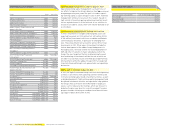

Reebok 2008 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 Group Management Report – Our Financial Year Subsequent Events and Outlook

Subsequent Events and Outlook

In 2009, recessionary pressures in most key

global markets are expected to have a negative

impact on overall consumer demand and the

sporting goods industry. Despite our strong

market positions in most major markets, a

regionally balanced sales mix and strength in

innovation, we expect these developments to

have a negative impact on the development of

the adidas Group’s fi nancial results in 2009.

As a result, we forecast adidas Group sales

and earnings per share to decline in 2009.

Subsequent changes in the Group structure

Effective January 2009, the adidas Group acquired the remain-

ing 5% of shares of its subsidiary in Greece, adidas Hellas A.E.,

Thessaloniki. Also effective January 2009, the adidas Group

acquired the remaining 25% of shares of Reebok’s subsidiary

in Spain, Reebok Spain S.A., Alicante. Both transactions refl ect

the Group’s strategy to gain control over distribution in matur-

ing markets.

No other subsequent changes

Since the end of 2008, there have been no signifi cant macro-

economic, sociopolitical, legal or fi nancing changes which we

expect to infl uence our business materially going forward.

In addition, there have been no major management changes

since the end of 2008.

Group business outlook affected by uncertain global

macroeconomic development

Expectations for the development of the global economy and

the sporting goods industry in 2009 are currently subject

to a high degree of uncertainty. The unprecedented slowdown

in economic activity recorded towards the end of 2008 has

consequences currently not fully foreseeable. As a result,

macroeconomic forecasts for 2009 given by various govern-

ment bodies and research institutes differ widely in their

assessment of how long and deep the expected economic

downturn will be. In addition, the effect rising unemploy-

ment and lower consumer confi dence could have on private

consumption cannot be fully assessed. Consequently, the

effect global macroeconomic developments could have on the

adidas Group’s business outlook is currently diffi cult to fore-

cast, especially with regard to the second half of the year. Our

outlook is hence based solely on the scenario of economic and

sector development laid down in this report, acknowledging

actual developments might signifi cantly differ from this sce-

nario. In addition, it is currently diffi cult to quantify the impact

negative currency translation effects could have on the Group’s

top- and bottom-line performance. Due to the fact that many

currencies such as the Russian ruble, the British pound and

several currencies in Latin America have signifi cantly depreci-

ated against the euro towards the end of 2008 and at the begin-

ning of 2009, we currently forecast these effects to have a sig-

nifi cant negative impact on our Group’s fi nancial performance.

Global economic slowdown projected to intensify in 2009

According to the World Bank, in 2009 growth of the global

economy is projected to slow to a level of around 1% due to

the real-economy side effects of the banking crisis which

inten sifi ed during the second half of 2008. Although several

governments around the world are instigating policies to

combat recessionary pressures, an outright global recession

cannot be ruled out.

In Europe, GDP in the Euro Zone is expected to decline around

1.5% in 2009, driven by weakness in domestic consumption,

a deteriorating export outlook as well as the impact of tighter

fi nancing conditions on investment. European emerging

markets are forecasted to show modest growth of around 0.5%

in 2009. Economies such as Russia and Turkey are expected to

show a steep slowdown based on falling commodity prices and

diffi culties related to tightening credit markets which may lead

to higher levels of unemployment.

In North America, GDP is also projected to decline approxi-

mately 1.5% versus the prior year. With consumer confi dence

at record lows and expected increases in unemployment

throughout the year, lower consumer spending is forecasted

to lead to a sharp decline in GDP particularly in the fi rst half of

2009. A government stimulus package involving infrastructure

spending is expected to lift the economy out of recession in the

second half of the year.

In Asia, compared to 2008, growth excluding Japan is likely

to slow slightly to a level of around 5% in 2009, the weakest

since 2001. China and India are forecasted to be affected by

lower industrial production growth, and a slowdown of exports.

Japan’s economy is forecasted to decline around 3% in 2009

versus 2008. Falling exports as well as a lack of stimulus for

domestic consumption and the likelihood of stagfl ation make

the Japanese macroeconomic landscape similar to that in the

USA and the Euro Zone.

In Latin America, growth rates are likely to slow to a level

of around 1% in 2009. Private consumption is expected to

continue to increase in most major markets. Differences with

regard to exposure to commodity prices and dependency on

exports are likely to lead to a high variance of GDP develop-

ment by country.

Low consumer spending to negatively impact the develop-

ment of the global sporting goods industry

In 2009, we expect the global sporting goods industry to

decline. In mature markets such as the USA and Western

Europe, the decline is expected to be more pronounced due

to low levels of consumer confi dence and diffi cult trading

conditions for retailers. This is likely to lead to a highly promo-

tional environment in these markets. Emerging markets such

as China are expected to be more resilient as opportunity for

distribution expansion continues in these markets.