Reebok 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

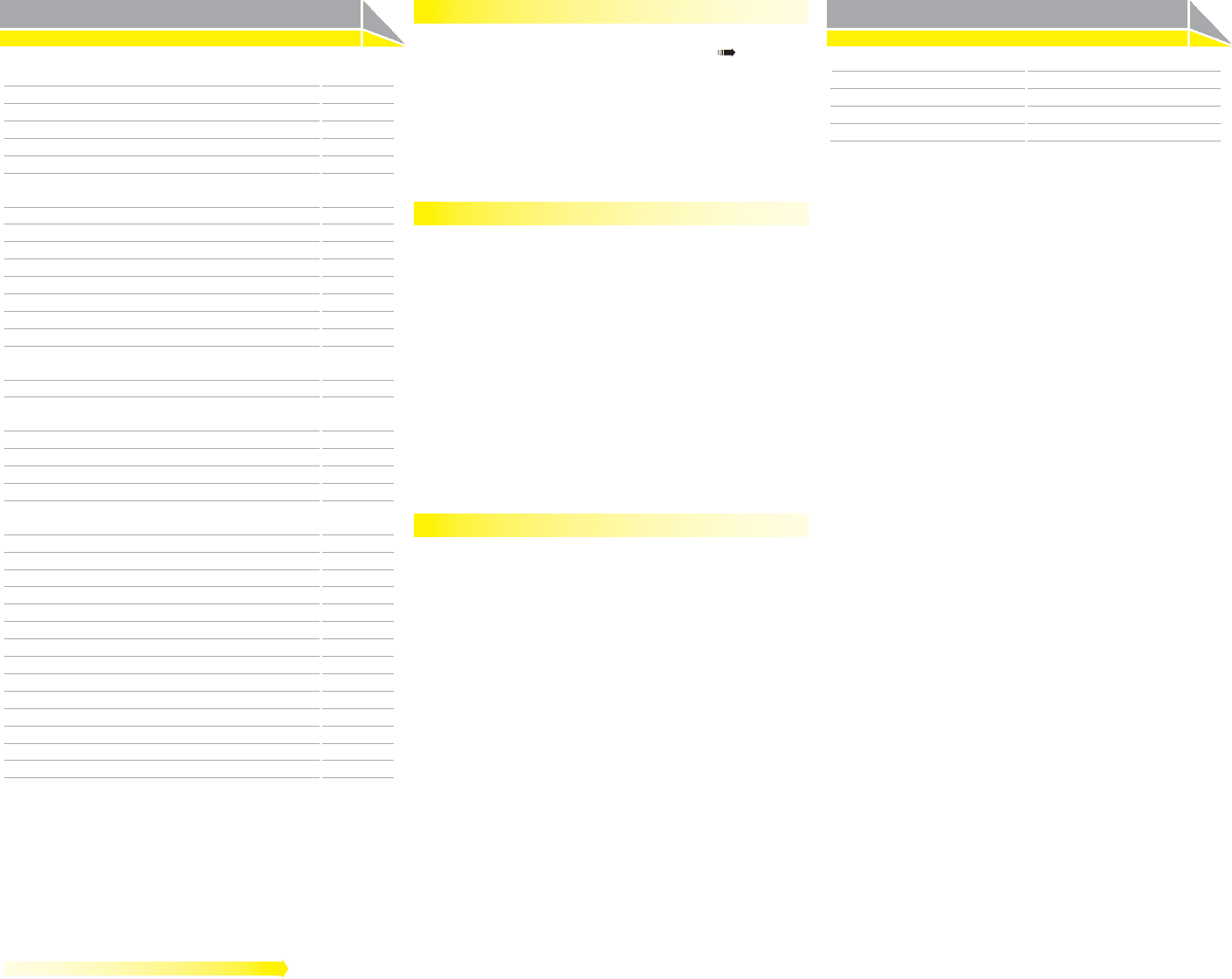

124 Group Management Report – Our Financial Year Subsequent Events and Outlook

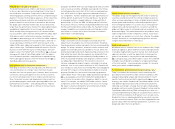

2009 Product Launch Schedule

Product Brand Launch Date

adiPure football boot adidas January

CC Genius tennis shoe adidas January

adidas tennis rackets adidas January

Style Essentials footwear adidas January

adidas Originals Vespa footwear and

apparel collection

adidas January

Terrex outdoor footwear and apparel adidas February

adidas SLVR Label footwear and apparel adidas February

Gazelle running footwear and apparel adidas March

UEFA Champions League Finale Ball “Rome” adidas April

F50i football boot adidas June

Supernova™ Sequence 2 running shoe adidas June

Remix basketball footwear and apparel adidas June

adidas TECHFIT™ Tuned Compression adidas June

Men’s training FreeRunning footwear

and apparel

adidas June

UEFA Champions League 09/10 season ball adidas July

2010 FIFA World Cup™ federation

home jerseys

adidas November

2010 FIFA World Cup™ match ball adidas December

EasyTone™ training shoe Reebok January

Playcool X apparel Reebok January

SelectRide™ running and training shoe Reebok February

Reebok Cirque du Soleil footwear and

apparel collection

Reebok February

Premier Trinity KFS IV running shoe Reebok July

Premier Verona KFS II running shoe Reebok July

DresSports® 2 Rockport September

Octo Gun stick line CCM Hockey April

Glove line CCM Hockey April

U+™ Pro Skate CCM Hockey April

KFS protective equipment Reebok Hockey April

KFS hockey gloves Reebok Hockey April

10K Sickick II stick Reebok Hockey April

8.0.8 O-Stick Reebok Hockey October

R9™ drivers TaylorMade-adidas Golf March

R9™ fairway woods TaylorMade-adidas Golf March

R9™ Rescue TaylorMade-adidas Golf March

Burner® 09 irons TaylorMade-adidas Golf March

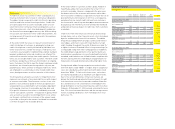

adidas Group 2009 outlook

Currency-neutral sales growth low- to mid-single-digit decline

Gross margin decline

Operating margin decline

Earnings per share decline

Working capital management to improve balance sheet

