Reebok 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

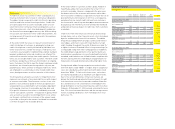

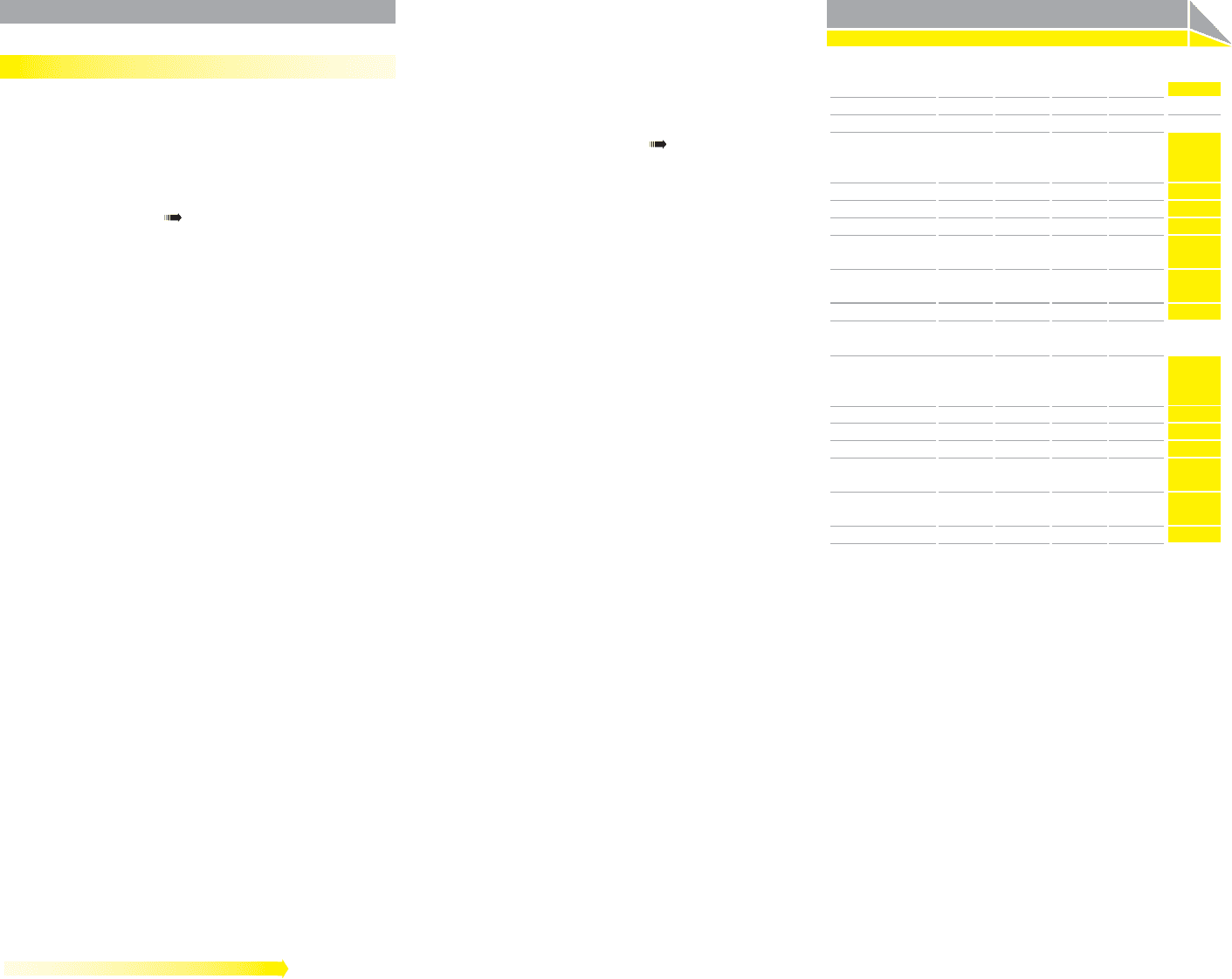

114 Group Management Report – Our Financial Year Risk and Opportunity Report

Future cash outfl ows

€ in millions

Up to

1 year

Between 1

and 3 years

Between 3

and 5 years

After

5 years

Total

As at December 31, 2008

Bank borrowings

incl. commercial

paper 748 — — — 748

Private placements 462 539 374 261 1,636

Convertible bond 408 — — — 408

Accounts payable 1,218 — — — 1,218

Other fi nancial

liabilities 25 1 — 2 28

Derivative fi nancial

liabilities 57 15 6 2 80

Total 2,918 555 380 265 4,118

As at December 31, 2007

Bank borrowings

incl. commercial

paper 198 — — — 198

Private placements 254 684 435 461 1,834

Convertible bond 10 408 — — 418

Accounts payable 849 — — — 849

Other fi nancial

liabilities 16 1 1 2 20

Derivative fi nancial

liabilities 88 62 8 2 160

Total 1,415 1,155 444 465 3,479

Financial Risks

Credit risks

A credit risk arises if a customer or other counterparty to a

fi nancial instrument fails to meet its contractual obligations.

The adidas Group is exposed to credit risk from its operating

activities and from certain fi nancing activities. Credit risks

arise principally from accounts receivable and to a lesser

extent from other contractual fi nancial obligations such as

other fi nancial assets, short-term bank deposits and deriva-

tive fi nancial instruments see Note 23, p. 182. Without taking

into account any collateral or other credit enhancements, the

carrying amount of fi nancial assets represents the maximum

exposure to credit risk.

At the end of 2008, there was no relevant concentration of

credit risk by type of customer or geography. Instead, our

credit risk exposure is mainly infl uenced by individual cus-

tomer characteristics. Under the Group’s credit policy, new

customers are analysed for creditworthiness before standard

payment and delivery terms and conditions are offered. This

review utilises external ratings from credit agencies. Purchase

limits are also established for each customer. Then both credit-

worthiness and purchase limits are monitored on an ongoing

basis. Customers that fail to meet the Group’s minimum credit-

worthiness are allowed to purchase products only on a pre-

payment basis. Other activities to mitigate credit risks, which

are employed on a selective basis only, include credit insur-

ances, bank guarantees as well as retention of title clauses.

The Group utilises allowance accounts for impairments that

represent our estimate of incurred credit losses with respect

to accounts receivable. The allowance consists of two com-

ponents: (1) an allowance based on historical experience of

