Reebok 2008 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group Annual Report 2008 179

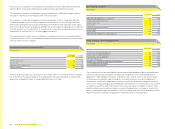

4) on September 30, 2008, the voting interest of Invesco Inc., Toronto, Canada, in adidas AG fell

below the threshold of 3% and amounted to 2.98% of the voting rights (5,894,813 shares) on this

date. All of these voting rights are attributable to Invesco Inc. in accordance with § 22 section 1

sentence 1 number 6 WpHG in conjunction with § 22 section 1 sentence 2 WpHG.

5) on September 30, 2008, the voting interest of Invesco Holdings Company Limited, London, UK,

in adidas AG fell below the threshold of 3% and amounted to 2.98% of the voting rights (5,894,813

shares) on this date. All of these voting rights are attributable to Invesco Holdings Company

Limited in accordance with § 22 section 1 sentence 1 number 6 WpHG in conjunction with § 22

section 1 sentence 2 WpHG.

6) on September 30, 2008, the voting interest of AIM Funds Management Inc., Toronto, Canada, in

adidas AG fell below the threshold of 3% and amounted to 2.98% of the voting rights (5,894,813

shares) on this date. All of these voting rights are attributable to AIM Funds Management Inc. in

accordance with § 22 section 1 sentence 1 number 6 WpHG.

Due to concerns of the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienst-

leistungsaufsicht – BaFin) regarding formal requirements, the aforementioned notifi cations have

not been disclosed so far.

Fidelity International, Tadworth, Great Britain, informed the Company by letter on December 15,

2008 pursuant to § 21 section 1 sentence 1 WpHG that on December 12, 2008, the voting inter-

est of FMR LLC, Boston, Massachusetts, USA, in adidas AG exceeded the threshold of 3% and

amounted to 3.08% of the voting rights (6,108,384 shares) on this date. All of these voting rights

are attributable to FMR LLC in accordance with § 22 section 1 sentence 1 number 6 WpHG in

conjunction with § 22 section 1 sentence 2 WpHG.

The Capital Research and Management Company, Los Angeles, USA, informed the Company by

letter on January 5, 2009, pursuant to § 21 section 1 sentence 1 WpHG, that on December 19,

2008, their voting interest in adidas AG exceeded the threshold of 5% and amounted to 5.01%

of the voting rights (9,695,127 shares) on this date. All of these voting rights are attributable to

the Capital Research and Management Company, in accordance with § 22 section 1 sentence 1

number 6 WpHG.

Euro Pacifi c Growth Fund, Los Angeles, USA informed the Company by letter on January 19, 2009

in accordance with § 21 section 1 WpHG that on January 13, 2009, their voting interest in adidas

AG exceeded the threshold of 3% and amounted to 3.11% of the voting rights (6,021,253 shares)

on this date.

The Bank of New York Mellon Corporation, New York, USA informed the Company by letter on

February 3, 2009 in accordance with § 21 section 1 WpHG that on January 14, 2009, their voting

interest in adidas AG exceeded the threshold of 3% and amounted to 3.05% of the voting rights

(5,901,424 shares) on this date. All of these voting rights are attributable to the Bank of New York

Mellon Corporation in accordance with § 22 section 1 sentence 1 number 6 WpHG in conjunction

with § 22 section 1 sentence 2 WpHG.

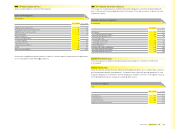

Capital management

The Group’s policy is to maintain a strong capital base so as to maintain investor, creditor and

market confi dence and to sustain future development of the business.

The Group seeks to maintain a balance between a higher return on equity that might be possible

with higher levels of borrowings and the advantages and security afforded by a sound capital

position. The primary Group’s fi nancial leverage target is below 50% net debt to equity.

There were no changes in the Group’s approach to capital management during the year.

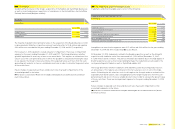

Reserves

Reserves within shareholders’ equity are as follows:

—

Capital reserve: comprises the paid premium for the issuance of share capital.

—

Cumulative translation adjustments: this reserve comprises all foreign currency differences

arising from the translation of the fi nancial statements of foreign operations.

—

Hedging reserve: comprises the effective portion of the cumulative net change in the fair

value of cash fl ow hedges related to hedged transactions that have not yet occurred as well as of

hedges of net investments in foreign subsidiaries.

—

Other reserves: comprise the cumulative net change of actuarial gains or losses of defi ned

benefi t plans, expenses recognised for share option plans as well as fair values of available-for-

sale fi nancial assets.

—

Retained earnings: comprise the accumulated profi ts less dividends paid.

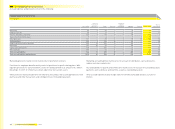

Distributable profi ts and dividends

Distributable profi ts to shareholders are determined by reference to the retained earnings of

adidas AG and calculated under German Commercial Law.

The dividend for 2007 was € 0.50 per share (total amount: € 99 million) approved by the 2008

Annual General Meeting. The Executive Board of adidas AG will propose to shareholders a

dividend payment of € 0.50 per dividend-entitled share for the year 2008 to be made from

retained earnings of € 237 million reported as at December 31, 2008. The subsequent

remaining amount will be carried forward.

193,515,512 dividend-entitled shares exist as at December 31, 2008, which would lead to a

dividend payment of € 97 million.