Reebok 2008 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group Annual Report 2008 123

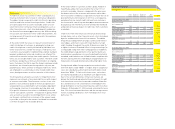

Reebok order backlogs (currency-neutral) 1)

Development by product category and region in %

Europe

North

America Asia Total

Footwear (12) (22) (11) (10)

Apparel (22) (50) (16) (33)

Total 2) (15) (29) (13) (17)

1) At year-end, change year-over-year.

2) Includes hardware backlogs.

Reebok order backlogs (in €) 1)

Development by product category and region in %

Europe

North

America Asia Total

Footwear (18) (19) (7) (11)

Apparel (25) (49) (12) (33)

Total 2) (20) (26) (9) (18)

1) At year-end, change year-over-year.

2) Includes hardware backlogs.

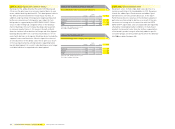

TaylorMade-adidas Golf sales to increase

at a low-single-digit rate

We expect the consolidation of Ashworth, Inc. for the full

12-month period to support a currency-neutral low-single-

digit sales increase at TaylorMade-adidas Golf in 2009. On a

comparable basis, however, excluding Ashworth, sales are

projected to decline despite a strong product pipeline see

TaylorMade-adidas Golf Strategy, p. 056. This will be a result of the

challenging market situation in North America. Because the

order profi le in golf differs from other parts of our Group’s

business, we do not provide order information for TaylorMade-

adidas Golf.

Reebok backlogs decline

Currency-neutral Reebok backlogs at the end of 2008 were

down 17% versus the prior year. In euro terms, this repre-

sents a decline of 18%. Footwear backlogs decreased 10%

in currency-neutral terms (–11% in euros) as a result of

declines in all regions. Apparel backlogs declined 33% on a

currency-neutral basis driven by lower orders for licensed

apparel in particular in North America (– 33% in euros). These

develop ments largely refl ect challenging market conditions in

Reebok’s major markets. Due to the exclusion of the own-retail

business and the high share of at-once business in Reebok’s

sales mix, order backlogs in this segment are not indicative of

expected sales development.

Reebok segment sales to be at least stable

Reebok segment sales are projected to be at least stable

compared to the prior year on a currency-neutral basis in 2009.

The brand’s key focus categories, Women’s Fitness and Men’s

Sport, are expected to develop signifi cantly better compared to

other categories due to new product launches and campaigns

in 2009 see Reebok Strategy, p. 052. In the Classics category,

we will continue to visibly upgrade and improve the brand’s

product offering. The consolidation of sales from Reebok’s new

companies in Latin America for the full twelve-month period is

projected to support revenue development.