Operating working capital management is a major focus of

our efforts to improve the Group’s balance sheet see Internal

Group Management System, p. 058. Our goal is to reduce operat-

ing working capital as a percentage of sales in 2009. Inventory

management will be a focus area in this respect. Based on

tight control of inventory ageing, optimising inventory levels

for fast replenishment is at the forefront of our activities to

ensure we are able to satisfy short-term retailer demand on an

at-once basis.

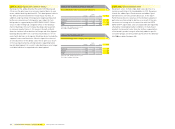

Investment level to be between € 300 and € 400 million

In 2009, investments in tangible and intangible assets are

expected to amount to € 300 million to € 400 million (2008:

€ 380 million). Investments will focus on adidas and Reebok

controlled space initiatives, in particular in emerging mar-

kets. These investments will account for almost 50% of total

investments in 2009. Other areas of investment include the

further development of the adidas Group Headquarters in

Herzogenaurach, Germany and the increased deployment of

SAP and other IT systems in major subsidiaries within the

Group. The most important factors in determining the exact

level and timing of investments will be the rate at which we

are able to successfully secure controlled space opportunities.

All investments within the adidas Group in 2009 are expected

to be fully fi nanced through cash generated in our operating

businesses.

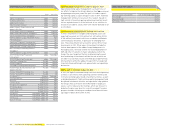

Excess cash to be used to reduce net debt

In 2009, we expect continued strong cash fl ows from operating

activities. Cash infl ows from operating activities will be used

to fi nance working capital needs, investment activities, as well

as dividend payments. Tight working capital management and

disciplined investment activities are expected to help optimise

the Group’s free cash fl ow in 2009. We intend to largely use

excess cash to reduce net borrowings, which we forecast to

be below the prior year level. As a result, we expect to make

progress towards achieving our medium-term fi nancial lever-

age target of below 50% (2008: 64.6%).