € 10 million less

liabilities of € 6 million.

In connection with the planned divesture of the Maxfl i golf ball brand, the carrying amount

of this trademark was also classifi ed as an asset held-for-sale (€ 7 million) at December 31,

2007. The selling negotiations commenced in September 2007, and the contract was executed

in February 2008.

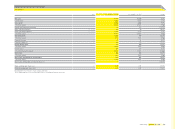

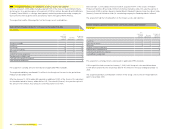

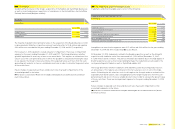

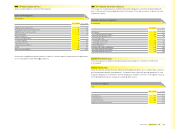

Assets classifi ed as held-for-sale

€ in millions

Dec. 31, 2008 Dec. 31, 2007

Accounts receivable and other current assets 14 33

Inventories 4 —

Property, plant and equipment, net 10 40

Trademarks and other intangible assets, net 3 7

Total 31 80

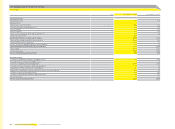

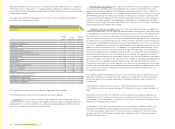

Liabilities classifi ed as held-for-sale

€ in millions

Dec. 31, 2008 Dec. 31, 2007

Accounts payable and other current liabilities 2 2

Accrued liabilities and provisions 1 2

Deferred tax liabilities 3 —

Total 6 4