Reebok 2008 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group Annual Report 2008 189

28 Income taxes

adidas AG and its German subsidiaries are subject to German corporate and trade taxes. For the

year ending December 31, 2008, the statutory corporate income tax rate of 15% plus a surcharge

of 5.5% thereon is applied to earnings. The municipal trade tax is approximately 11.6% of taxable

income.

For non-German companies, deferred taxes are calculated based on tax rates that have been

enacted or substantively enacted by the closing date.

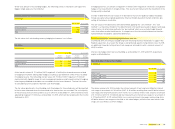

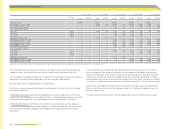

Deferred tax assets and liabilities

Deferred tax assets and liabilities are offset if they relate to the same fi scal authority. The follow-

ing deferred tax assets and liabilities, determined after appropriate offsetting, are presented on

the balance sheet:

Deferred tax assets /liabilities

€ in millions

Dec. 31, 2008 Dec. 31, 2007

Deferred tax assets 344 315

Deferred tax liabilities (463) (450)

Deferred tax assets, net (119) (135)

The movements of deferred taxes are as follows:

Movement of deferred taxes

€ in millions

2008 2007

Deferred tax assets, net as at January 1 (135) (190)

Deferred tax income 71 26

Change in consolidated companies see Note 4 1) (9) —

Change in deferred taxes on assets classifi ed as held-for-sale see Note 3 2) 3 —

Change in deferred taxes attributable to effective portion of qualifying hedging

instruments recorded in equity see Note 23 (41) 11

Currency translation differences (5) 25

Change in deferred taxes attributable to actuarial gains and losses recorded

in equity see Note 18 (3) (7)

Deferred tax assets, net as at December 31 (119) (135)

1) Relates to the acquisition of Ashworth, Inc. and Textronics, Inc. for the year ending December 31, 2008.

2) Relates to the disposal group Gekko Brands, LLC which is classifi ed as held-for-sale for the year ending December 31, 2008.

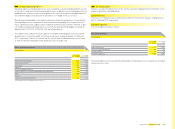

Gross Group deferred tax assets and liabilities before valuation allowances and appropriate off-

settings are attributable to the items detailed in the table below:

Deferred taxes

€ in millions

Dec. 31, 2008 Dec. 31, 2007

Non-current assets 88 75

Current assets 100 112

Accrued liabilities and provisions 140 143

Accumulated tax loss carry-forwards 91 8

Deferred tax assets 419 338

Non-current assets 444 420

Current assets 45 47

Accrued liabilities and provisions 49 6

Deferred tax liabilities 538 473

Deferred tax assets, net (119) (135)

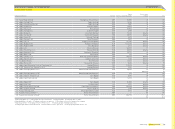

The acquisitions of Ashworth, Inc. and Textronics, Inc. were accounted for under the “purchase

method” see Note 4. Deferred tax liabilities were recorded representing the difference between

the fair value and the tax basis of acquired assets.