Reebok 2008 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group Annual Report 2008 183

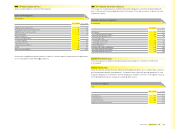

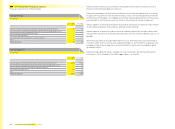

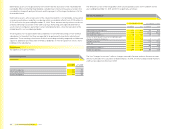

Carrying amounts of fi nancial instruments as at December 31, 2007, according to categories of IAS 39 and their fair values

€ in millions

Category

according

to IAS 39

Carrying

amount

Dec. 31, 2007

Amortised

cost

Fair value

recognised

in equity

Fair value

recognised

in net income

Measurement

according

to IAS 17

Fair value

Dec. 31, 2007

Assets

Cash and cash equivalents n. a. 295 295 295

Short-term fi nancial assets FAHfT 86 86 86

Accounts receivable LaR 1,459 1,459 1,459

Other current assets

Derivatives being part of a hedge n. a. 12 12 12

Derivatives not being part of a hedge FAHfT 22 22 22

Other fi nancial assets LaR 88 88 88

Long-term fi nancial assets

Available-for-sale fi nancial assets AfS 92 92 92

Loans LaR 11 11 11

Other non-current assets

Derivatives being part of a hedge n. a. 7 7 7

Derivatives not being part of a hedge FAHfT 0 0 0

Other fi nancial assets LaR 23 23 23

Assets classifi ed as held for sale LaR 4 4 4

Liabilities

Short-term borrowings

Private placements FLAC 186 186 186

Convertible bond FLAC — — —

Accounts payable FLAC 849 849 849

Accrued liabilities and provisions FLAC 349 349 349

Other current liabilities

Derivatives being part of a hedge n. a. 72 72 72

Derivatives not being part of a hedge FLHfT 17 17 17

Finance lease obligations n. a. 2 2 2

Other fi nancial liabilities FLAC 14 14 14

Long-term borrowings

Bank borrowings incl. commercial paper FLAC 198 198 198

Private placements FLAC 1,378 1,378 1,394

Convertible bond FLAC 384 384 810

Other non-current liabilities

Derivatives being part of a hedge n. a. 32 26 6 32

Derivatives not being part of a hedge FLHfT 10 10 10

Finance lease obligations n. a. 3 3 3

Other fi nancial liabilities FLAC 1 1 1

Liabilities classifi ed as held for sale FLAC 2 2 2

Thereof: aggregated by category according to IAS 39

Financial Assets at fair value through profi t or loss 108

thereof: designated as such upon initial recognition (Fair Value Option – FVO) —

thereof: Held for Trading (FAHfT) 108

Loans and Receivables (LaR) 1,585

Available-for-Sale fi nancial assets (AfS) 92

Financial Liabilities measured at Amortised Cost (FLAC) 3,361

Financial Liabilities at fair value through profi t or loss Held for Trading (FLHfT) 27