Reebok 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group Annual Report 2008 115

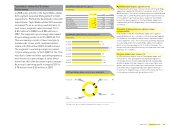

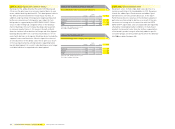

Exposure to foreign exchange risk 1)

based on notional amounts, € in millions

USD GBP JPY

As at December 31, 2008

Exposure from fi rm commitments

and forecasted transactions (2,341) 323 339

Balance sheet exposure including

intercompany exposure (192) (24) (7)

Total gross exposure (2,533) 299 332

Hedged with other cash fl ows 83 — —

Hedged with currency options 457 (25) (57)

Hedged with forward contracts 1,294 (197) (185)

Net exposure (699) 77 90

As at December 31, 2007

Exposure from fi rm commitments

and forecasted transactions (1,810) 372 249

Balance sheet exposure including

intercompany exposure (65) 15 9

Total gross exposure (1,875) 387 258

Hedged with other cash fl ows 136 0 0

Hedged with currency options 562 0 (142)

Hedged with forward contracts 1,124 (153) (107)

Net exposure (53) 234 9

1) Rounding differences may arise in totals.

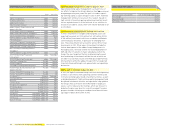

Sensitivity analysis of foreign exchange rate changes

€ in millions

USD GBP JPY

As at December 31, 2008

EUR +10% EUR +10% USD +10%

Equity (108) 17 22

Net income 10 (1) (1)

EUR – 10% EUR – 10% USD – 10%

Equity 133 (20) (21)

Net income (13) 0 1

As at December 31, 2007

EUR +10% EUR +10% USD +10%

Equity (111) 9 28

Net income 5 (1) (1)

EUR – 10% EUR – 10% USD – 10%

Equity 130 (11) (26)

Net income (6) 2 1

This leads to a maximum exposure of € 58 million in the event

of default of any single bank. Furthermore, we held derivatives

with a positive fair market value in the amount of € 213 mil-

lion. The maximum exposure to any single bank resulting from

these assets amounted to € 23 million and the average con-

centration was 4%.

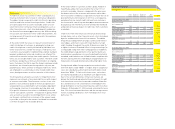

Financing and liquidity risks

Liquidity risks arise from not having the necessary resources

available to meet maturing liabilities with regard to timing,

volume and currency structure. In addition, the adidas Group

faces the risk of having to accept unfavourable fi nancing terms

due to liquidity restraints. Our Group’s Treasury department

uses an effi cient cash management system to manage liquidity

risk. At December 31, 2008, Group cash and cash equivalents

amounted to € 244 million (2007: € 295 million). Moreover,

our Group maintains € 2.7 billion bilateral short-term credit

lines and a € 2 billion committed medium-term syndicated

loan facility with international banks, which does not include

a market disruption clause. The € 4.7 billion in credit lines

are designed to ensure suffi cient liquidity at all times see

Treasury, p. 093.

Future cash outfl ows arising from fi nancial liabilities that are

recognised in the Consolidated Balance Sheet are presented

within the adjacent table. This includes payments to settle

obligations from borrowings as well as cash outfl ows from

cash-settled derivatives with negative market values. Financial

liabilities that may be settled in advance without penalty are

included on the basis of the earliest date of potential repay-

ment. Cash fl ows for variable-interest liabilities are deter-

mined with reference to the conditions at the balance sheet

date.

Based on our available credit lines and business model, we

continue to regard the occurrence probability of fi nancing

and liquidity risks, which could also lead to increased interest

costs, as low. Nevertheless, failure to maintain liquidity could

have a high fi nancial impact on Group performance.

Currency risks

Currency risks for the adidas Group are a direct result of multi-

currency cash fl ows within the Group. The biggest single driver

behind this risk results from the mismatch of the currencies

required for sourcing our products versus the denominations

of our sales. The vast majority of our sourcing expenses are

in US dollars while sales are denominated in other currencies

to a large extent – most notably the euro. Our main exposures

are presented in the adjacent table. The exposure from fi rm

commitments and forecasted transactions was calculated on a

one-year basis. The 2007 fi gures have been restated to provide

consistency of presentation.

In line with IFRS 7 requirements, we have estimated the impact

on net income and shareholders’ equity based on changes in

our most important currency exchange rates. The calculated

impacts mainly result from fair value changes of our hedging

instruments. The analysis does not include effects that arise

from the translation of our foreign entities’ fi nancial state-

ments into the Group’s reporting currency. The sensitivity

analysis is based on the net balance sheet exposure, including

intercompany balances from monetary assets and liabilities

denominated in foreign currencies. Moreover, all currency

derivatives were re-evaluated using hypothetical foreign

exchange rates to determine the effects on net income and

equity. The analysis was performed on the same basis for both

2007 and 2008.

Based on this analysis, a 10% increase in the euro versus the

US dollar at December 31, 2008, would have led to a € 10 mil-

lion increase in net income. The more negative market values

of the US dollar hedges would have decreased shareholders’

equity by € 108 million. A 10% weaker euro at December 31,

2008 would have led to a € 13 million decrease in net income.

Shareholders’ equity would have increased by € 133 million.

The impacts of fl uctuations of the euro against the British

pound and of the US dollar against the Japanese yen on net

income and shareholders’ equity are also included in accord-

ance with IFRS requirements.

However, many other fi nancial and operational variables that

could potentially reduce the effect of currency fl uctuations are

excluded from the analysis. These include:

—

Interest rates and all other exchange rates are assumed

constant.