Reebok 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group Annual Report 2008 091

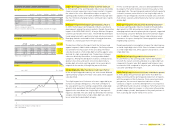

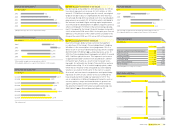

Total assets

€ in millions

2004 1) 4,434

2005 5,750

2006 2) 8,379

2007 8,325

2008 9,533

1) Restated due to application of amendment to IAS 19.

2) Including Reebok business segment from February 1, 2006 onwards.

Inventories

€ in millions

2004 1,155

2005 1,230

2006 1) 1,607

2007 1,629

2008 1,995

1) Including Reebok business segment from February 1, 2006 onwards.

Receivables

€ in millions

2004 1,046

2005 965

2006 1) 1,415

2007 1,459

2008 1,624

1) Including Reebok business segment from February 1, 2006 onwards.

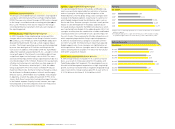

Other current assets up 49%

Other current assets increased 49% to € 789 million at the

end of 2008 from € 529 million in 2007. This development

was mainly due to higher fair values of fi nancial instruments

see Note 9, p. 168.

Fixed assets increase 9%

Fixed assets increased 9% to € 4.074 billion at the end of 2008

versus € 3.726 billion in 2007. This was mainly the result of

continued own-retail expansion, investment into the Group’s

IT infrastructure, the transfer of assets held-for-sale to

fi xed assets as well as the acquisition of Ashworth, Inc. and

Textronics, Inc. Additions of € 378 million were partly offset

by depreciation and amortisation of € 234 million as well as

disposals in an amount of € 41 million. Currency translation

effects on fi xed assets denominated in currencies other than

the euro had a positive effect of € 120 million.

Assets held-for-sale decrease 60%

At the end of 2008, assets held-for-sale decreased 60% to

€ 31 million (2007: € 80 million). In the second quarter of

2008, land and buildings in Herzogenaurach, Germany, which

are no longer in the scope of a sale, were transferred to fi xed

assets. At the end of 2008, assets held-for-sale mainly related

to warehouses for sale in the UK and in the USA, property in

Herzogenaurach and assets in connection with the planned

divestiture of Gekko Brands, LLC acquired with Ashworth, Inc.

see Note 3, p. 163.

Other non-current assets increase 25%

Other non-current assets increased by 25% to € 180 million at

the end of 2008 from € 147 million in 2007, mainly driven by an

increase in the fair value of fi nancial instruments see Note 14,

p. 170.

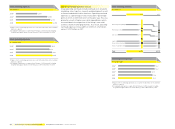

Accounts payable grow 43%

Accounts payable increased 43% to € 1.218 billion at the end

of 2008 versus € 849 million in 2007. On a currency-neutral

basis, accounts payable were up 37%. This development was

mainly a result of a higher volume of production and product

shipments towards the end of the year in anticipation of future

price increases as well as potential regulatory changes in

Latin America see Risk and Opportunity Report, p. 107. The new

Reebok companies in Latin America as well as the consoli-

dation of the Ashworth business acquired in November also

contributed to the increase.

Other current liabilities increase 11%

Other current liabilities increased 11% to € 295 million at the

end of 2008 from € 266 million in 2007, primarily as a result

of increases in tax liabilities other than income taxes see

Note 17, p. 173.

Other non-current liabilities decrease 23%

Other non-current liabilities decreased 23% to € 52 million at

the end of 2008 from € 69 million in 2007, primarily as a result

of a decrease in the fair value of non-current forward contracts

see Note 19, p. 175.

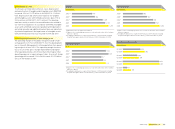

Equity grows due to increase in net income

Shareholders’ equity rose 12% to € 3.386 billion at the end of

2008 versus € 3.023 billion in 2007. The net income gener-

ated during the period more than offset the buyback of adidas

AG shares. Currency translation effects and increases in the

fair value of forward contracts also positively impacted this

develop ment see Note 21, p. 176.

Expenses related to off-balance sheet items

Our most important off-balance sheet assets are operating

leases, which are related to retail stores, offi ces, warehouses

and equipment. The Group has entered into various operating

leases as opposed to property acquisitions to reduce exposure

to property value fl uctuations. Rent expenses increased 25%

to € 422 million in 2008 from € 337 million in the prior year,

mainly due to the continued expansion of the adidas Group’s

own-retail activities see Note 22, p. 181.