Reebok 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

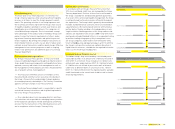

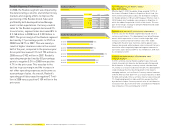

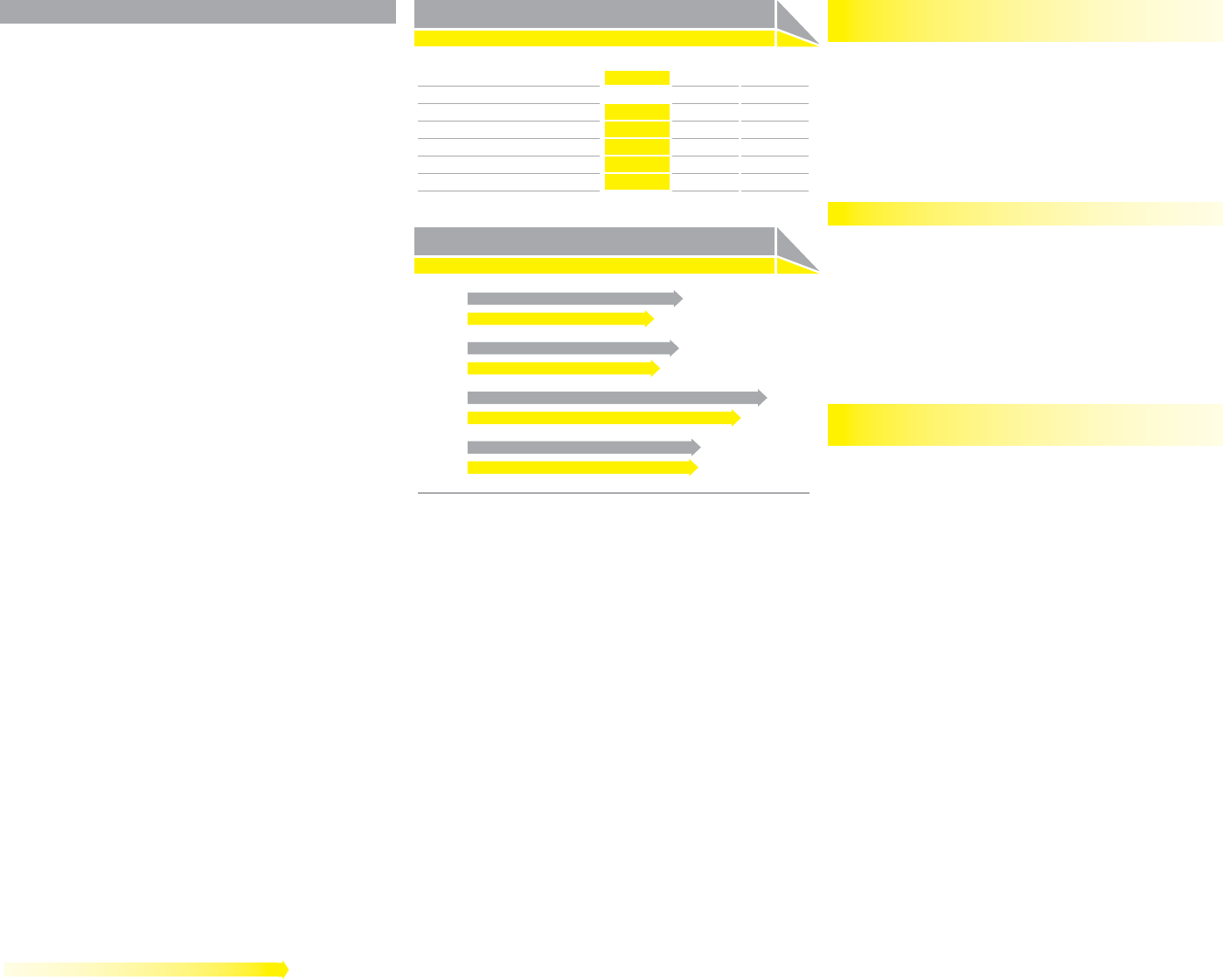

102 Group Management Report – Our Financial Year Business Performance by Segment — Reebok Business Performance

Reebok at a glance

€ in millions

2008 2007 Change

Net sales 2,148 2,333 (8%)

