Reebok 2008 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

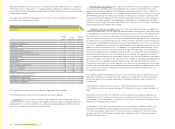

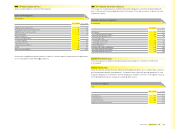

164 Consolidated Financial Statements Notes

4 Acquisition /disposal of subsidiaries as well as assets and liabilities

Effective January 3, 2008, adidas Canada acquired 100% of the shares of Saxon Athletic Manu-

facturing, Inc. for a purchase price in the amount of CAD 4.6 million. Based in Brantford /Ontario

(Canada), Saxon Athletic is a design, development, marketing and manufacturing company for

team uniforms worn by professional and amateur teams throughout North America.

The acquisition had the following effect on the Group’s assets and liabilities:

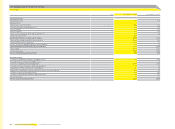

Saxon Athletic Manufacturing, Inc.’s net assets at the acquisition date

€ in millions

Pre-

acquisition

carrying

amounts

Fair value

adjustments

Recognised

values on

acquisition

Accounts receivable 1 — 1

Inventories 1 — 1

Borrowings (1) — (1)

Other current liabilities (1) — (1)

Net assets 0 — 0

Goodwill arising on acquisition 2

Purchase price settled in cash 2

Cash and cash equivalents acquired —

Cash outfl ow on acquisition 2

Pre-acquisition carrying amounts were based on applicable IFRS standards.

The acquired subsidiary contributed € 0 million to the Group’s net income for the period from

February to December 2008.

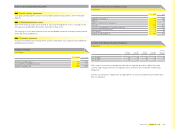

Effective January 10, 2008, adidas AG acquired an additional 22.5% of the shares of its subsidiary

for the adidas brand in Greece, adidas Hellas A.E., Thessaloniki (Greece), for a purchase price in

the amount of € 6 million, thus taking its controlling stake to over 95%.

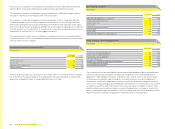

Effective April 1, 2008, adidas International B.V. acquired 99.99% of the shares of Reebok

Productos Esportivos Brasil Ltda. (formerly Comercial Vulcabras Ltda.) for a purchase price in

the amount of BRL 6 million. Based in Jundiai (Brazil), Reebok Productos Esportivos Brasil Ltda.

(formerly Comercial Vulcabras Ltda.) is a marketing company for Reebok products in Brazil.

The acquisition had the following effect on the Group’s assets and liabilities:

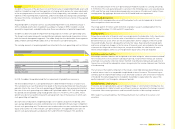

Reebok Productos Esportivos Brasil Ltda.’s net assets at the acquisition date

€ in millions

Pre-

acquisition

carrying

amounts

Fair value

adjustments

Recognised

values on

acquisition

Inventories 2 — 2

Other current assets 0 — 0

Net assets 2 — 2

Goodwill arising on acquisition —

Purchase price settled in cash 2

Cash and cash equivalents acquired —

Cash outfl ow on acquisition 2

Pre-acquisition carrying amounts were based on applicable IFRS standards.

If this acquisition had occurred on January 1, 2008, total Group net sales would have been

€ 10.8 billion and net income would have been € 641 million for the year ending December 31,

2008.

The acquired subsidiary contributed € 6 million to the Group’s net income for the period from

April to December 2008.