Reebok 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group Annual Report 2008 109

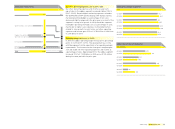

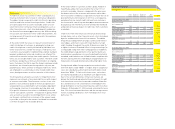

Corporate risk overview

Probability

of occurrence

Potential

fi nancial

impact

External and industry risks

Macroeconomic risks High High

Consumer demand risks Medium Medium

Industry consolidation risks High Medium

Political and regulatory risks Low Medium

Legal risks Low Medium

Risk from product counterfeiting and imitation High Low

Social and environmental risks Low Low

Natural risks Low Low

Strategic & operational risks

Portfolio integration risks Low Low

Risks from loss of brand image Medium Medium

Own-retail risks Medium Medium

Risks from rising input costs Medium Medium

Supplier default risks Low Low

Product quality risks Low Low

Customer risks Medium Medium

Risk from loss of key promotion partnerships Medium Low

Product design and development risks Low High

Personnel risks Low Medium

Risks from non-compliance Low Medium

IT risks Low High

Financial risks

Credit risks Medium Medium

Financing and liquidity risks Low High

Currency risks Medium Medium

Interest rate risks Low Low

External and Industry Risks

Macroeconomic risks

Growth of the sporting goods industry is infl uenced by con-

sumer confi dence and consumer spending. Abrupt economic

downturns, in particular in regions where the Group is highly

represented, therefore pose a signifi cant short-term risk to

sales development. To mitigate this risk, the Group strives

to balance sales across key global regions and also between

developed and emerging markets. In addition, a core ele-

ment of our performance positioning is the utilisation of an

extensive global event and partnership portfolio where demand

is more predictable and less sensitive to macroeconomic

infl uence.

In 2009, the Group expects global economic growth to slow

considerably. North America and Europe are expected to

remain in recession see Subsequent Events and Outlook, p. 120.

Economic expansion in emerging markets, including China,

Russia and India, is expected to continue, albeit at a more

moderate rate compared to prior years. These markets have

overtaken North America and Western Europe as the largest

contributors to Group revenue growth. As a result of the

current global macroeconomic uncertainty, we now assess the

likelihood that adverse macroeconomic events could impact

our business as high. We also now assess the potential fi nan-

cial impact of such events as high.

Consumer demand risks

Failure to anticipate and respond to changes in consumer

demand for sporting goods products is one of the most serious

threats to our industry. Consumer demand changes can be

sudden and unexpected. Because industry product procure-

ment cycles average 12 to 18 months, the Group faces a risk of

short-term revenue loss in cases where it is unable to respond

quickly to such changes. Even more critical, however, is the

risk of continuously overlooking a new consumer trend or fail-

ing to acknowledge its potential magnitude over a sustained

period of time.

To mitigate this risk, continually identifying and responding to

consumer demand shifts as early as possible is a key respon-

sibility of our brands. In this respect, we utilise extensive pri-

mary and secondary research tools as outlined in our risk and

opportunity identifi cation process.

As a leader in our industry, our core brand strategies continue

to be focused on infl uencing rather than reacting to the chang-

ing consumer environment. We invest signifi cant resources

in

research and development to innovate and bring fresh new

technologies and designs to market see Research and

Develop-

ment, p. 074. In addition, we also seek to enhance consumer

demand for our brands and brand initiatives through extensive

marketing, product and brand communication programmes.

And we continue to focus on supply chain improvements to

speed up creation-to-shelf timelines see Global Operations,

p. 064. In 2009, the adidas Group will continue to refi ne the

Reebok brand’s communication programme in alignment with

the brand’s positioning see Reebok Strategy, p. 052.

Given the broad spectrum of our Group’s product offering,

retailer feedback, visibility provided through our order back-

logs and other early indicators see Internal Group Manage-

ment System, p. 058, we view the overall risk from consumer

demand shifts as unchanged versus the prior year. Changes

in consumer demand continue to have a medium likelihood of

occurrence and could have a potential medium impact on our

Group.