Gross profi t 795 902 (12%)

Gross margin 37.0% 38.7% (1.7pp)

Operating profi t (7) 109 (106%)

Operating margin (0.3%) 4.7% (5.0pp)

Reebok net sales by quarter

€ in millions

Q1 2007

Q1 2008

524

454

Q2 2007

Q2 2008

514

469

Q3 2007

Q3 2008

728

665

Q4 2007

Q4 2008

567

561

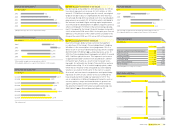

Reebok Business Performance

In 2008, the Reebok segment was impacted by

the deteriorating economic environment in key

markets and ongoing efforts to improve the

positioning of the Reebok brand. Sales and

profi tability both developed below Manage-

ment’s initial expectations. Currency-neutral

sales for the Reebok segment decreased 2%.

In euro terms, segment sales decreased 8% to

€ 2.148 billion in 2008 from € 2.333 billion in

2007. The gross margin of the Reebok segment

declined by 1.7 percentage points to 37.0% in

2008 from 38.7% in 2007. This was mainly a

result of higher clearance sales in the second

half of the year, compared to the previous year.

Gross profi t decreased 12% to € 795 million in

2008 versus € 902 million in 2007. Reebok’s

operating margin declined by 5.0 percentage

points to negative 0.3% in 2008 from positive

4.7% in the prior year. This was due to the

decline in gross margin and the increase in

net other operating expenses and income as

a percentage of sales. As a result, Reebok’s

operating profi t decreased to negative € 7 mil-

lion in 2008 versus positive € 109 million in the

prior year.

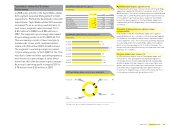

New companies in Latin America impact

sales and royalties

Effective April 1, 2008, the adidas Group acquired 99.99% of

the shares of Reebok Productos Esportivos Brasil Ltda. (for-

merly Comercial Vulcabras Ltda.), the distribution company

for Reebok products in Brazil and Paraguay. Effective June 2,

2008, Reebok also founded a new company in Argentina, in

which the adidas Group holds 99.99% of the shares. This was

part of the Group’s strategy to bring the Reebok brand under

direct control in all regions.

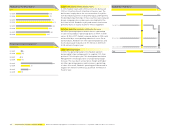

Segment sales decline 2% on a currency-neutral basis

In 2008, sales for the Reebok segment decreased 2% on a

currency-neutral basis. This development was below Manage-

ment’s initial expectation of a low- to mid-single-digit sales

increase. Currency-neutral footwear sales were stable

compared to the prior year. Currency-neutral apparel sales,

however, decreased, while hardware sales increased. Currency

translation effects negatively impacted segment revenues in

euro terms. Sales decreased 8% to € 2.148 billion in 2008 from

€ 2.333 billion in 2007.

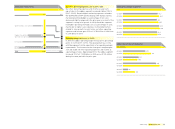

Growth in emerging markets offset by lower sales

in mature markets

In 2008, currency-neutral Reebok segment sales increased

in both Asia and Latin America, but decreased in Europe and

North America. In Europe, currency-neutral sales declined

3%, mainly as a result of a decline in the UK. This development

could only be partly offset by strong growth in the region’s

emerging markets, such as Russia. Currency-neutral revenues

in North America were down 16% as a result of declines in both

the USA and Canada. In Asia, currency-neutral sales increased

7%. Double-digit growth in India and China was partly offset

by a decline in Japan. Currency-neutral sales in Latin America

increased 192%, due to the fi rst-time consolidation of Reebok’s

new companies in the second quarter of 2008.