Reebok 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group Annual Report 2008 061

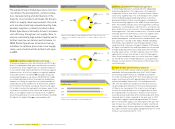

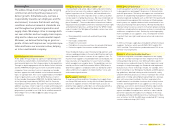

Targets versus actual key metrics

2007

Actual

2008

Initial Target

2008

Actual

2009

Outlook

Group sales (currency-neutral) 7% high-single-

digit increase

9% low- to mid-

single-digit

decline

adidas segment sales (currency-neutral) 12%

high-single-

digit increase

14% low- to mid-

single-digit

decline

Reebok segment sales (currency-neutral) 0%

low- to mid-

single-digit

increase

(2%) at least

stable

TaylorMade-adidas Golf segment sales (currency-neutral) 9% 1)

mid-single-

digit increase

7% low-single-

digit increase

Group gross margin 47.4% 47.5 to 48% 48.7% decline

adidas segment gross margin 47.4% increase 48.6%

Reebok segment gross margin 38.7% increase 37.0%

TaylorMade-adidas Golf segment gross margin 44.7% increase 44.3%

Group net other operating expenses and income (in % of sales) 39.2% increase 39.6% increase

adidas segment net other operating expenses and income (in % of sales) 35.6% increase 35.6%

Reebok segment net other operating expenses and income (in % of sales) 35.8% increase 38.7%

TaylorMade-adidas Golf segment net other operating expenses and income (in % of sales) 34.4% increase 32.1%

Group operating margin 9.2% at least 9.5% 9.9% decline

adidas segment operating margin 12.9% increase 14.0%

Reebok segment operating margin 4.7% increase (0.3%)

TaylorMade-adidas Golf segment operating margin 8.1% increase 9.6%

Net income growth (attributable to shareholders) 14% at least 15% 16% decline

Operating working capital (in % of net sales) 25.2%

further

reduction

24.5% further

reduction

Capital expenditure (€ in million) 2) 289 300 – 400 380 300 – 400

Net debt (€ in million) 1,766 maintain

2007 level

or reduce

2,189 reduction

1) On a like-for-like basis, excluding prior year sales related to the Greg Norman Collection wholesale business which was divested in November 2006.

2) Excluding acquisitions and fi nance leases.

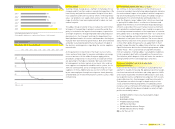

Management appraisal of performance and targets

We communicate our Group’s fi nancial targets on an annual

basis. We also provide updates throughout the year as appro-

priate. In 2008, we achieved or exceeded all key fi nancial

targets we had set for the Group except for net borrowings,

which surpassed the prior year level. We outperformed macro-

economic and global industry growth see Economic and

Sector Development, p. 080, improved Group gross and operating

margins and increased earnings per share at a double-digit

rate.

By segment, development at adidas and TaylorMade-adidas

Golf exceeded our initial sales expectations while the Reebok

segment performed below initial expectations. At Reebok,

sales increases in the emerging markets, particularly in Asia

and in Eastern Europe, were more than offset by lower than

anticipated revenues in North America and the UK.

Our expectations for Group business performance in 2009

refl ect the deterioration of the global economy towards the end

of 2008 and at the beginning of 2009. We expect the recession-

ary environment in many major markets to have a signifi cant

negative impact on our Group’s fi nancial performance in 2009,

resulting in declines in both Group sales and earnings per

share. The degree of the decline in earnings per share will also

depend on the development of exchange rates. In 2010, assum-

ing an improving global economy, we are confi dent to increase

sales and earnings per share compared to 2009. We believe

our outlook is realistic within the scope of the current trading

environment. Compared to prior years, however, it entails a

higher degree of uncertainty. No material event between the

end of 2008 and the publication of this report has altered our

view see Subsequent Events and Outlook, p. 120.