unexpected losses established for all receivables dependent

on the ageing structure of receivables past due date, and

(2) a specifi c allowance that relates to individually assessed

risk for each specifi c customer – irrespective of ageing. Allow-

ance accounts are used to record impairment losses unless

our Group is satisfi ed that no recovery of the amount owed

is possible; at that point the amount considered irrecoverable

is written off against the receivable directly.

At the end of 2008, no customer at either adidas, Reebok or

TaylorMade-adidas Golf accounted for more than 10% of

accounts receivable. However, compared to the prior year,

the deterioration of the economic environment and a reduc-

tion in consumer confi dence is expected to increase the risk of

poor performance from retailers in 2009. As a consequence,

we believe that our overall credit risk level from customers

has increased in several key markets see Economic and Sector

Development, p. 080. Therefore, we now estimate the likelihood

and potential fi nancial impact of credit risks from customers

as medium.

Credit risks from other fi nancial contractual relationships

include items such as other fi nancial assets, short-term bank

deposits and derivative fi nancial instruments. The adidas

Group Treasury department arranges currency and interest

rate hedges, and invests cash, with major banks of a high

credit standing throughout the world. All banks are rated “A–”

or higher in terms of Standard & Poor’s long-term ratings (or

a comparable rating from other rating agencies). In addition,

the credit default swap premiums of our partner banks are

monitored on a weekly basis. In case the defi ned threshold is

exceeded, credit balances are shifted to banks compliant with

the limit. During 2008, the credit default swap premiums for

many banks increased dramatically, indicating higher risks.

Foreign-based adidas Group companies are authorised to

work with banks rated “BBB+” or higher. Only in exceptional

cases are subsidiaries authorised to work with banks rated

lower than “BBB+”. To limit risk in these cases, restrictions

are clearly stipulated such as maximum cash deposit levels.

Due to the current diffi culties in fi nancial markets, we

believe the likelihood and potential fi nancial impact of credit

risks from these assets has increased to medium. Neverthe-

less, we believe our risk concentration is limited due to the

broad distribution of our investment business with more than

25 banks. At December 31, 2008, no bank accounted for more

than 16% of our investment business and the average concen-

tration, including subsidiaries’ short-term deposits in local

banks, was 1%.